The latest predictions from the financial institutions signal a troubling trend for global growth.

According to the latest findings, the anticipated growth rate for the global economy is just 2.3%, a decline from the previous year’s figure of 2.7%. While growth might seem positive, this number signifies the weakest performance in nearly two decades. Alarmingly, such slow growth has only been matched during times of economic recession.

Even more concerning is that these figures mask a deeper issue; the economic disparity between nations means that many developing countries are already teetering on the brink of recession.

Yet amidst this grim outlook, a noteworthy development emerges: cryptocurrency, particularly Bitcoin, shows promising growth prospects.

Factors Contributing to Economic Stagnation

The latest economic report sheds light on the troubling dynamics affecting global growth, noting that the current growth rate of 2.3% is unprecedented for a non-recession year since 2008.

The primary reasons identified for this downturn include:

- Continued trade tensions, especially concerning tariffs.

- A significant deceleration in global trade activity.

Data indicates that the pace of global trade growth has been steadily declining:

- 5.1% in the early 2000s

- 4.6% through the 2010s

- 2.6% in the current decade

Much of the stagnation in trade has been exacerbated by rising tariffs, particularly those instituted by the U.S. These tariffs have fostered uncertainty, leading to a predicted world trade volume increase of only 1.8%, a stark contrast to pre-pandemic levels.

This downward trend poses significant risks to international trade viability.

Moreover, high-profile economies such as the U.S. (forecasted growth of 1.4%) and the Eurozone (1.0% to 1.5%) are also experiencing rapid deceleration. Without focused policy interventions and a reduction in trade hostilities, the global economy risks entering a drawn-out downturn.

What’s troubling is that the repercussions of this downturn will not be uniformly shared across the globe.

Struggles of Developing Nations

Emerging economies are disproportionately affected by this downturn:

- Approximately two-thirds of these nations are now growing below their average performance over the past decade.

- Per capita income growth increasingly fails to keep pace with rising population numbers.

Particularly in regions like Africa and Latin America, the combination of soaring debt, slow investments, and inflationary pressures poses severe challenges, especially as population growth remains high.

For example, sub-Saharan Africa is projected to see population increases of nearly 20% by the end of the decade.

The current economic climate puts over half of low-income countries at extreme risk of debt distress.

Additionally, rising interest rates in developed nations are diverting investment away from emerging markets, compounding their challenges.

Without necessary reforms, economic development, and improved access to capital, these regions may find themselves stuck in a cycle of low performance, further damaging the global economy’s prospects.

Interestingly, despite these mounting pressures, one asset class continues to flourish.

Bitcoin’s Ascendancy as a Safe Haven

In challenging economic climates, gold has long been the safe-haven choice for investors.

This trend persists, with gold seeing a yearly increase of over 18%, indicative of investor trepidation.

However, Bitcoin is also positioning itself as a formidable contender.

Bitcoin has experienced a remarkable 54% surge in the past year, boasting a market capitalization nearing $2.08 trillion. Though it remains a fraction of gold’s staggering $23 trillion value, the simultaneous rise of both assets is noteworthy.

Annual average gold prices are projected to reach record highs this year, driven by safe haven demand, before stabilizing in the subsequent years.

— Financial Institute

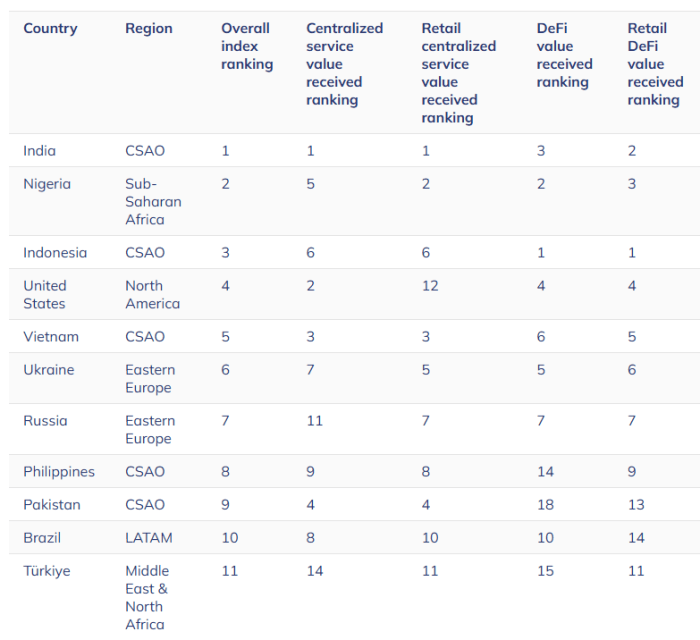

As a significant indicator of this trend, crypto adoption is intensifying, particularly among institutional investors.

