In recent days, Bitcoin has displayed remarkable resilience, hovering around the pivotal price level just shy of its historic peak of $112,000. This persistence comes as market participants absorb significant macroeconomic updates that have sparked a wave of optimism across the financial landscape. Legislative advancements in the U.S. and an unexpectedly robust jobs report have contributed to a growing sense of security among investors, setting the stage for Bitcoin’s forthcoming movements.

Additionally, the derivatives sector is witnessing substantial growth. Recent statistics from CryptoQuant reveal that the Bitcoin futures market on Binance—launched in late 2019—has amassed over $650 trillion in total volume. For comparison, spot trading during the same timeframe only reached $168 trillion, indicating a marked shift towards leveraged trading strategies in influencing Bitcoin’s price trajectory.

As Bitcoin stabilizes within this critical zone, the interaction between macroeconomic influences and the burgeoning futures market is likely to be crucial in determining if we will experience an upward breakout into uncharted high territory or a possible correction. Currently, Bitcoin stands on firm ground, captivating the attention of traders eager for signs of which direction the market will take next.

Bitcoin Eyes New Heights as Futures Momentum Builds

Bitcoin is poised for potential price discovery, with bullish momentum keeping it well above the crucial support level of $107,000. Following a phase of consolidation marked by volatility, the market sentiment appears to shift positively as uncertainties wane. Having surged 47% from the lows seen in April, Bitcoin is now tantalizingly close—less than 2% away—from its all-time high of $112,000. The days ahead are critical, as an upward breakout could unleash a new bullish wave, while a drop below established support might spark short-term declines.

Market analyst Darkfost has highlighted significant data revealing the evolution of Bitcoin trading dynamics. The explosion in futures trading demonstrates how investor behavior is changing. The cumulative volume of Bitcoin futures on Binance—more than $650 trillion—far exceeds that of spot trades, underscoring the increasing role of speculative trading in market movements.

This shift represents a new trend in market engagement. While spot trading typically reflects longer-term confidence in assets, the ascendance of futures trading showcases the growing impact of short-term speculation and leveraged positions on price movements, shaping investor strategies and market dynamics.

Throughout this cycle, daily volumes in BTC futures have crossed the remarkable threshold of $75 billion, a significant indicator of a vibrant market. As Bitcoin teeters on the edge of a potential new peak, the interaction between futures-driven investment and prevailing market sentiment will be pivotal in ascertaining the sustainability of forthcoming trends. Whether we’re on the verge of an exciting upward journey or an extended period of sideways trading, the current landscape underscores the dominance of derivatives.

BTC Price Review: Key Resilience Level at $109,000

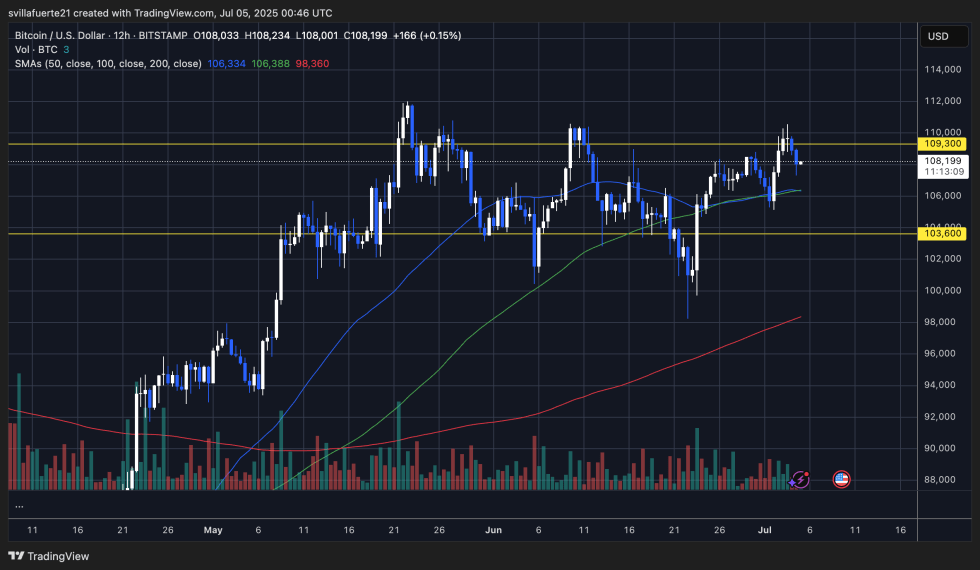

Bitcoin’s current behavior reflects a consolidation phase just beneath its previous all-time high, with technical analysis indicating resistance around the $109,300 region. Price movement is currently confined within the $109K resistance and a supportive range between $106,000 and $106,300, aligning with significant moving averages. This consolidation suggests that the market is gearing up for a larger directional move.

The slight decrease in volume reflects a period of uncertainty. However, Bitcoin remains stable above the 200 SMA—an encouraging sign for future price developments. The higher-low formation established since mid-June continues to signal bullish potential as long as the $106K support remains intact. A breakthrough above the $109,300 resistance could pave the way for a significant rally into price discovery beyond the $112K mark, although current conditions necessitate some caution.

A retreat below the $106K support level might trigger a test of $103,600, identified as an essential demand center. Nonetheless, buyers show determination in defending major moving averages, bolstering the current upward trajectory. As traders await decisive signals, attention will be directed toward volume fluctuations and potential breakouts for future pricing direction. With macroeconomic indicators improving and overall sentiment appearing bullish, Bitcoin’s next major move may well shape the trends for the foreseeable future.

Featured image courtesy of Dall-E, chart details via TradingView.