Binance Coin (BNB) has reached an impressive milestone, hitting a record $804 recently as the altcoin market shows signs of resilience amid broader fluctuations. While Bitcoin and Ethereum seem to be settling into lateral price movements, BNB is asserting itself with remarkable vigor. This shift can be attributed to robust fundamentals related to Binance’s increasing profitability and its strong market presence.

Recent analytics from CryptoQuant indicate that the unrealized profits from Binance’s Bitcoin reserves have surged to an unprecedented 60,000 BTC, showcasing a significant growth trend. Interestingly, this rise occurs even as Binance’s Bitcoin reserves have faced a notable decline since September 2024, raising questions about its long-term strategy.

As institutional interest swells and altcoins regain traction, BNB’s recent performance could provide insights into the potential direction of the overall market. Given Bitcoin and Ethereum’s stabilization within key price areas, BNB emerges as a standout asset, bolstered by growing exchange profitability and heightened investor confidence. The upcoming days will be crucial for determining if this bullish trend has further momentum.

Understanding Binance’s Bitcoin Holdings

Renowned analyst Darkfost has provided key insights regarding Binance’s Bitcoin reserves, illustrating the strategic maneuvers that support the exchange’s operational framework. As reported, Binance’s critical BTC reserve has decreased from around 631,000 BTC in September 2024 to approximately 574,000 BTC today. This reduction highlights a strategic adjustment rather than a sign of weakness, reflecting changing market conditions and demand shifts.

Additionally, Binance retains about 16,000 BTC in custodial wallets. These assets play a pivotal role in supporting the BTCB token, catering to user demand for tokenized Bitcoin within the BNB Chain. This setup allows Binance to ensure liquidity while maintaining operational transparency.

Monitoring these reserves provides an insightful perspective on macroeconomic sentiment. A decline in exchange reserves often indicates a growing level of trust among long-term investors, as more Bitcoin is transferred to cold storage for extended holding periods—this typically suggests a belief in long-term price appreciation.

Despite a decrease in total BTC holdings, the valuation of Binance’s remaining reserves has escalated. The continual rise in Bitcoin prices has elevated Binance’s unrealized profit to an astounding 60,000 BTC. This contrast—declining reserves coupled with soaring profits—underscores the market’s strength and Binance’s adeptness in profiting during this phase. As market dynamics evolve, the data surrounding Binance’s reserves will remain a crucial indicator of investor actions and institutional strategies.

Market Trends: BNB’s Breakout and Future Potential

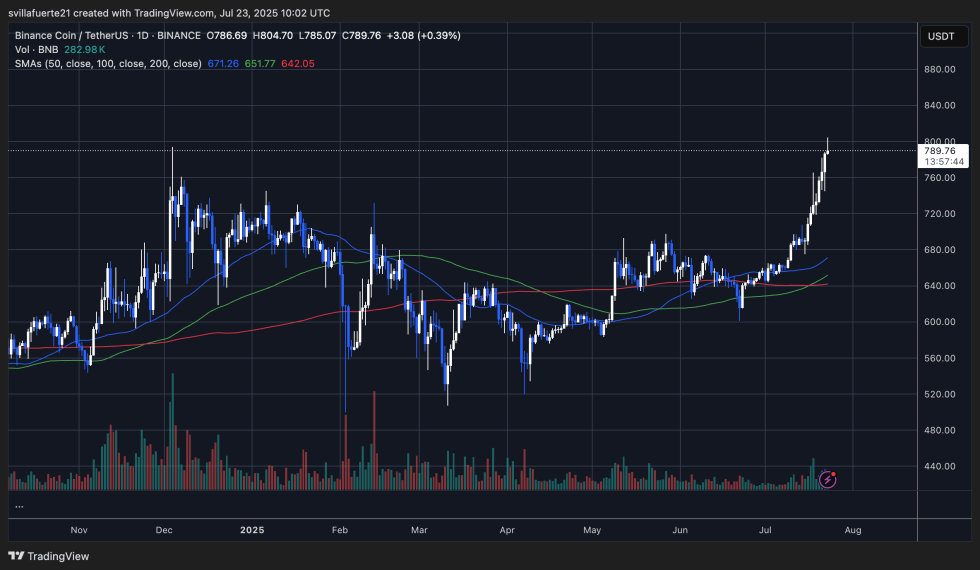

Binance Coin (BNB) has officially ventured into a new price realm, achieving an unprecedented high of $804. The current technical analysis reflects a sustained uptrend, with BNB climbing from around $670 in early July to nearly $800 within weeks. This upward trajectory indicates increasing bullish momentum and market confidence.

All primary moving averages—50-day ($671), 100-day ($652), and 200-day ($642)—are showing an upward trend, signaling a robust bullish framework. The latest price movements have seen a considerable rise in trading volume, further reinforcing the validity of the breakout.

With BNB having surpassed all significant resistance levels, it now embarks on price discovery, exploring new heights with minimal technical barriers. The decisive break above the $720–740 range served as a catalyst for this acceleration.

Traders should now closely monitor the $780–790 range as a short-term support level. As long as BNB remains within this zone, the bullish momentum looks promising. Without historical resistance blocks in the way, we could see a rally towards $850 or even higher—particularly if the overall market sentiment remains favorable and Bitcoin/Ethereum are consolidated.

Featured image created by Dall-E, chart sourced from TradingView