Recent analysis indicates a significant divergence in the Bitcoin Taker Buy/Sell Ratio on Binance compared to other exchanges. This discrepancy could have implications for market sentiment and price movements.

Increasing Divergence: Insights from the Taker Buy/Sell Ratio

In a detailed analysis featured in a recent CryptoQuant article, experts have highlighted a noteworthy trend regarding the Taker Buy/Sell Ratio across different cryptocurrency platforms. This ratio serves as a crucial indicator of market dynamics, signifying the balance between buying and selling activity on an exchange.

A ratio exceeding 1.0 typically indicates a bullish market, with more traders willing to purchase Bitcoin at elevated prices. Conversely, a ratio falling below this threshold signifies an increasing sell volume, reflecting a bearish outlook among traders.

Below is a representation of the Bitcoin Taker Buy/Sell Ratio across various exchanges over recent weeks:

The chart illustrates a recent upward trend across exchanges, with the 7-day average of the Bitcoin Taker Buy/Sell Ratio significantly surpassing 1.0. This surge indicates a robust buyer presence, overshadowing selling activities in the broader market.

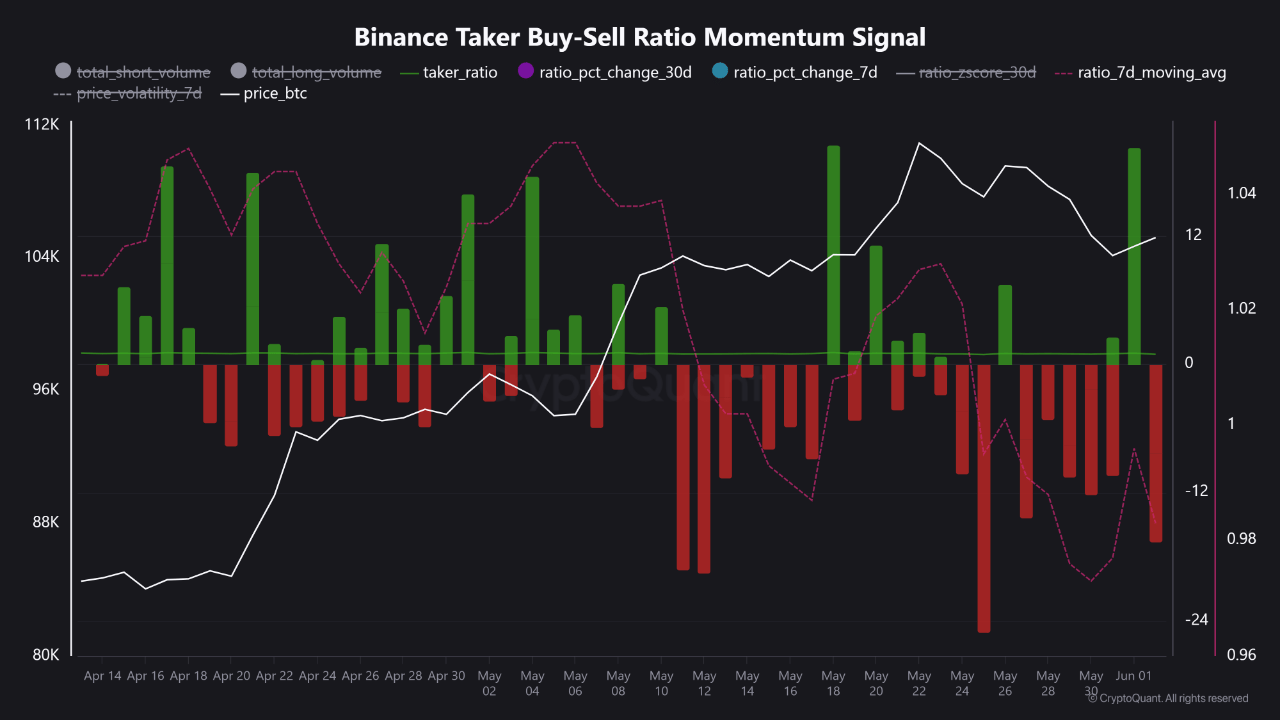

However, the situation on Binance illustrates a contrasting trend. The following chart specifically for Binance demonstrates this discrepancy:

The graph reveals a concerning decline in the 7-day average of the Taker Buy/Sell Ratio on Binance, dipping below the 1.0 mark. This suggests that traders on Binance are adopting a more bearish perspective, contrasting sharply with the bullish sentiment displayed across other platforms.

“Given that Binance consistently accounts for approximately 60% of global BTC transactions and maintains a substantial portion of futures open interest, this discrepancy in taker behavior can heavily influence market dynamics,” explains the analyst. “When selling activity dominates on Binance, it can often skew bullish signals from other exchanges.”

The analyst also referenced previous occurrences in August 2023 and February 2024, where similar patterns led to notable declines in Bitcoin’s value, ranging from 5% to 10% shortly thereafter.

The upcoming days will be pivotal in determining whether this divergence will persist, potentially indicating further bearish sentiment, or if the Taker Buy/Sell Ratio on Binance will align with the increasingly bullish trend seen on other exchanges.

Current BTC Market Insights

As of the latest update, Bitcoin is trading around $104,300, reflecting a decline of over 5% in the past week.