As the spotlight shines on cryptocurrency, the ongoing discussions in the US Congress during “Crypto Week” could pave the way for transformational legislation. This week marks a crucial juncture for digital asset regulations that may set a precedent for the future, leaving investors eager for updates.

At the same time, Bitcoin is demonstrating resilience. After hitting a tremendous peak of $123,200, it has recently found stability between $116,000 and $118,000. Despite a minor pullback, the bullish momentum appears to be intact, with strong buying support defending key levels.

However, new insights from CryptoQuant reveal underlying tensions in the market. Following a sudden drop, there has been a noticeable surge in selling activity, with some investors possibly exiting positions out of fear. This selling pressure raises concerns but may also lead to a healthier market as it shakes out less committed participants.

Market Volatility Triggers Major Sell-Off

Respected analyst Axel Adler indicates that a staggering 50,000 BTC were sold at a loss recently—one of the largest capitulation events in recent memory. This wave of selling appears to be a direct response to Bitcoin’s decline from its recent high, showcasing heightened panic. Many investors are reportedly selling at a loss, a classic indication of capitulation among less committed traders.

While this dynamic can seem alarming, history suggests that such events often set the stage for renewed upward momentum in strong uptrends. By removing uncertainty from the market, there may now be room for a healthier recovery driven by fundamental strength rather than mere speculation.

Nonetheless, concern looms as three significant crypto bills were rejected in Congress at the beginning of “Crypto Week.” This setback raises questions about the future regulatory landscape, leaving institutional investors in a state of caution as they seek clearer guidelines before committing further capital.

Despite these uncertainties, the fundamental aspects supporting Bitcoin remain robust. Key indicators reveal low exchange reserves, a steady supply from long-term holders, and increasing network activity. Additionally, the rise in retail participation and interest in altcoins hints at an emerging growth phase, signaling a promising outlook for both Bitcoin and the wider crypto ecosystem.

BTC Displays Resilience Post-Correction

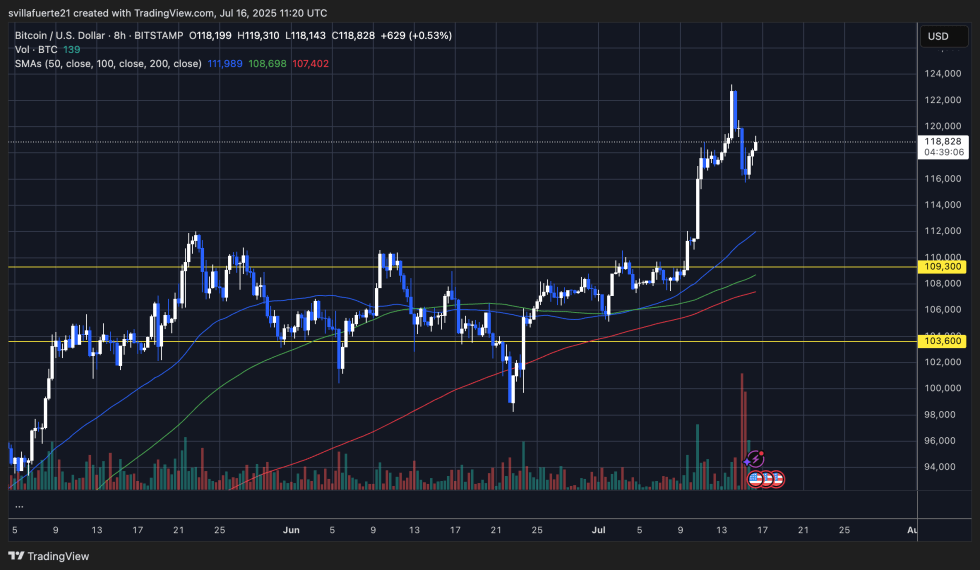

In the wake of recent volatility, Bitcoin’s 8-hour chart indicates that it is showing resilience. Following a drop to around $115,700, BTC has found solid footing and is currently trading around $118,800. The price structure remains bullish, characterized by higher lows and consistent upward movement.

Notably, the alignment of the 50, 100, and 200-period Simple Moving Averages emphasizes a strong uptrend. BTC continues to hold well above a critical support level around $109,300, which was previously a resistance zone, now acting as an essential demand area. If the bulls maintain their momentum and push back above the $120,000 level, a retest of the previous all-time highs could be on the horizon.

Overall, heightened trading volumes during the recent dip suggest a combination of fear-driven selling and a strategic correction of weaker hands. Nonetheless, swift recovery patterns indicate ongoing demand and persistent confidence among long-term holders.

Featured image by Dall-E; chart sourced from TradingView.