As Bitcoin nears the critical threshold of $110,000, market watchers are on high alert for potential developments. Following a sustained bullish trend, BTC is encountering significant resistance that could shape its trajectory for the coming weeks. In an environment marked by rising uncertainties, such as geopolitical tensions and fluctuations in interest rate policies, Bitcoin has managed to maintain its strength. This resilience is particularly noteworthy as traditional markets exhibit signs of turbulence, leading to increasing demand for stable digital assets like Bitcoin.

Recent on-chain analytics provide further evidence that confidence among investors remains robust. Data from various sources indicates that the short-term holder Spent Output Profit Ratio (STH SOPR) has experienced a recent uptick, highlighting a rise in profits realized by newer investors in the BTC market. Typically, such metrics suggest a healthy market sentiment, often associated with upward price movement.

Interestingly, the level of realized profits has not reached extreme heights, which usually coincide with market euphoria. This indicates that the current profit-taking behavior is sustainable and supports the overarching bullish narrative. With a solid momentum in place, all eyes are on whether Bitcoin will make its next significant leap.

Potential Breakout on the Horizon Amidst Global Market Changes

Bitcoin is currently navigating a crucial resistance area just under the $110,000 mark, maintaining a tight consolidation as it explores the possibilities for a major breakout. The ongoing price structure shows signs of bullishness across various timeframes, lending credence to the expectation that BTC may soon generate enough energy to breach and enter uncharted territory.

Simultaneously, global market dynamics are shifting, exacerbating volatility in the financial landscape. A pivotal judicial ruling regarding international trade tariffs has unsettled expectations within the markets, creating an added layer of unpredictability. While traditional investments scramble to adapt, cryptocurrencies like Bitcoin and Ethereum have demonstrated surprising stability and, in some cases, growth, even as economic conditions tighten. This resilience signals an enduring interest in these digital currencies as viable alternatives in times of uncertainty.

Further validation of this optimism comes from on-chain data revealed by analysts, indicating that short-term holders are securing considerable profits. However, the metrics remain far from the euphoric peaks typically associated with market tops, suggesting that demand for Bitcoin is still strong. This trend indicates that the current bullish phase is likely to persist.

The combination of disciplined profit-taking and steadfast holding behavior posits a market primed for further advances. Should the resistance level be surpassed, Bitcoin could initiate a robust rally, potentially influencing the broader cryptocurrency market positively.

BTC Trades Just Below Key Resistance Levels

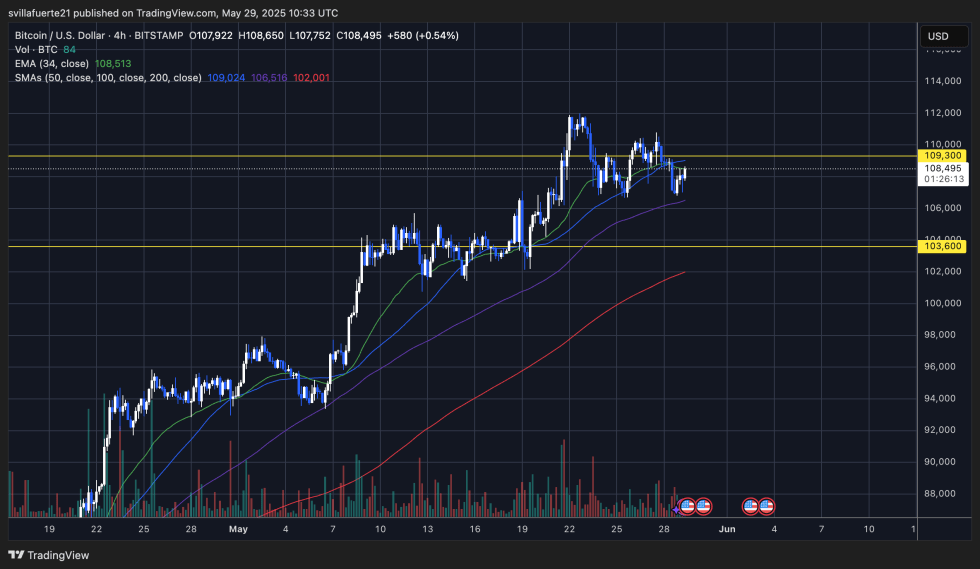

Currently, Bitcoin is clocking in at approximately $108,495 on the 4-hour chart, continuing its consolidation phase just beneath the pivotal resistance level at $109,300. This area has proven to be a formidable barrier in prior trading sessions, creating a ceiling the bulls have been struggling to penetrate. Nevertheless, Bitcoin is firmly positioned within an uptrend, characterized by higher lows and persistent buying interest around key moving averages.

The 34 EMA positioned at $108,513 serves as dynamic support, while the 50 and 100 SMAs, located at $109,024 and $106,516 respectively, have effectively cushioned previous downturns. A successful breach of the $109,300 resistance could provoke a vigorous move towards the previous all-time high near $112K, raising the stakes for both short and long-term holders.

Trading volume remains stable, while prices are sustained above a broad support range between $106,000 and $103,600. This zone has functioned as a critical launching pad for recent bullish movements, and as long as Bitcoin maintains its position above it, the bullish narrative remains firmly in place.

Featured image from Dall-E, chart from TradingView