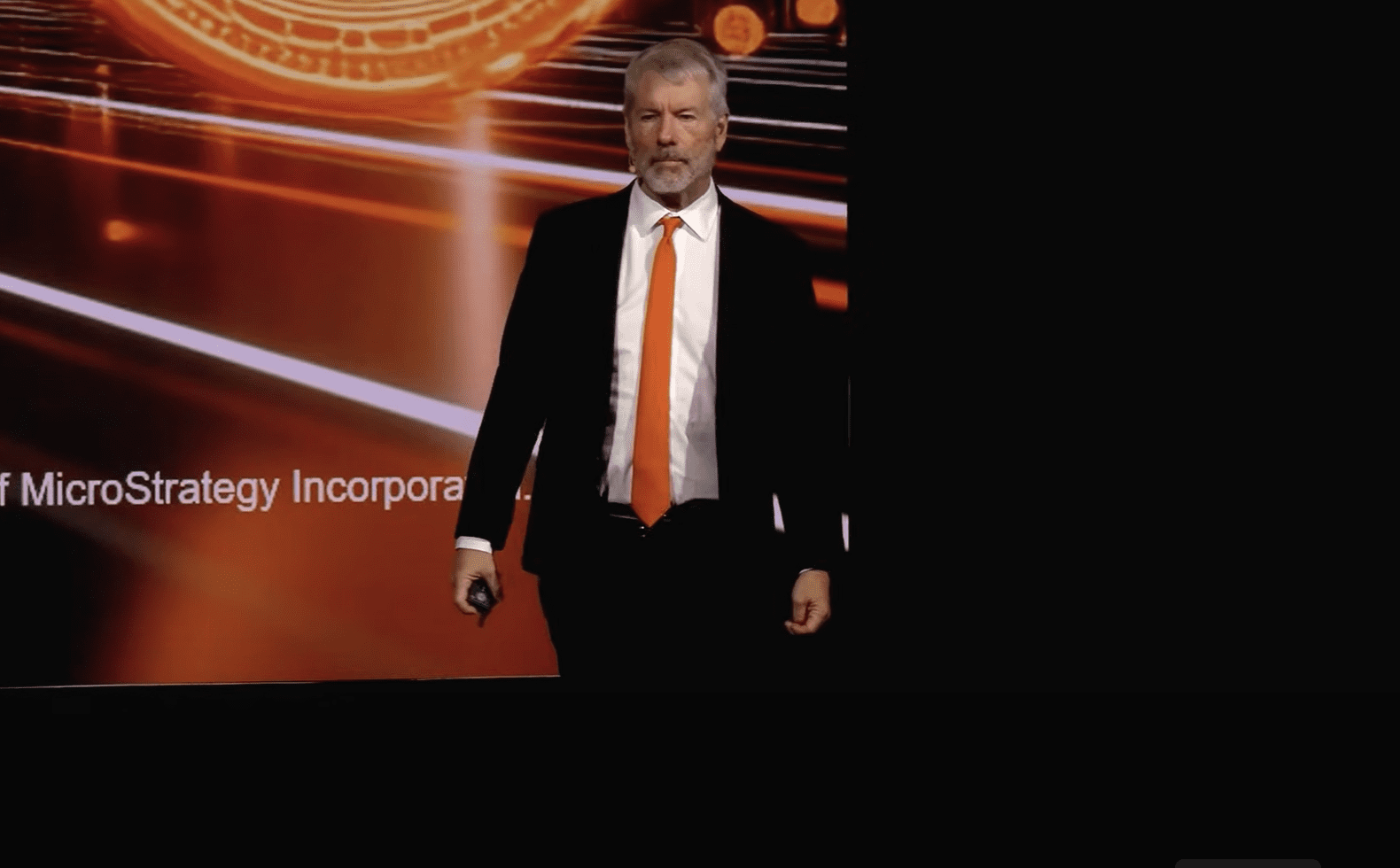

During his keynote at the Bitcoin for Corporations 2025 event, Michael Saylor, executive chairman of MicroStrategy, issued a strong challenge to Microsoft, one of the wealthiest companies in tech. Addressing an audience of CFOs and treasury executives, he urged Microsoft to redirect substantial sums from stock buybacks and short-term Treasuries into Bitcoin, labeling it the “universal, perpetual, profitable merger partner” that surpasses all other treasury assets in the age of artificial intelligence.

