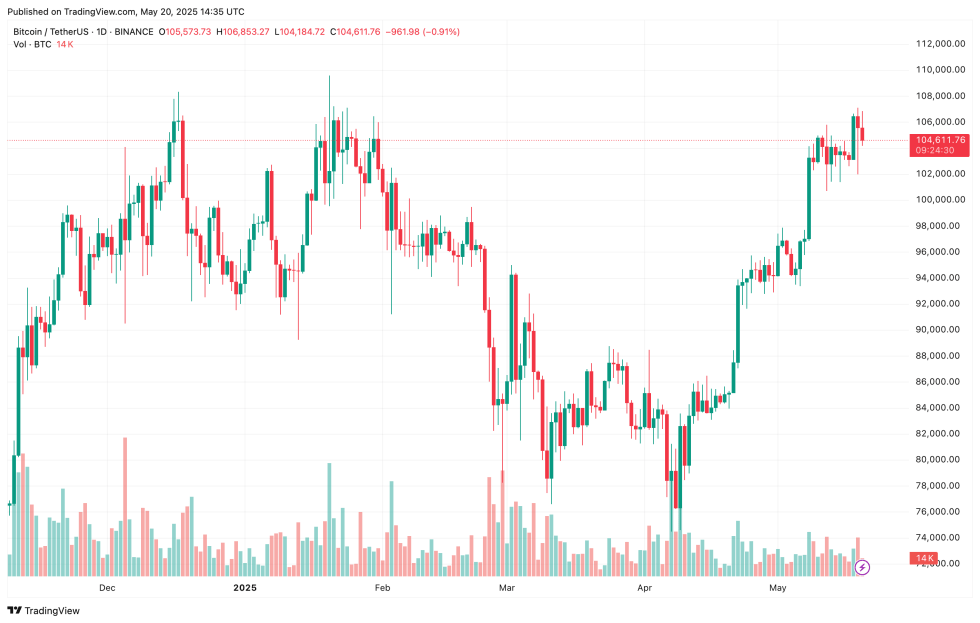

The cryptocurrency scene continues to buzz with excitement, particularly around Bitcoin (BTC). Recently, data from Binance indicates noteworthy patterns that could lead to a bullish surge for the cryptocurrency. Over the last month alone, Bitcoin has experienced a remarkable increase of 23.8%, positioning it just 4% shy of its record-high value.

Could Another Bitcoin Surge Be Upon Us?

In a recent analysis shared on CryptoQuant, expert Crazzyblockk proposed the potential for an imminent Bitcoin rally. Utilizing the Binance Taker Buy-Sell Ratio Momentum Signal, several strong indicators suggest that Bitcoin may be ready to surpass its previous all-time high.

One significant observation is the recent surge in weekly and monthly buy-side taker volumes. This spike reflects increasing demand from market participants eager to execute trades at market value, suggesting a shift towards bullish market sentiment.

Related Insight: Some analysts speculate that Bitcoin may be preparing for a monumental leap to $120,000 as it’s believed the market is reaching the final stages of the Wyckoff Accumulation phase.

For those new to the cryptocurrency world, the concept of buy-sell taker volume pertains to the quantities of BTC that traders, known as takers, buy or sell. When buy-side taker volume rises, it indicates strong buying interest, typically seen during bullish market phases.

Another crucial indicator to consider is Bitcoin’s 30-day Z-score, which is currently around 1. This value signifies neutral market behavior, indicating that the current conditions are not overheated, which might allow buyer dominance to be sustainable over time.

To clarify further, the 30-day Z-score measures the deviation of a metric, like trading volume or price, from its 30-day average in standard deviations. A Z-score close to 0–1 indicates normal activity levels, while values exceeding 3 suggest overheated market conditions.

Furthermore, analyst Crazzyblockk noted that Bitcoin has recently experienced its lowest weekly price volatility in several months. Historical trends suggest that periods of low volatility are often precursors to substantial price movements, and given the present buy-side strength, the anticipated direction appears to favor upward movement.

Finally, assessments regarding the intraday taker buy-sell imbalance reveal a preference for buyers. As highlighted by CryptoQuant’s contributor:

While the total volume between bids and asks may balance out, the aggressive nature of takers indicates a strong leaning towards buying, revealing a definitive momentum in short-term execution intent.

In summary, Binance’s data regarding taker behavior reveals a bullish control in the market. If the trends persist, the most likely scenario for the short-term outlook is a continuation of upward movement.

Price Predictions from Analysts

As Bitcoin approaches its record high from January of $108,786, multiple crypto analysts are sharing their projections for this cycle. For example, analyst Ali Martinez has identified a significant resistance level at $116,900.

On the other hand, on-chain specialist Burak Kesmeci envisions a potential rally for Bitcoin reaching as high as $159,000 in this current bull cycle. As of now, Bitcoin is trading at $104,611, reflecting a modest 1.1% increase in the last 24 hours.