Recently, a flurry of speculation suggested that the US government had discreetly liquidated a substantial part of its Bitcoin holdings. However, these rumors were promptly quashed when new on-chain data was released. Arkham Intelligence, a prominent blockchain analytics organization based in the US, provided fresh insights that the government still retains at least 198,000 BTC, valued at approximately $23.5 billion.

The cryptocurrency is housed in a variety of addresses managed by different governmental entities such as the FBI, DEA, DOJ, and the US Marshals Service (USMS). Despite widespread claims of a significant sell-off, it seems that these assets have remained static for over four months, supporting the notion that the government is holding its Bitcoin reserves firmly.

The rumors gained traction primarily due to a misinterpretation surrounding a Freedom of Information Act (FOIA) response from the USMS, which reported only 28,988 BTC in holdings. This figure, however, represents just a fraction of the overall reserves, leading to misunderstandings among the public.

Analysis of US Government Bitcoin Holdings

Per data from Arkham Intelligence, a major segment of the US government’s total of 198,000 BTC—worth around $23.5 billion—has origins linked to two notable seizures: the infamous Bitfinex hack and the notorious Silk Road operation.

The largest single source is attributed to the 2022 seizure involving Ilya Lichtenstein and Heather ‘Razzlekhan’ Morgan. After their arrest, authorities confiscated 94,000 BTC from their possession, which, when combined with further recoveries, totals 114,599 BTC, valued now at approximately $13.65 billion. These funds were notably stolen from Bitfinex customers and, following legal proceedings, may potentially be allocated back to the affected users.

Another significant contributor to the US government’s Bitcoin reserves includes the 69,369 BTC (valued at $8.26 billion) confiscated from ‘Individual X’ in 2020. This individual supposedly exploited a loophole to gain access to Silk Road funds after the platform had already shut down. The forfeiture of these assets was part of a landmark legal case, with the government taking ownership of the BTC.

Arkham has also identified other BTC sources held by US authorities, including minor seizures from various criminal operations and forfeitures due to legal settlements. These assets are distributed among wallets associated with agencies like the DOJ, FBI, and USMS.

This transparency serves to dispel the recent rumors of government liquidation and sheds light on the current bitcoin landscape. While the majority of these seized funds remain inactive, market analysts are vigilantly observing any movements, given their potential impact on the overall cryptocurrency market. For the moment, these funds remain untouched, providing some reassurance as Bitcoin approaches its historical price peaks.

Market Assessment: Navigating Technical Boundaries

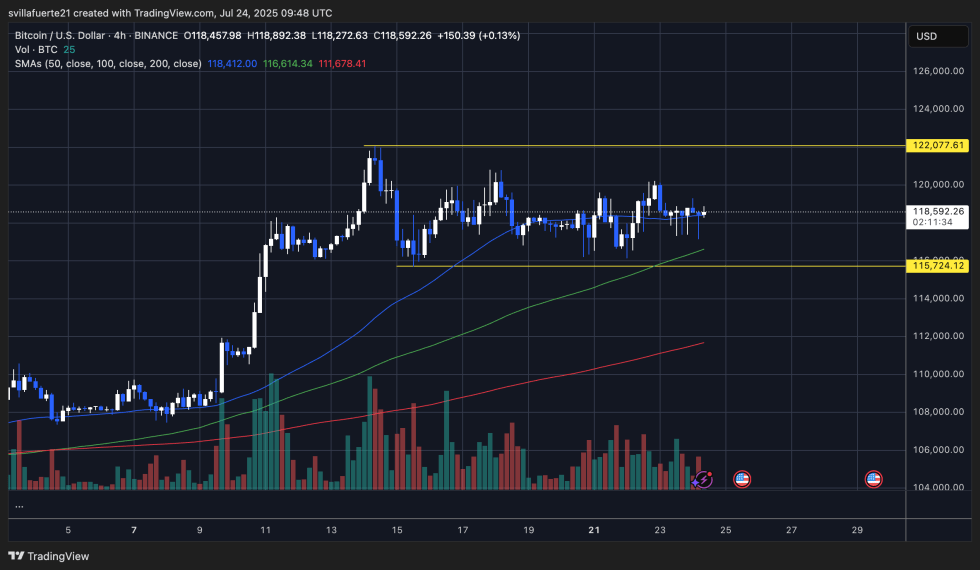

Bitcoin continues to oscillate within a restricted range of $115,724 to $122,077, as illustrated in the 4-hour chart. Following a vigorous rally earlier in July that propelled BTC toward unprecedented highs, the market has since struggled to penetrate the $122,077 resistance. Conversely, the $115,724 support level has been repeatedly defended by buyers.

The chart prominently shows that BTC is hovering around the 50-period simple moving average (SMA) at $118,412, slightly above the 100-SMA ($116,614) and the 200-SMA ($111,678), all of which indicate an upward trajectory—a reflection of a broader bullish trend. Nevertheless, a drop in trading volume during this consolidation phase highlights some market ambivalence.

A breakout beyond the $122,077 level could unleash fresh momentum aimed at achieving a psychological target of $125,000. However, a failure to maintain the $115,724 support could trigger a more significant retracement, with the 100-SMA and 200-SMA serving as dynamic support areas.

Image courtesy of Dall-E, chart provided by TradingView.