Recent developments in the cryptocurrency market have stirred excitement, especially following a bold move by Strategy. Let’s explore the latest investment and the implications it has for the company’s financial landscape.

Strategy’s Significant Bitcoin Purchase: A Deep Dive

Strategy has officially announced a substantial investment in Bitcoin, acquiring 7,390 BTC for approximately $764 million. This announcement came from the company’s chairman, Michael Saylor, via a recent tweet.

Acquired at an average price of about $103,498 per coin, this investment marks the company’s third purchase within May. Notably, this latest acquisition dwarfs their first buy of $180 million but still trails behind the second acquisition that reached $1.34 billion.

With this latest purchase, Strategy’s total Bitcoin holdings have surged to around 576,230 BTC. The firm’s overall investment now stands at a staggering $40.18 billion, translating to an approximate cost of $69,726 per Bitcoin—significantly lower than the current market value, indicating a profitable position for the company.

CryptoQuant’s Maartunn shared insightful analytics in a post on X, showcasing the profitable standing of Strategy after this latest acquisition here.

The chart above clearly illustrates that Strategy has been riding the wave of unrealized gains, as the price of Bitcoin continues to climb. Currently, the company is basking in a remarkable profit of $21.1 billion.

Since late 2023, Strategy’s holdings have consistently been profitable, largely unaffected by Bitcoin’s inherent volatility over the past year. If the current upward trend in BTC prices persists, Strategy is well-positioned to maintain its favorable standing.

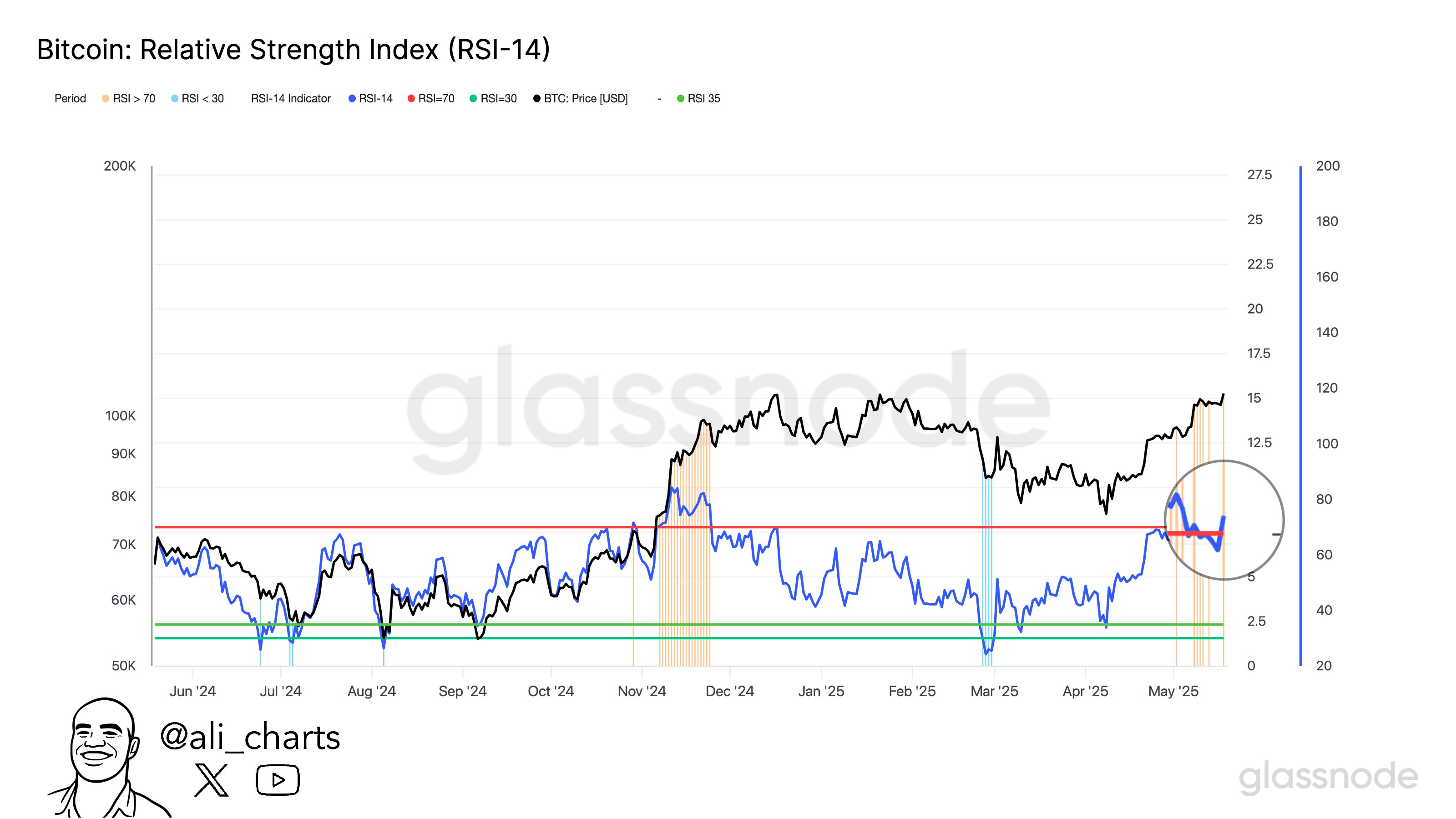

However, questions linger about the sustainability of this price rally. The Relative Strength Index (RSI) serves as a valuable tool for gauging market conditions. Analyst Ali Martinez highlighted in an X post that the RSI has recently entered the overbought zone, which can signify potential price corrections ahead here.

The RSI is a crucial indicator that assesses price movement over a certain period, typically 14 days in this context. A reading above 70 indicates potential overvaluation, while a reading below 30 suggests undervaluation.

Currently, Bitcoin’s RSI has recently re-entered the overbought territory. This fluctuation implies that, should the trend continue, BTC may face challenges in the immediate future.

Analyzing BTC’s Current Market Position

In the past day, Bitcoin’s price has demonstrated notable volatility, oscillating sharply, with the latest spike bringing it to around $105,200. Such fluctuations are not uncommon in the crypto realm.