Following a vigorous surge that propelled Bitcoin past the $100,000 threshold, the market has settled into a recognizable pattern of consolidation. As of now, Bitcoin’s price is approximately $103,000, and technical evaluations suggest that this period may precede another major move toward the $106,000 to $110,000 range.

Crypto analyst RLinda from TradingView believes this recent stabilization phase reflects a strategic pause rather than a sign of fatigue.

Bitcoin Price Stabilization Between Critical Levels Enhancing Momentum

Bitcoin’s ascent from the $97,860 breakout point to the resistance level at $104,300 clearly indicates a distribution phase. Currently, prices are fluctuating between $104,300 and $102,300, with a noticeable slowdown in momentum over the last two days.

Yet, analyst RLinda has remarked that this sideways trading movement is a positive indication, suggesting bullish trends are still in play rather than indicating weakness. A rebound from the lower end of this zone, especially around $103,300, $102,300, or even as low as $101,700, could serve as a launching pad for another attempt to exceed the $104,300 resistance barrier.

Moreover, the analyst pointed out that a third retest fell short of pushing prices back to resistance, leading to a temporary drop. However, the price drop below $103,336 signals that the core strength remains intact. If Bitcoin can successfully retest $103,600 and bounce from the liquidity area between $102,700 and $102,300, it could make another effort to break through the $104,300 level.

Should these scenarios unfold, the next potential peak may reach $106,000 or even $107,000; from there, additional momentum could propel the price past its previous all-time high of $108,786 and onto the $110,000 mark before May concludes. Beyond this point, projections suggest targets could rise to between $120,000 and $180,000 by year-end.

Chart Image Source: TradingView by RLinda

On-Chain Indicators Support Positive Expectations

This recent consolidation phase is not happening in isolation, as it coincides with a decrease in selling pressure. Importantly, on-chain metrics and the prevailing market mood reinforce Bitcoin’s upward trajectory for the remainder of the month.

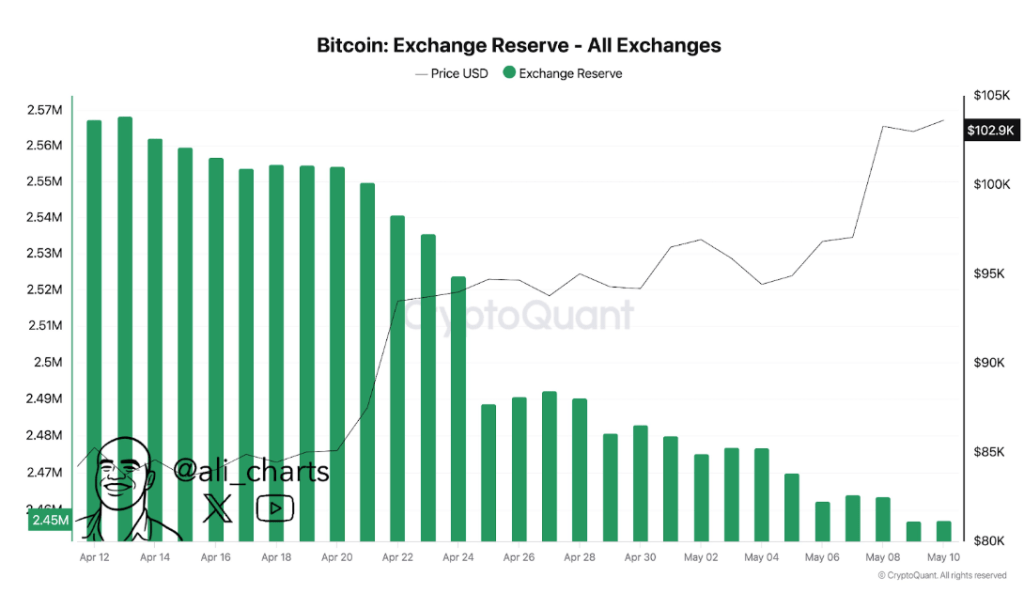

As per analyst Ali Martinez, over 110,000 BTC have been withdrawn from centralized platforms in the past month. This trend has resulted in a decrease in total Bitcoin reserves on exchanges, shrinking from 2.57 million BTC to 2.45 million BTC as shown in the CryptoQuant chart below.

This indicates that investors are opting to move their assets to cold storage or holding them long-term, which lessens immediate selling pressure and fosters positive price movement.

Chart Image from X: @ali_charts

Currently, key support levels to monitor are $103,300, $102,300, and $101,700, while resistance levels to new all-time highs are $104,300 and $108,786.

As of now, Bitcoin is trading at $103,670.

Featured image from Unsplash, chart from TradingView