Recent market analysis indicates that Dogecoin (DOGE) has faced substantial long liquidations amid a notable price decrease over the last 24 hours.

Dogecoin Encounters a Price Reversal

After breaking through the significant threshold of $0.25 at the week’s start, Dogecoin has seemingly reversed its momentum, experiencing a sharp drop within the past day.

Below is a visual representation detailing the latest price movements of the popular cryptocurrency.

The graph illustrates that Dogecoin fell to a low of $0.217 during its plunge. Since that point, there has been a modest recovery, with the price currently sitting at $0.227. However, despite this small upswing, DOGE is still down nearly 10% in the last day.

Most cryptocurrencies have also struggled during this period, but DOGE stands out as one of the poorest performers among top market cap assets. Yet, if we zoom out to the past week, DOGE shines brighter with a remarkable increase exceeding 34%.

In terms of market capitalization, DOGE retains its position as the eighth-largest cryptocurrency, ahead of notable competitors like Cardano (ADA).

DOGE Faces Significant Long Liquidations

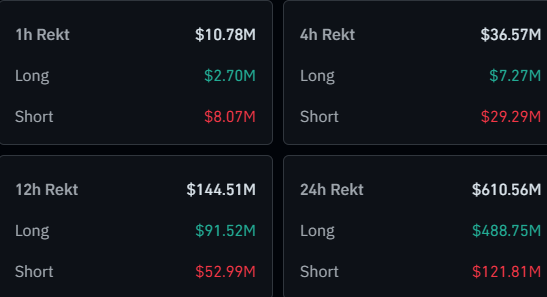

The bearish trend across the cryptocurrency landscape has resulted in heightened liquidations on derivative exchanges. Liquidations occur when open contracts are forcibly closed after incurring a specific loss percentage.

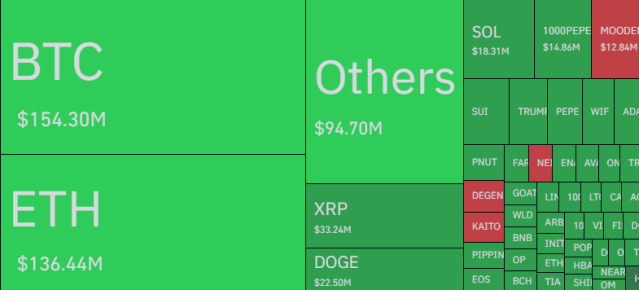

Due to Dogecoin’s recent volatility and its appeal to speculators, it ranks highly in terms of liquidations. Data sourced from CoinGlass substantiates this claim.

According to the heatmap, Dogecoin has experienced approximately $22.5 million in liquidations within the past day, ranking it as the fourth highest in the cryptocurrency market. Notably, over $19 million of these liquidated positions were long positions, which aligns with the prevailing negative price trends.

While these figures for DOGE are significant, they still fall short compared to Bitcoin’s staggering $154 million and Ethereum’s $136 million in liquidations, highlighting the difference in speculative behaviors between these leading assets and altcoins.

In total, the cryptocurrency market has witnessed liquidations exceeding $610 million, with approximately $489 million attributable solely to long-term investors.