On July 10–11, 2025, Bitcoin shattered its previous records, hitting an impressive new milestone of $118,403.89 in the early hours of July 11, 2025.

This significant price rise marks a transformational moment in the cryptocurrency world. After initially breaking through $112,000, Bitcoin quickly garnered momentum, leading to a rally driven by both solid fundamentals and speculative fervor.

With robust market indicators and an overall optimistic sentiment, Bitcoin’s ascent might just be the beginning. As Bitcoin climbs higher, emerging altcoins and meme coins – including tokens like Snorter Token ($SNORT) – are also likely to seize the opportunity to surge.

What does all this mean for Bitcoin, and what should investors anticipate moving forward?

Unwavering Institutional Investor Interest

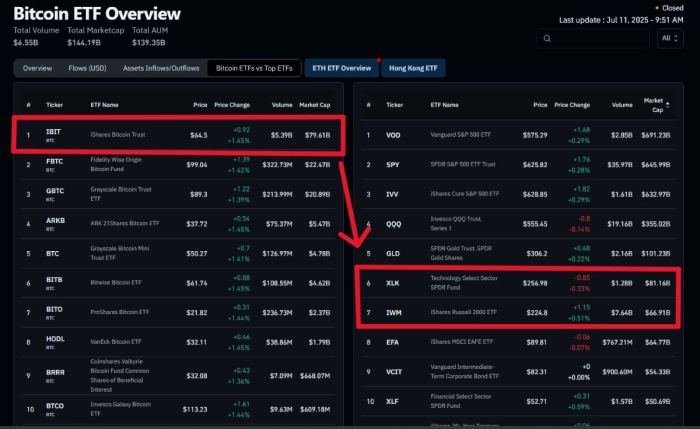

BlackRock’s spot Bitcoin ETF, known as $IBIT, has reached an astonishing total of over $79 billion, tripling in value within a year. This achievement far surpasses the growth trajectory of the largest gold ETFs that took over ten years to realize similar gains. Furthermore, Bitcoin ETFs collectively attracted a staggering $1.18 billion in net inflows in just one day.

This surge in Bitcoin’s value, paired with an increased presence of ETFs, particularly $IBIT, appears to be pioneering uncharted territories, solidifying its status among leading ETFs.

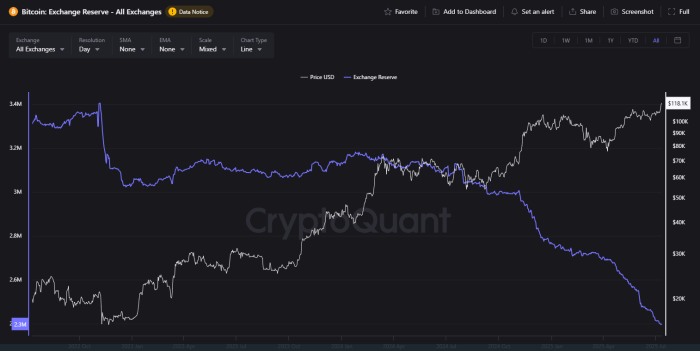

As capital continues to flow into ETFs while exchange inflows remain low (approximately ~3,200 BTC daily—levels not seen since 2015), the sentiment appears firmly bullish, indicating strong interest among long-term investors and limited pressure for immediate selling.

Macroeconomic developments further bolster Bitcoin’s case. The passing of the U.S. $3.3 trillion ‘Big Beautiful Bill’ increased fiscal deficit expectations by $410 billion, leading many investors to view Bitcoin as a safe haven against inflation and a weakening dollar.

Additionally, expectations of a Federal Reserve rate cut—potentially as early as September—have further fueled the ongoing rally.

Favorable regulatory developments, including new guidelines for stablecoins and a shift towards more crypto-positive governance, are also reshaping investor confidence.

Corporate Adoption and Retail Enthusiasm on the Rise

Major corporations are increasingly adding Bitcoin to their balance sheets, recognizing it as a legitimate reserve asset. Some notable companies accumulating Bitcoin include:

- MicroStrategy

- GameStop

- Tesla

- K Wave Media from South Korea

The entire crypto market is experiencing a resurgence, with altcoins like Ethereum (+8.3%), Solana (+3.96%), XRP (+5.7%), and Dogecoin (+9%) seeing renewed interest from investors.

Consumer engagement is also rising, supported by a recent study from Jan Wüstenfeld’s Bit of Bitcoin Research (Issue #13), highlighting key adoption metrics:

- 48 million Americans (18.6% of adults) now own Bitcoin.

- 11 million Americans (4.21%) maintain their Bitcoin holdings in self-custody.

- The demographic of Bitcoin holders skews younger and more diverse.

- Bitcoin ownership spans the political spectrum with no significant partisan bias.

Currently, Bitcoin faces technical support around $113K, with resistance levels set at $120K and $128.5K. However, risks remain—historical volatility and correlations with traditional markets mean unforeseen events, such as geopolitical conflicts or economic downturns, could threaten price stability.

While the market overall shows positive momentum, the leading 15 cryptocurrencies (excluding stablecoins) are performing well across the board.

This collective rise in momentum benefits various projects, including Snorter Token ($SNORT), which exemplifies the perfect timing for good investments.

Snorter Token ($SNORT) – Uncovering Hidden Meme Coin Opportunities

Meme coins have a unique allure; new ones launch rapidly, offering substantial profit potential. Unfortunately, many investors miss these opportunities entirely, dealing with countless meme coins that may come and go, often discussed on platforms like Telegram.

However, individuals investing in Snorter Token ($SNORT) enjoy a competitive advantage. By utilizing the Snorter Bot, they gain access to the most promising meme coin opportunities, transforming under-the-radar tokens into lucrative investments. This custom-built trading bot is specifically tailored to locate low-cap Solana meme coins buzzing on Telegram.

Through $SNORT, investors can gain early access to new tokens and uncover the best meme coins, revealing potential investment opportunities before they become widely recognized. The Snorter Token boasts low transaction fees on the Solana blockchain, rapid trade execution, and protective features against front-running and miner extraction value (MEV).

The Snorter Bot itself is equipped with various advanced features:

- Swift and secure transactions

- Automated trading strategies

- Protection against rug pulls and honeypots

- Options for copy trading

- Limit order placements

The presale for $SNORT is gaining traction, with $1.7 million raised so far. Investors can purchase $SNORT tokens for just $0.0979 if they act promptly—check out our guide on how to buy Snorter Token.

Navigate to the Snorter Token ($SNORT) presale page for more information.

A Bitcoin Bull Market Sets the Stage for Meme Coin Growth

The rise of Bitcoin above the $118K threshold is fueled by more than just speculation; it signifies deep-seated institutional adoption, favorable macroeconomic trends, and increasing corporate treasury investments.

Consequently, the growing number of retail investors is driving prices higher, not just for altcoins but for memecoins as well.

As always, conduct thorough research – this is not financial advice.