In a recent update from CryptoQuant, analyst Crazzyblockk noted that Bitcoin’s (BTC) Binance Taker Buy-Sell Ratio has increased to 1.131. This rise indicates a growing bullish trend, with aggressive buyers currently dominating the market.

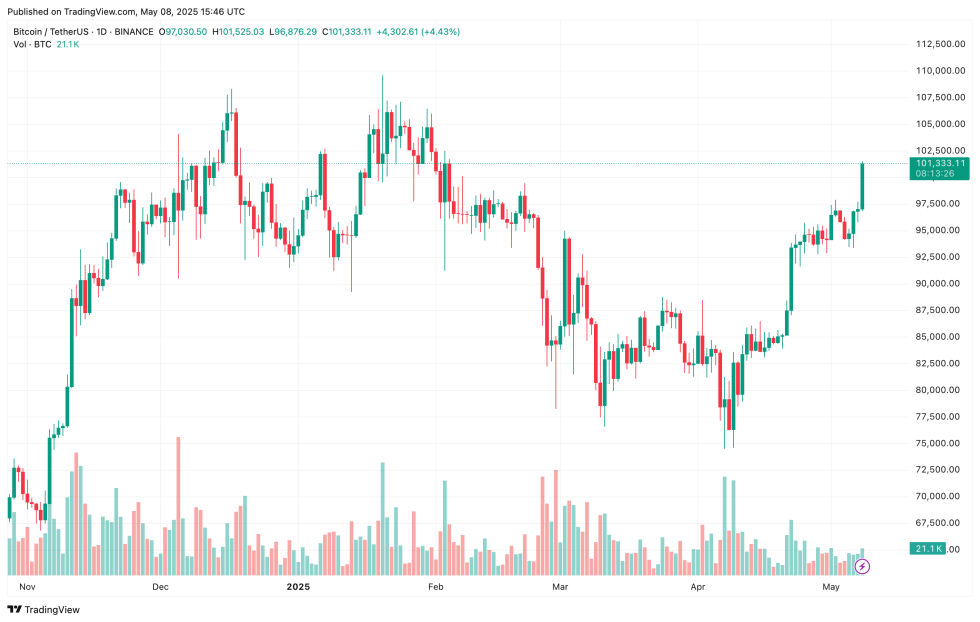

Bitcoin Surge Amid Bullish Trends

With BTC trading above the $100,000 mark, the Binance Taker Buy-Sell Ratio reflects strong buying pressure. Crazzyblockk points out that the current ratio signals a predominant bullish sentiment, with buyers outpacing sellers on Binance.

For clarity, the Binance Taker Buy-Sell Ratio monitors active buyer and seller behavior on Binance. A ratio over 1 suggests buyer strength (bullish), while a ratio under 1 indicates seller strength (bearish).

The 7-day moving average stands at 1.045 and is on an upward trajectory. Moreover, a 30-day change shows an increase of 12.1%, indicating ongoing buying interest and robust momentum.

Nevertheless, not all indicators are favorable. The Z-score of the ratio has hit 2.45, implying that the market might be nearing overbought conditions. Crazzyblockk noted:

Historically, when ratios exceed 1.1 alongside high z-scores, corrections often occur before upward trends resume.

Additionally, Crazzyblockk mentioned the benefits of Binance data, highlighting its deep liquidity, which accurately reflects taker interactions, coupled with high trading volume for reliability.

Strategically, maintaining a ratio above 1.1 while BTC stays above $99,000 would signal bullish potential. In contrast, a dip below 1.05 might indicate profit-taking, leading to a short-term pullback.

