The landscape of Bitcoin’s market dynamics is evolving significantly, even as its price hovers around the impressive $100,000 mark. Current analyses reveal intriguing trends that contrast sharply with the exuberance suggested by price movements. A recent study by the analytics firm Glassnode unveils that while Bitcoin approaches its all-time high of $111,700, on-chain metrics are indicating signs typically associated with a bearish phase.

Anomaly in Coin Activity Amid Price Growth

According to a comprehensive report by Glassnode, the blockchain activity for Bitcoin has notably diminished, despite its uplifted price levels. Daily transactions have decreased to a range of approximately 320,000 to 500,000, down from a remarkable peak of over 730,000 transactions in 2024—a drastic reduction for a network typically thriving in a bullish scenario.

This decline in Bitcoin transactions can largely be attributed to a plummet in non-financial activities like Inscriptions and Runes, which previously bolstered transaction volumes. While monetary value transfers have remained relatively stable, the overall dip in network activity creates a disparity—in prior price surges, rising on-chain transactions were the norm.

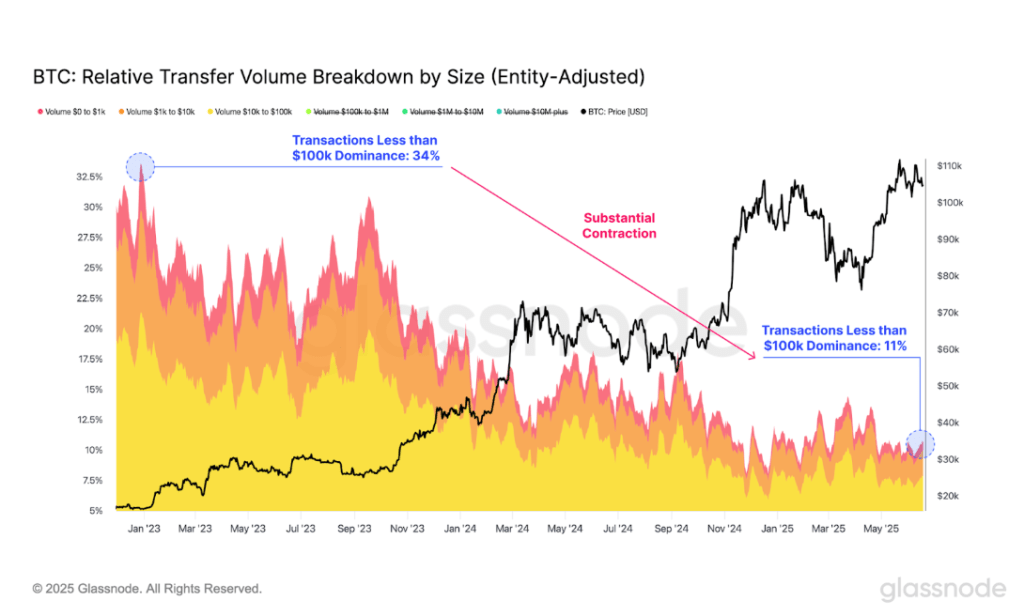

Although the number of transactions is waning, the Bitcoin blockchain continues to process substantial dollar volumes. The current average daily transaction volume hovers around $7.5 billion, peaking at $16 billion during late 2024’s price rally. The nature of these transactions indicates a shift from retail traders to large institutional investors, evident from the average transaction size now surpassing $36,000.

Retail transactions, specifically those falling below $100,000, have witnessed a significant decline in their overall volume contribution, with transactions in the $0 to $1,000 bracket now accounting for less than 1% of total exchange value—a steep drop from around 4% at the cycle’s onset.

