The cryptocurrency landscape is abuzz with anticipation as Bitcoin prepares for what could be a groundbreaking surge in price. With recent movements indicating robust strength above key support levels, market participants are eyeing a possible breakaway from the prevailing trading range. After an unsuccessful attempt to surpass the all-time high of $112,000, bulls are now focused on achieving a strong weekly closing price that could catalyze further upward momentum.

A closer look at the on-chain metrics reveals encouraging signs. The Binary Coin Days Destroyed (CDD) metric—which highlights transactions of long-standing coins—indicates a current activity level that is significantly below the annual moving average. Historically, such low activity levels have preceded distribution phases among long-term holders. However, the present subdued movement indicates that these investors are holding firm, expressing confidence in the asset’s future potential.

This diminished activity in the CDD, combined with steady price retention and a strong support level around $108,000, creates a favorable outlook for Bitcoin. Should the current bullish trend persist, BTC might venture into new price territories, reaffirming its status as a premier asset in the cryptocurrency market.

Long-Term Holders Exhibit Patience

For several months, Bitcoin has been moving within a narrow band beneath its all-time high, yet signs of potential breakout are emerging. Since late June, the cryptocurrency has appreciated by 10% and continues to remain solidly above key support zones, notably around $108,000. This consistent endurance has led industry analysts to speculate that a significant breakthrough above the $112K threshold could ignite a new phase of price exploration.

While the short-term trajectory remains ambiguous, the long-term framework appears promising. Analysts emphasize that once Bitcoin surpasses this resistance level, it could rapidly ascend to unforeseen heights, driven by a combination of robust investor trust and favorable on-chain signals.

Respected analyst Axel Adler provides insights into the Binary CDD metric, illuminating the behavior of long-term holders. According to Adler, the current levels of ancient coin activity, being half of the annual average, suggest that seasoned investors are refraining from selling, even amid upward price movement.

Interestingly, the recent circulation of coins associated with notable figures like Roger Ver has had minimal impact on the market beyond momentary excitement. Observing prior market cycles, spikes in CDD have often been linked to market peaks, such as around $70,000 and $100,000. The current lack of such spikes suggests that the ongoing rally remains structurally sound, distancing itself from any overheated tops.

As Bitcoin maintains stability and old coins remain largely inactive, the environment appears conducive for an imminent breakout. Should bulls successfully reclaim the $112,000 level, Bitcoin might enter a new phase of price discovery, influencing the wider cryptocurrency market in the upcoming weeks.

Bitcoin Price Maintains Key Support Amid Bullish Defense

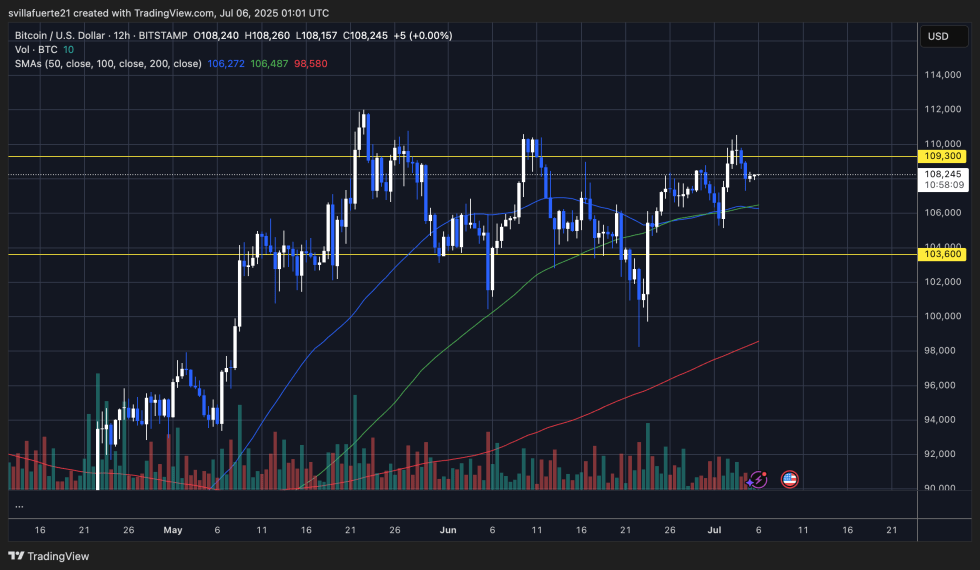

Currently, Bitcoin is trading in a snug consolidation phase beneath its all-time high of $112,000, with prices hovering around $108,245. Analysis of the 12-hour chart illustrates that BTC has encountered resistance at the $109,300 level repeatedly without breaking through decisively. At the same time, bulls are energetically defending the $106,000–$106,500 zone, bolstered by the 50 and 100-period simple moving averages, which serve as moving points of support.

Trade volume remains relatively muted compared to the breakout in May, hinting at a potential buildup ahead of a substantial price movement. The existing consolidation range between $103,600 and $109,300 mirrors a typical high-timeframe range, setting up liquidity traps for traders above and below. A confirmed breakout above $109,300 could catalyze a wave of price discovery, while a drop below $103,600 might necessitate a reevaluation of lower support levels.

As the market holds its bullish structure by maintaining above $106,000 and particularly the $103,600 support area, recent price movements indicate that Bitcoin may be poised for a pronounced directional change. Stakeholders should keep an eye out for volume escalation and a defined break above or below key levels in the coming days to validate the next phase in this dynamic market.

Featured image from Dall-E, chart from TradingView