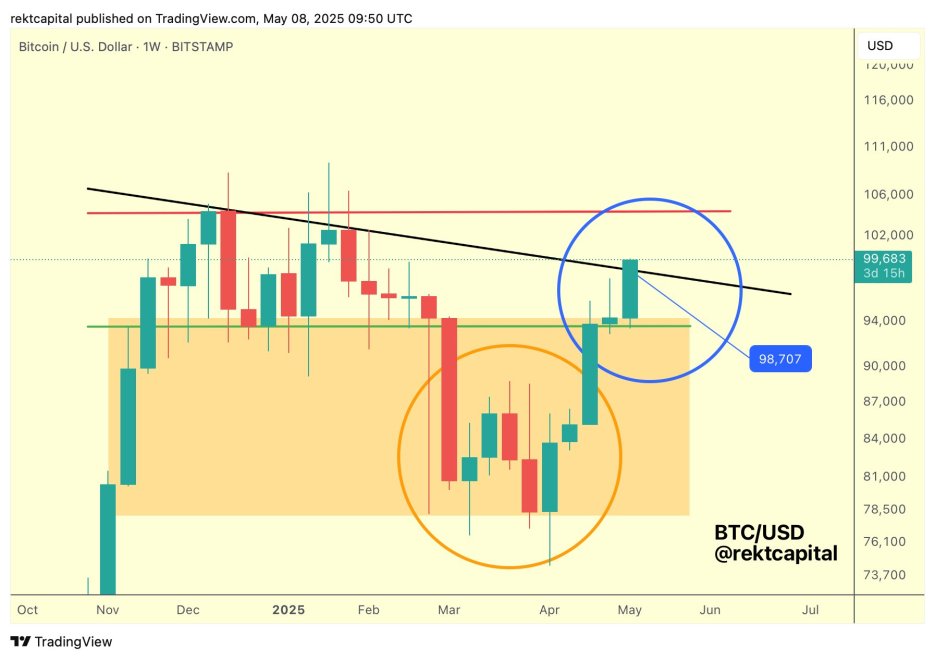

BTC Breaking Downtrend but Resistance Lies Ahead

Meanwhile, analyst Rekt Capital revealed a weekly Bitcoin chart indicating that BTC is close to breaking out of a long-term downtrend that started in December 2024. To confirm this breakout, BTC must stay over $98,700, setting the stage for a rally towards a resistance level of $104,500.

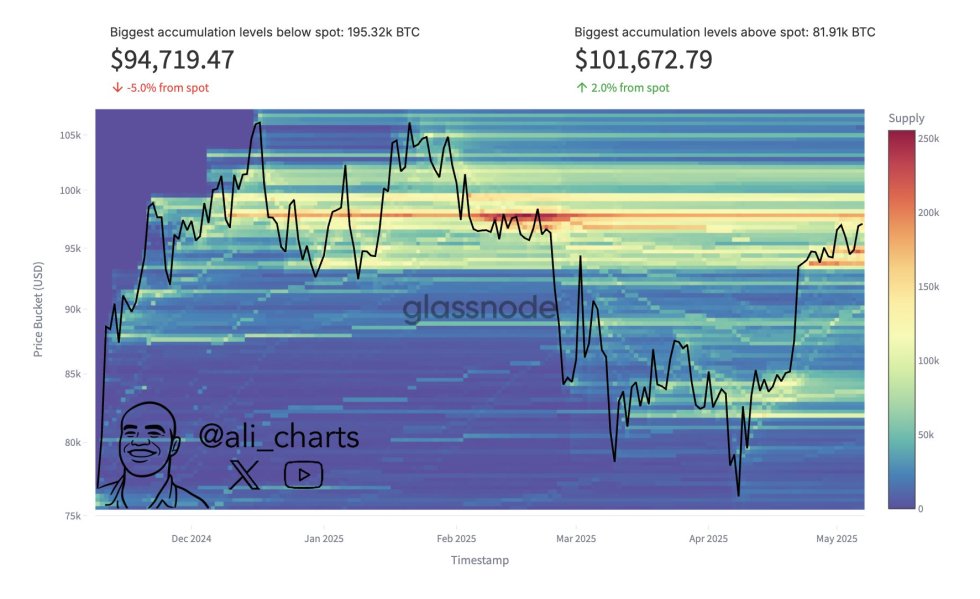

Similarly, analyst Ali Martinez identified $101,673 as a crucial resistance area where 81,910 BTC were previously held. Martinez cautioned that failing to surpass this level could lead to consolidation.

To avoid a significant downturn, BTC must protect key support levels. Martinez also noted that BTC should not fall below the $93,198 support level, or it might plunge to $83,444.

On a positive note, the number of BTC wallets depositing on exchanges recently fell to an 8-year low, signaling bullish potential that could drive BTC closer to its all-time high. As of now, BTC is trading at $101,333, reflecting a 3.7% gain over the last 24 hours.