Reduced Fees and the Shift to Off-Chain Trading

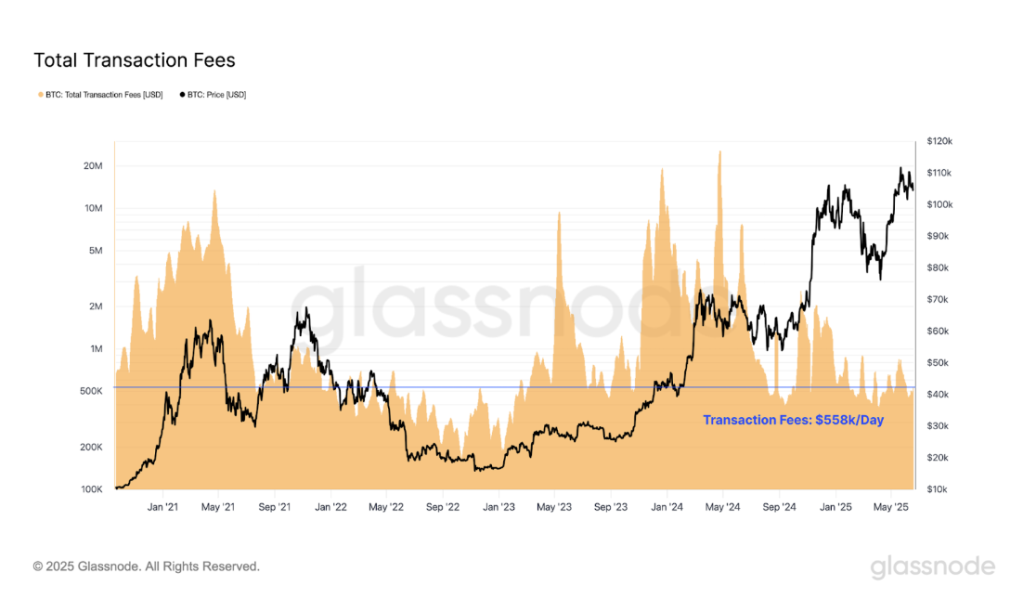

Additionally, the report from Glassnode identifies a marked decrease in transaction fees, even in light of Bitcoin’s soaring price levels. With average miner revenue falling to approximately $558,000 per day, this downturn ties to improvements in technology alongside declining demand for block space, leading to fewer transactions overall.

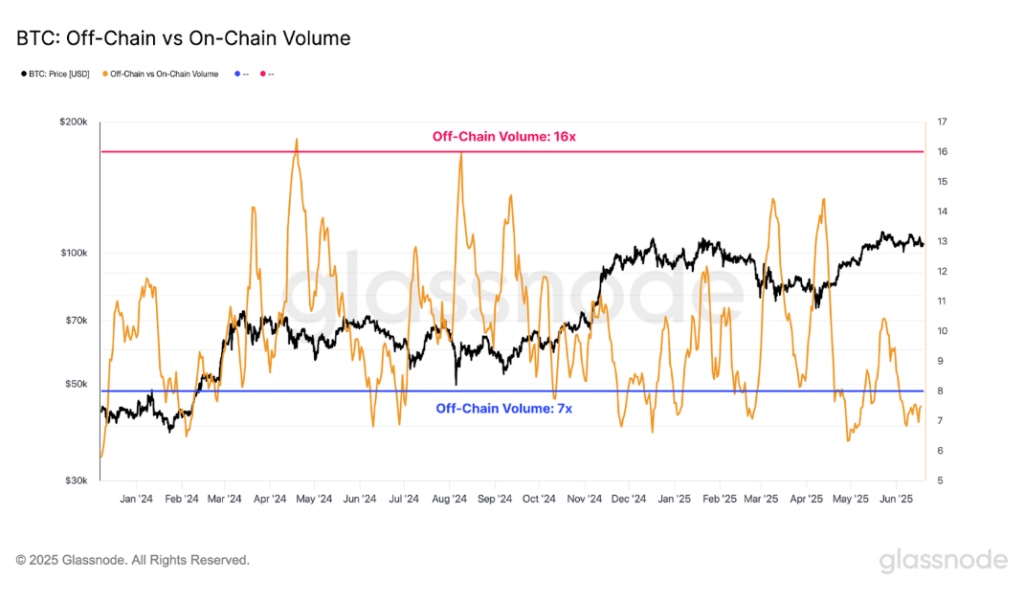

In contrast, trading activities appear to be favoring off-chain platforms, predominantly within centralized exchanges. Spot trading volumes frequently soar beyond $10 billion, while futures markets are significantly more active with an average daily volume nearing $57 billion and occasional surges exceeding $120 billion. Options markets are also expanding, managing over $2.4 billion daily. Collectively, these off-chain venues account for 7 to 16 times the total volume compared to what is settled directly on the Bitcoin blockchain.

In summary, the analysis presented by Glassnode reveals a significant transformation in the Bitcoin ecosystem, trending increasingly towards institutional investors as opposed to retail participants. At the time of this writing, Bitcoin’s price is positioned at $103,470, having seen a decline of 2% over the previous 24 hours.

Featured image from Pexels, chart from TradingView