Recent statistics indicate a significant turnaround in investor profitability within the Ethereum ecosystem, marking a resurgence following the recent price rally.

A Notable Shift in Ethereum Holder Profitability

A recent update from Sentora, a leading provider of institutional DeFi solutions, highlighted a striking change in the profit-loss landscape for Ethereum holders.

The key on-chain metric under examination is the “Historical In/Out of the Money,” which categorizes Ethereum users into three groups: profits (“in the money”), losses (“out of the money”), and break-even points (“at the money”).

This metric assesses the average acquisition cost for Ethereum held by addresses, enabling analysts to evaluate who is currently benefiting from their investments. A lower acquisition price compared to the current market price identifies a user as being “in the money,” while the opposite indicates an “out of the money” status.

Let’s take a look at the evolving statistics related to Ethereum’s Historical In/Out of the Money over the past decade:

The chart indicates a significant decline in Ethereum holders benefiting from their investments after the market downturn that began in December 2024. Initially, over 90% of investors were in profit, but this number plummeted to just 32% by April 2025.

However, the latest market oscillation has led to a revival, with nearly 60% of holders now back “in the money.” While this figure is shy of the levels seen last year, it represents a substantial improvement compared to previous lows.

Sentora’s analysis points out that such dramatic changes in profitability aren’t commonplace, with the last comparable volatility observed during the 2017 market cycle.

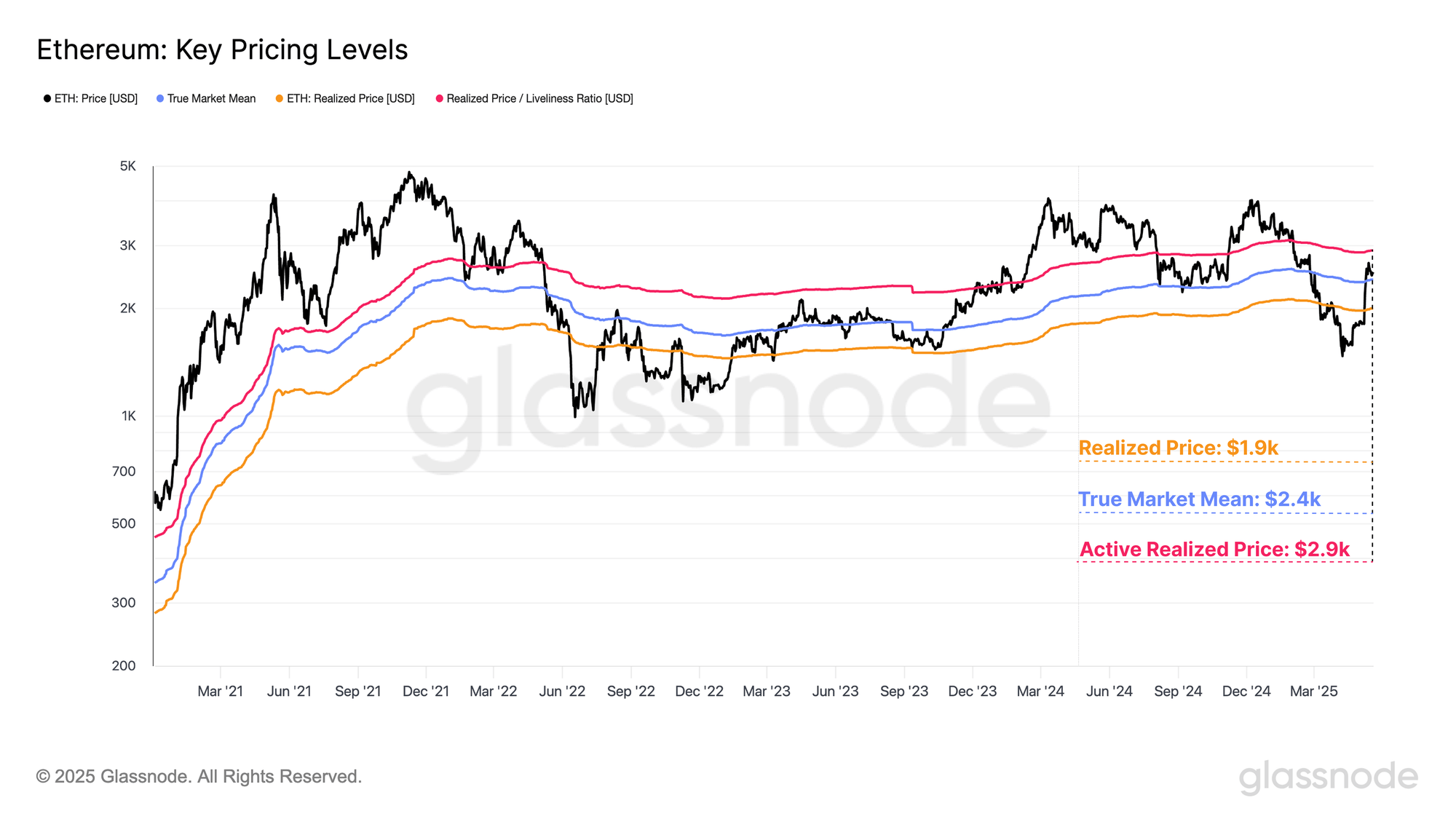

In related developments, Ethereum has recently regained critical on-chain functional thresholds, as highlighted in a weekly report from Glassnode.

Realized Price" width="2000" height="1125" title="Ethereum Sees Profits Surge: 60% Of Holders In The Green-Bitrabo">

Realized Price" width="2000" height="1125" title="Ethereum Sees Profits Surge: 60% Of Holders In The Green-Bitrabo">

The analysis outlines that Ethereum successfully reclaimed the Realized Price at the beginning of its upward trajectory. The Realized Price, a critical benchmark representing the average cost basis of all investors on the Ethereum chain, currently stands at $1,900, indicating that many holders are now experiencing significant profits.

Furthermore, Ethereum has also moved beyond the True Market Mean at $2,400, a metric designed to yield a more precise average acquisition price by excluding inactive, obsolete supply.

The remaining target for Ethereum is the Active Realized Price at $2,900, which refines the Realized Price concept.

Current ETH Price

Following a revival, Ethereum has risen to approximately $2,660, representing a 4% increase over the past week.