In a recent discussion, renowned economist Julien Bittel from Global Macro Investor presented a thought-provoking theory he dubs “The Everything Code,” a framework that intertwines demographics, debt, and liquidity dynamics. He predicts this confluence could escalate the valuation of digital assets from its current approximate $3.5 trillion to an astonishing $100 trillion within the next decade.

Against the remarkably buoyant backdrop of the crypto market, which has seen significant growth since early 2024, Bittel critiques the labor landscape of developed nations. He asserts that the “labor force participation rate is unlikely to rebound – instead, a downward trend is expected.” This, he argues, is a fundamental issue as “the workforce is rapidly being supplemented—and in some cases, replaced—by advanced technologies, ushering in a period of deflation.” His perspective highlights a troubling paradox: diminishing labor forces coupled with unwavering entitlement obligations call for increased fiscal stimulus to sustain economic systems while grappling with high levels of debt.

Diving deeper into fiscal realities, Bittel emphasizes the staggering level of global liabilities, presently nearing 120% of GDP. In his view, “The solution resides in more debt, which the system seems to favor.” He warns that sluggish economic growth will lead to a rising debt-to-GDP ratio, a condition policymakers may address through monetary easing rather than fiscal austerity measures.

Highlighting the cumulative effects of monetary debasement, Bittel describes it as an insidious annual loss of purchasing power that is often overlooked. He further asserts, “Holding cash has become increasingly perilous,” compelling investors to seek higher returns just to maintain their purchasing capacity.

The Journey to a $100 Trillion Cryptocurrency Empire

Transitioning to the topic of liquidity, Bittel aligns with the insights of GMI founder Raoul Pal, emphasizing its fundamental role in current economic frameworks. Their analysis reveals that the interplay of central bank asset purchases and commercial bank lending across prominent economies significantly influences market movements—accounting for a striking 90% of Bitcoin’s fluctuations, and 95% of those in the Nasdaq-100. The cyclic demand for liquidity is vital to avert a credit crisis, and according to Bittel’s studies, “Liquidity acts as a rising tide, lifting those assets that are seen as scarce and high-risk.”

Bittel connects this scarcity directly with Bitcoin, highlighting its exceptional historical performance. “Bitcoin has demonstrated a consistent capability to enhance purchasing power more effectively than any other asset, registering an astonishing annualized growth of approximately 150% beyond the rate of currency debasement since 2010,” he articulates. In contrast, even the Nasdaq’s impressive annual return of 13% pales significantly against Bitcoin’s performance, which he notes has fallen 99.94% behind the cryptocurrency since 2012. Such data frames Bitcoin as a potential antidote to the macroeconomic challenges posed by demographic trends, increasing leverage, and forced liquidity crises.

This analysis leads to Bittel’s bold forecast. “We are merely at the beginning of a global endeavor—a race among institutions, governments, and individuals to amass Bitcoin,” he predicts. He estimates that this pursuit will elevate the crypto domain from its $3 trillion valuation to an impressive $100 trillion over the ensuing seven to ten years.

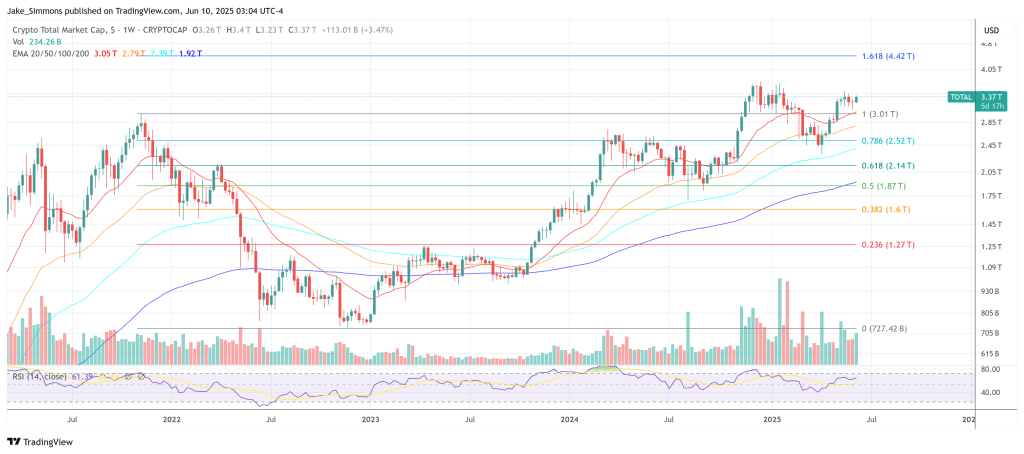

Analyzing the figures, transitioning from the existing $3.55 trillion market capitalization necessitates a 40% compound annual growth rate over the decade. Remarkably, this figure increases to around 61% if we anticipate a seven-year time frame—ambitious yet not unprecedented when we examine historical trends within the crypto landscape.

While Bittel recognizes that this path could be fraught with challenges, he asserts it may also provide unparalleled rewards. He envisions Bitcoin as “an integral part of the solution.” Together, Bittel and Pal categorize the upcoming rush for limited resources as “the most significant wealth-building opportunity of our generation,” concluding that if their forecasts materialize, this moment may be “celebrated as the most significant macroeconomic trade in history.” This encapsulates the essence of “The Everything Code.”

Similarly, Pal, during his recent talk at Real Vision’s Sui Basecamp, emphasized the concept of cryptocurrency functioning as “an immense gravitational force,” suggesting it outmatches the performance of all other investment vehicles. He identifies Bitcoin’s positioning in what he terms the “banana zone,” a stage where increased liquidity and collective investor behavior converge to fuel extraordinary price surges, with a projected target price of approximately $450,000 per coin. This aligns closely with Bittel’s vision of Bitcoin’s capitalization exceeding $40 trillion, even in scenarios that exclude alternative cryptocurrencies.

As of now, the total market cap for crypto assets stands at around $3.37 trillion.