Research from 2023 indicates that the interest in cryptocurrency among financial advisors has doubled, with traditional institutions increasingly embracing crypto-centric products.

Moreover, Bitcoin exchange-traded funds (ETFs) have attracted over $40 billion since their inception, showcasing an intersection between traditional finance and cryptocurrency.

Corporations are also joining the fray, highlighted by the successful Bitcoin treasury strategy advocated by industry leaders like MicroStrategy’s Michael Saylor.

Bitcoin is increasingly recognized as a hedge against not only inflation but also the risks associated with slow growth. Importantly, this adoption trend isn’t confined to wealthier nations.

Several developing economies facing severe economic impacts from a global downturn have emerged as leaders in cryptocurrency adoption, illustrating a significant shift in financial behavior across regions.

As the world braces for potential economic downturns, understanding the intersection of traditional finance and cryptocurrency becomes increasingly crucial. The future could very well hinge on how effectively we leverage our crypto wallets.

Explore the Future with Smart Wallet Solutions

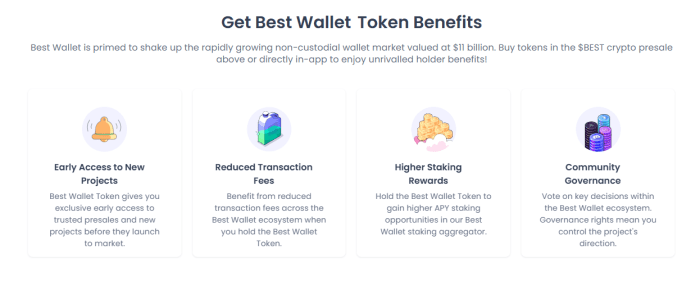

In today’s rapidly evolving landscape, preparing for financial shifts involves choosing the most efficient crypto wallet. One standout option is the Smart Wallet Token ($SMW), which promises to redefine how we interact with digital currencies.

The Smart Wallet app combines user-friendliness with robust security features. Its multi-layered authentication, decentralized finance (DeFi) capabilities, and upcoming debit card integration make it a comprehensive solution for crypto enthusiasts.

The $SMW token enhances your experience by minimizing transaction costs while significantly increasing staking incentives—boosting your wallet’s overall functionality.

With the non-custodial wallet sector surging to $11 billion, it’s evident that solutions like Smart Wallet are poised for rapid growth. Their unique presale feature is particularly appealing, gathering interest from a diverse range of investors.

Currently, the presale has amassed $14 million in funds, with pricing starting at $0.030, highlighting the project’s robust market interest and potential. It’s anticipated that $SMW could reach $0.075 in value within the next year, representing a remarkable 150% profit trajectory, fueling investor enthusiasm.

Head over to the Smart Wallet presale page for more details.

Can Cryptocurrency Combat Economic Downturns?

While cryptocurrencies like Bitcoin can’t single-handedly reverse trends in declining global GDP or trade disruptions, they are emerging as significant alternatives in hedging against such financial upheavals.

Bitcoin shares a unique position alongside timeless assets like gold, serving as a store of value amidst economic uncertainty. With rising national debts and tightening monetary policies, many investors are increasingly looking towards digital currencies as a ‘safety net’.

- Just like gold, Bitcoin offers a hedge against inflation.

- With national debts soaring, Bitcoin’s limited supply becomes more appealing.

- Adopting cryptocurrencies can lead to diversification in investment portfolios.

Could Bitcoin not only mirror gold’s valuation but also redefine hedging strategies for the future? This potential leads to broader discussions about crypto’s role in financial resilience.

Always conduct thorough research before making investment decisions. Stay informed, and consider obtaining a crypto wallet to safeguard your assets.