Recent trends in cryptocurrency mining highlight a concerning issue for Bitcoin miners. Current data indicates that these miners are facing significant financial strain, raising the question: could this result in increased selling pressure from them?

An In-Depth Look at Miner Profitability

Analysts have observed alarming declines in the potential earnings of Bitcoin miners. The Miner Profit/Loss Sustainability metric has fallen sharply, revealing a mismatch between miner earnings and mining difficulty levels. This important indicator sheds light on the economic health of miners and their ability to operate profitably.

When this metric is positive, it signifies that miners are performing well financially, generating adequate revenue compared to the mining difficulty. However, the current dip into the negative territory suggests the opposite—a scenario where miners earn less despite rising operational challenges.

Here’s a visual representation that illustrates the recent trend in miner sustainability:

The data now shows a concerning trend, confirming that miners are under unprecedented financial pressure. Historically, such situations lead to miners liquidating their holdings to cover expenses, suggesting potential volatility in Bitcoin prices if this trend continues.

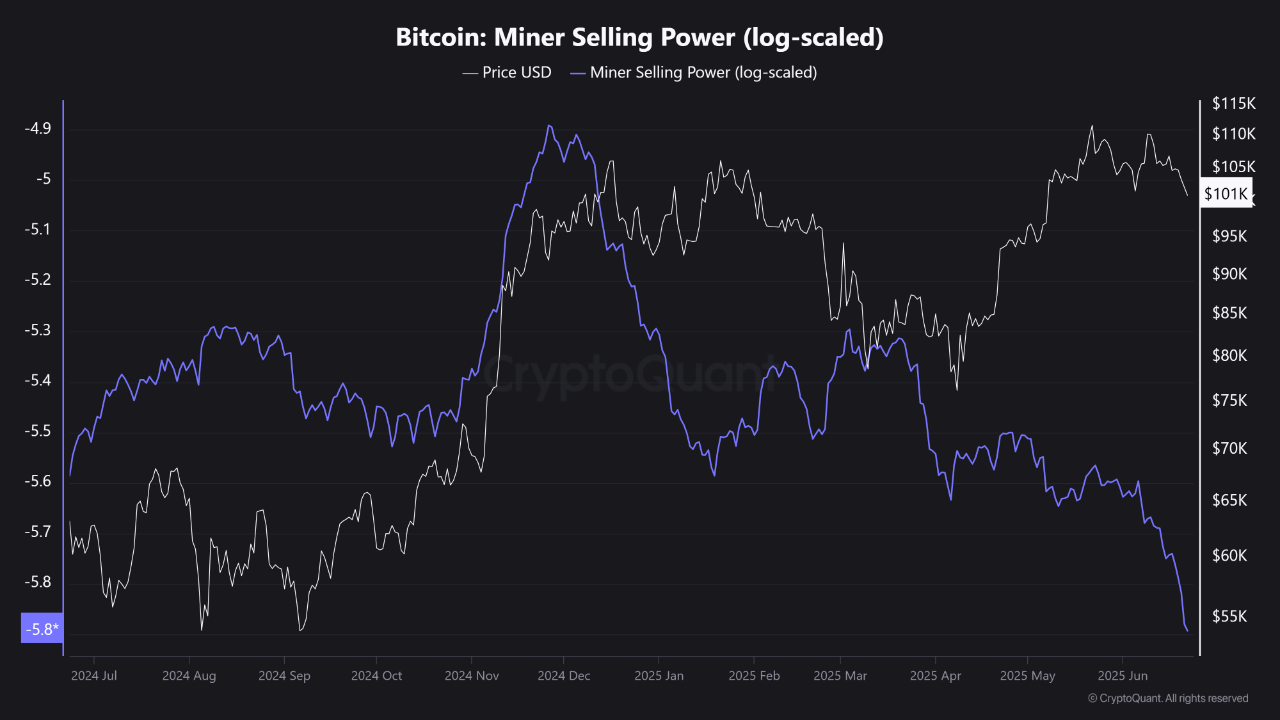

Interestingly, recent miner selling activity has not surged despite the dire indicators; rather, it seems to have decreased. This indicates an evolving dynamic that merits close attention.

From the chart above, we can assess the Bitcoin Miner Selling Power, which tracks how much Bitcoin miners offload relative to their total holdings. The downward trend may imply that miners are holding onto their coins instead of selling them, which could indicate hope for a recovery in prices or a reluctance to sell at low values.

However, the sustainability of this holding pattern is uncertain, particularly as miners face escalating operational costs and external pressures.

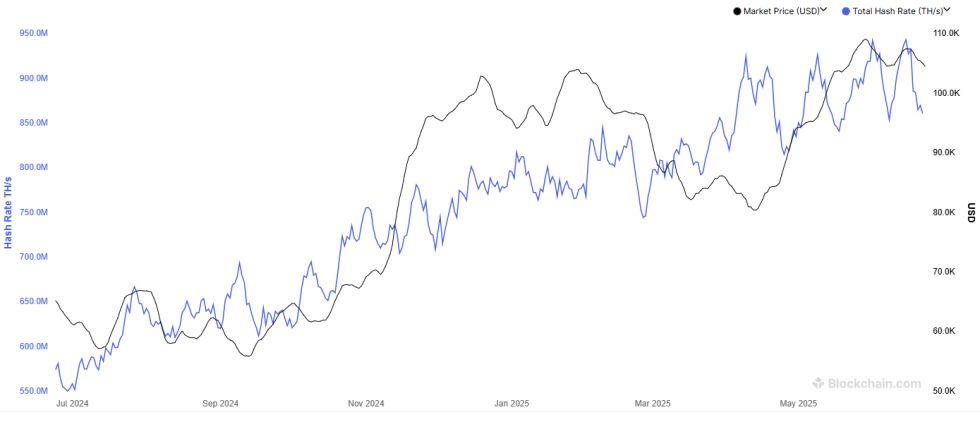

In addition to profit concerns, another critical metric, the Hashrate, has experienced a significant downturn recently. After reaching all-time highs earlier this month, the hashrate has fallen sharply, indicating that some miners are unable to maintain their previous capacity.

As mining upgrades are crucial for maintaining competitiveness, this drop in hashrate further signals the pressure miners are experiencing amidst fluctuating market conditions.

Current Bitcoin Pricing Trends

Bitcoin’s recent price movements have been tumultuous. After a significant drop towards the $98,000 region, the cryptocurrency has rebounded slightly to approximately $101,100, showcasing the volatility that often accompanies miner profitability issues.

These trends highlight the interconnected nature of miner profitability and overall Bitcoin market dynamics. Investors should remain aware of these factors as they may indicate impending shifts in market behavior.