Saylor’s Case for Bitcoin Investment

Saylor highlighted a stark contrast between Microsoft’s financial returns and Bitcoin’s performance: “Microsoft has seen an 18% annual growth over the last five years, while Bitcoin’s growth stands at 62%.” He noted that the S&P 500’s compound growth rate is approximately 14%, illustrating that Microsoft’s true outperformance is only 4%, compared to Bitcoin’s significant 48%. He questioned the wisdom of holding assets that devalue capital when Bitcoin offers nearly 50% growth above the cost of capital.

Examining Microsoft’s financial strategies, Saylor stated that investing in bonds could lead to a 99.7% capital decrease over ten years. He described stock buybacks as only slightly less disastrous, with a potential 97% loss. He asserted that purchasing Bitcoin could yield tenfold better results than buying back shares of Microsoft.

Saylor believes Bitcoin marks the beginning of a new financial era. “Gold represented nineteenth-century money, sovereign debt symbolized the twentieth century, and Bitcoin is twenty-first-century money—the first truly liquid, fungible asset without a counterparty,” he explained. He posited that 2024 will be “year zero” for Bitcoin, referenced by its SEC approval for spot ETFs, while designating 2025 as “year one,” emphasizing the importance of acting fast.

To underscore the potential benefits, Saylor shared insights from a stress test using the “Bitcoin 24” treasury modeling tool on Microsoft. They explored four different scenarios involving cash flow redistribution towards Bitcoin. Depending on the strategy, it could add between $155 and $584 per share—impacting enterprise value by up to $5 trillion, all while mitigating risk. He urged Microsoft to retain the capital they’ve worked hard to achieve over five years.

Emphasizing the operational pressures of financial management, Saylor cautioned that divesting $200 billion exacerbates risks, affecting both employees and customers. He warned that this approach could lead to competitive strain and legal issues—all in pursuit of immediate financial returns that could be shielded by holding stable, non-correlated assets.

He proposed a hypothetical scenario to Microsoft’s board: “If you could acquire a $100 billion company with 60% annual growth for just one time its revenue, would you?” He argued that this represents what Bitcoin offers, asserting that the consensus financial view of risk surrounding Bitcoin is misguided.

MICHAEL SAYLOR URGES MICROSOFT TO INVEST $75 BILLION IN #BITCOIN FOR A POTENTIAL $4 TRILLION GAIN

IT’S HAPPENING!!!

pic.twitter.com/ujyHwquA0e

— Vivek

(@Vivek4real_) May 6, 2025

In his closing remarks, Saylor emphasized the importance of owning hard assets for achieving wealth: “Wealth comes from holding tangible assets rather than dependence on future earnings. It’s better to be invested in a thriving company than to be in one that continually pays out dividends and raises prices.”

He urged a shift away from outdated capital methods—such as treasury bills and stock buybacks—in favor of embracing Bitcoin to foster sustainable growth for all stakeholders involved. The mentioned $75 billion proposal reflects Microsoft’s existing buyback authorization and projected dividends into a single digital asset allocation. However, it should be noted that Microsoft shareholders previously rejected a proposal to include Bitcoin on the company’s balance sheet at their meeting on December 10.

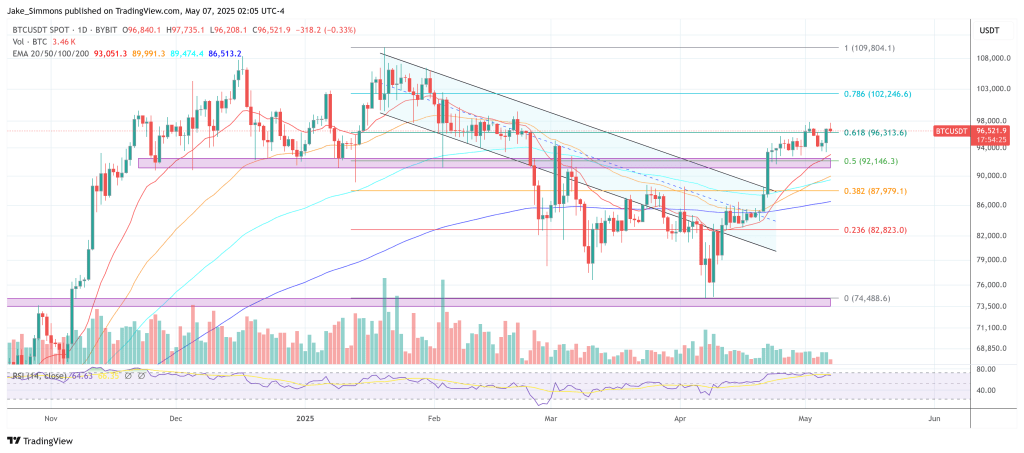

As of now, Bitcoin is trading at $96,521.