Ethereum has made a powerful leap, breaking the $1,850 resistance and soaring to a remarkable high of $2,490 within hours, representing an astonishing 37% increase. After several months of stagnant prices and negative sentiment, ETH has re-emerged with strong bullish energy, igniting optimism across the cryptocurrency market for the long-anticipated altseason.

This upward movement signals not only Ethereum’s resurgence but could also trigger a wider altcoin rally, particularly for those that have been trailing Bitcoin for over a year. With ETH reclaiming vital price levels and showing short-term strength, investors are starting to pivot their resources into promising altcoins.

Crypto analyst Quinten Francois added to the buzz by sharing a chart on X, illustrating that the ETH/BTC downward trend line spanning multiple years is finally being breached. This technical milestone hints at a potential reversal in Ethereum’s long-standing struggles against Bitcoin, a historically strong indicator of upcoming altcoin surges.

As ETH gains traction and the ETH/BTC ratio makes a significant shift, market sentiment is shifting towards the bullish side—not only for Ethereum but for the entire altcoin ecosystem. This breakout might just be the beginning of a greater movement.

Ethereum Surpasses Key Supply Levels and Approaches Significant Resistance

Following a tremendous surge that propelled Ethereum past resistance at $1,850 to a peak of $2,490, ETH is currently finding stability as buyers solidify support close to the $2,500 level. This area has quickly emerged as a crucial demand region, and how it holds up this weekend could play a key role in determining whether Ethereum continues its ascent or takes a breather for consolidation. With Bitcoin hovering near its peak, attention is now focused on altcoins, with Ethereum leading the way.

For the first time in several years, ETH seems to be establishing a strong bullish trend after enduring months of continuous selling pressure and negative sentiment. The recent price rally marks a notable change in market sentiment, as both technical indicators and fundamental conditions appear to be aligning. Significantly, Francois highlighted that the long-term downward trend line between ETH and BTC, which has been in effect since December 2021, is finally breaking—a historical precursor to major altcoin rallies.

Further boosting the optimistic outlook is Ethereum’s impending Pectra update, focused on enhancing efficiency, improving staking infrastructure, and simplifying network upgrades. This development is renewing investor trust, positioning ETH prominently for the next market phase.

If Ethereum can maintain its position at the $2,500 mark and Bitcoin continues to consolidate near its peaks, the groundwork is laid for Ethereum to embark on a new bullish phase. Traders will be keenly observing how ETH performs this weekend; if strength persists, it could signal the onset of a significant altseason. With key resistance levels surpassed, macro sentiment shifting, and essential upgrades on the horizon, Ethereum may well be poised to drive the market to new heights.

ETH Price Leap: Buying Activity Determines Direction

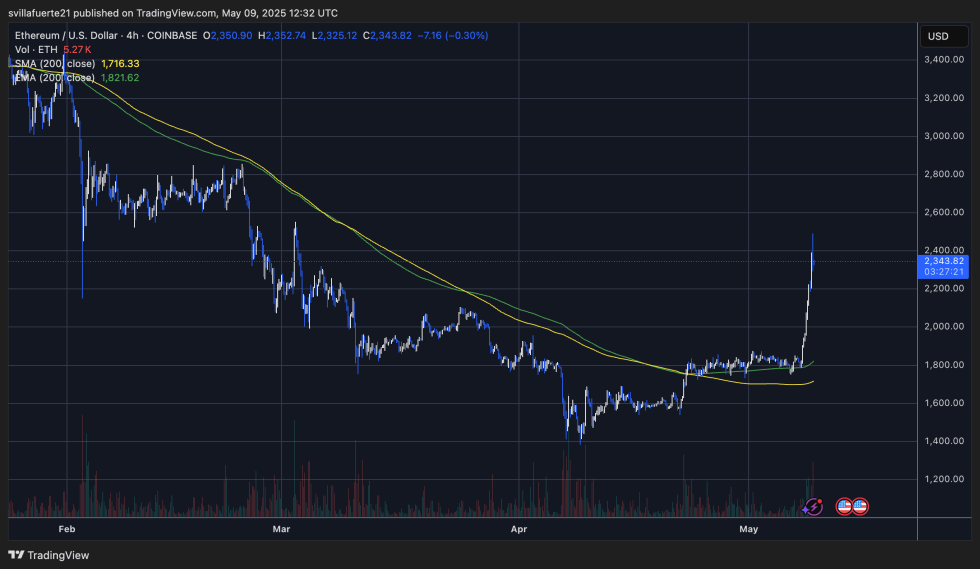

Recently, Ethereum exhibited remarkable price action, with ETH climbing from about $1,800 to a peak of $2,352 in just a few trading sessions. The 4-hour chart underscores the strength of this movement, coinciding with a substantial boost in volume and a steep bullish candle structure—clearly breaking above both the 200-day SMA and EMA, currently positioned around $1,716 and $1,821, respectively. These moving averages now serve as robust dynamic support levels.

Currently, the price is stabilizing just above $2,340, indicating that buyers are holding their gains and attempting to establish a foundation above this psychological barrier. This consolidation period may enable Ethereum to gain momentum for a push towards the next resistance zone around $2,500, consistent with previous local highs seen in early January.

Crucially, this breakout occurs after months of fluctuating prices and a prolonged downward trend. The steep incline of the recent movement reflects a change in the market environment, with bears being squeezed and buying momentum flowing into ETH. If buyers remain in control and the price stays above $2,200 in the near term, further upward movement is probable. However, if the price dips below $2,200 with strong volume, a retracement to the $2,000–$2,100 range may occur before any upward continuation.

Featured image from Dall-E, chart from TradingView