A new chapter in the realm of digital finance is unfolding as Bullish, a cryptocurrency exchange with backing from notable investor and PayPal co-founder Peter Thiel, gears up for a public debut. The recent announcement that Bullish has filed a registration statement on Form F-1 with the SEC marks a pivotal moment, showcasing the increasing interest of institutional investors in digital assets.

This move places Bullish at the forefront of a growing cohort of cryptocurrency companies vying to connect the worlds of traditional finance and blockchain technology. While the specifics regarding the IPO pricing and timeline are still under wraps, the eyes of eager investors and crypto advocates are trained on Bullish’s progress, as it could set a significant precedent for other firms aiming to enter public markets.

Timely and strategically framed, Bullish’s IPO comes amidst a recovering market sentiment and advancing regulatory frameworks for cryptocurrencies in the US. It may just be the catalyst that the digital currency landscape needs.

Institutional Endorsement Fuels Bullish’s IPO Aspirations

As Bullish’s journey towards a public listing gains traction, the endorsement from major Wall Street players underscores the importance of this offering. In its IPO filing, Bullish named J.P. Morgan and Jefferies as lead managers, clearly illustrating the strong institutional interest in this crypto-centric platform. Additionally, Citigroup joins in as a joint manager, further merging traditional finance with cryptocurrencies.

Other notable entities such as Cantor, Deutsche Bank Securities, and Societe Generale have joined as book-running managers, reflecting a worldwide enthusiasm for companies that operate within the digital asset infrastructure. Co-managers on this offering include Canaccord Genuity, Keefe, Bruyette & Woods, and Oppenheimer & Co., showcasing broad support across the finance sector.

When approved, the IPO will follow a standardized process via a prospectus made available through the SEC’s EDGAR system at www.sec.gov.

The filing reveals that Bullish has achieved an astounding milestone: recording over $1.25 trillion in total trading volume since its inception. This impressive statistic not only emphasizes the platform’s operational effectiveness but also highlights its allure for institutional and savvy investors. With the backing of influential financial institutions and increasing market momentum, Bullish’s IPO could signal a major shift in how the public views digital asset platforms.

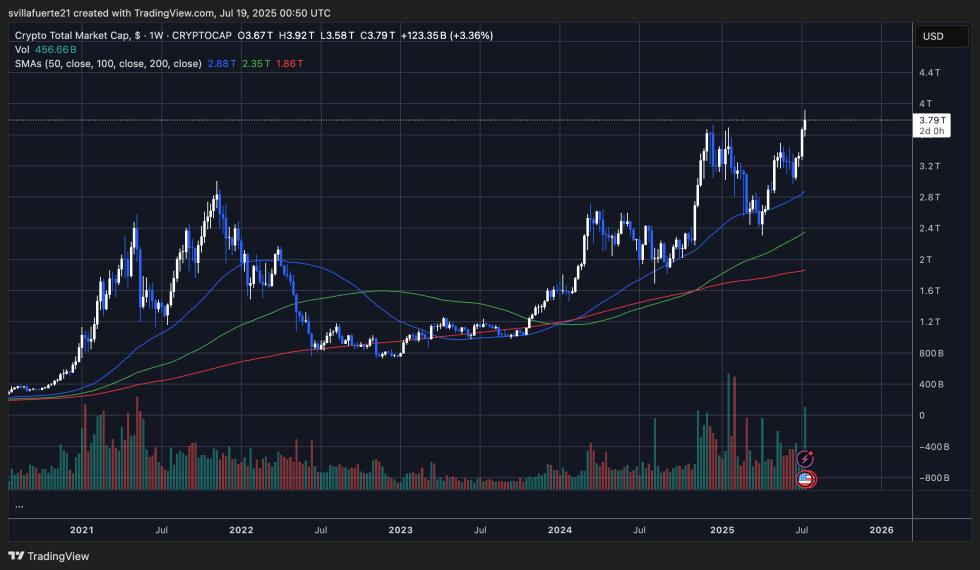

Crypto Market Cap Hits New Heights, Surpassing $3.7 Trillion

In a positive turn of events, the total market cap for cryptocurrencies has soared above $3.7 trillion, showcasing one of the most robust weekly performances observed since early 2024. The market has successfully surpassed previous resistance levels around $3.5 trillion, reflecting a solid bullish momentum. This climb is accompanied by increased transaction volumes, suggesting a strong commitment from buyers.

All significant moving averages are currently trending upwards, with the 50-week moving average crossing above both the 100-week and 200-week averages. This indicates a strong, sustained uptrend in the longer term, with prices significantly remaining above the 50-week SMA at $2.88 trillion, signifying robust market strength and reduced immediate downside risks.

As this bullish breakout materializes, many analysts are eyeing the $4 trillion mark as the next critical target, both psychologically and technically. This signals a potential new phase of growth and investment opportunity within the cryptocurrency domain.

Featured image from Dall-E, chart from TradingView