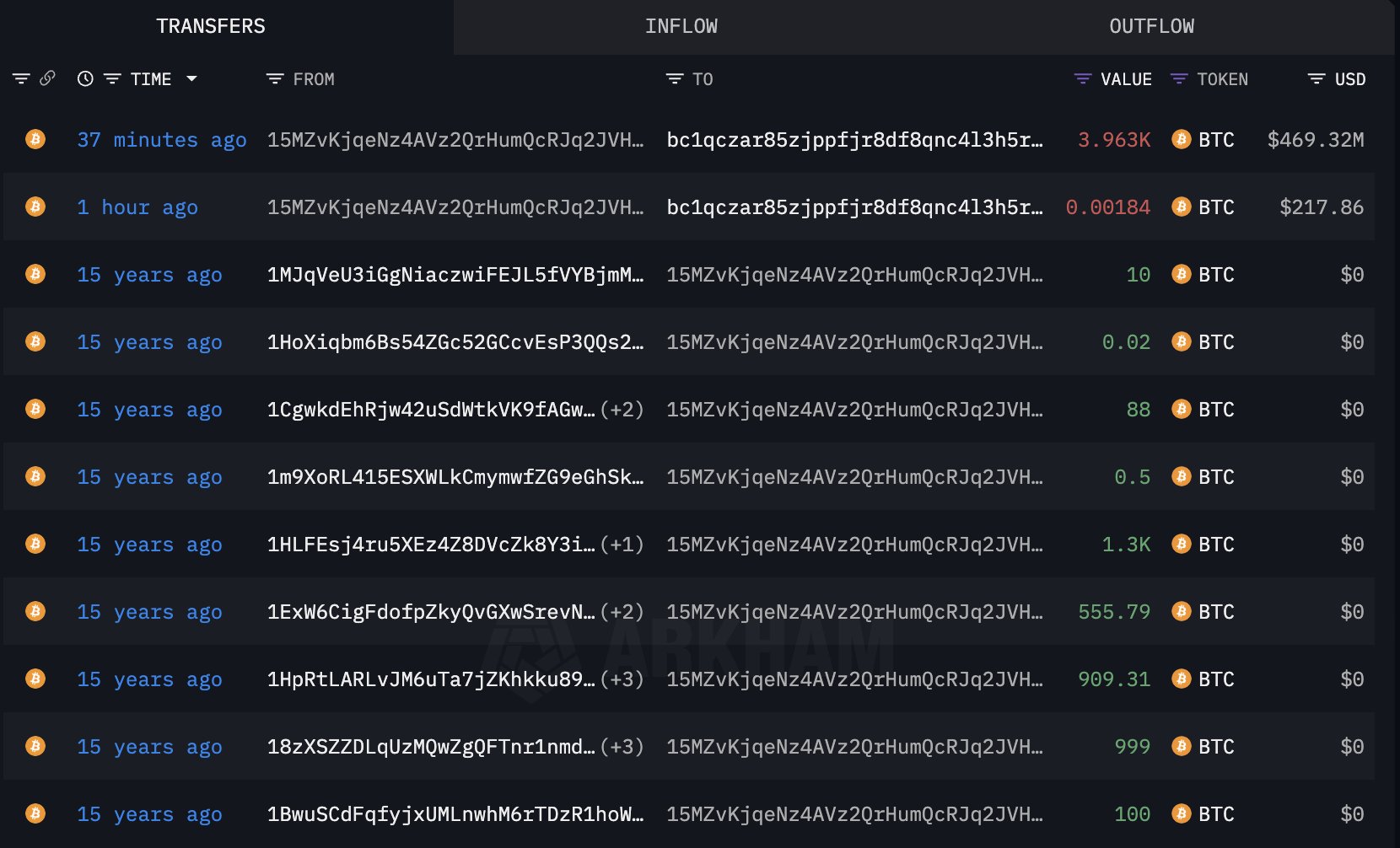

A notable event in the cryptocurrency world occurred recently when a Bitcoin wallet, dormant since 2011, suddenly came to life by transferring 3,962 BTC. Let’s delve into the potential implications of this significant transaction.

Long-Dormant Bitcoin Wallet Awakens After Over 14 Years

According to a recent update on X by blockchain investigator Lookonchain, a Bitcoin wallet that had been inactive for 14.5 years has finally made a move. This wallet received the substantial amount of 3,962 BTC as early as January 2011.

Back then, the price of Bitcoin was approximately $0.37, making this wallet’s holdings worth just around $1,460. Following the initial accumulation, the wallet entered a long period of inactivity.

Such prolonged dormancy often raises questions about the fate of wallets: they may have been forgotten, or the keys could have been lost. While losing access is a common reason for inactivity, it’s also possible the owner was intentionally holding onto their assets.

The wallet’s first sign of life was a small transaction of 0.0018 BTC, indicating it was indeed operational again.

In a dramatic turn of events, the wallet eventually transferred all its BTC to a newly established wallet, raising eyebrows across the cryptocurrency community.

When the wallet executed this latest transaction, the value of the 3,962 BTC stack skyrocketed to approximately $469 million. Given that the initial investment was only around $1,460, this represents a staggering profit for the original holder.

Typically, movements from previously dormant wallets can signal intentions to sell. But why emerge from silence after 14.5 years? If the owner lost access to the wallet, it may have taken this long to regain control. Alternatively, if access was always retained, the current bull market might have offered a tempting opportunity to realize profits.

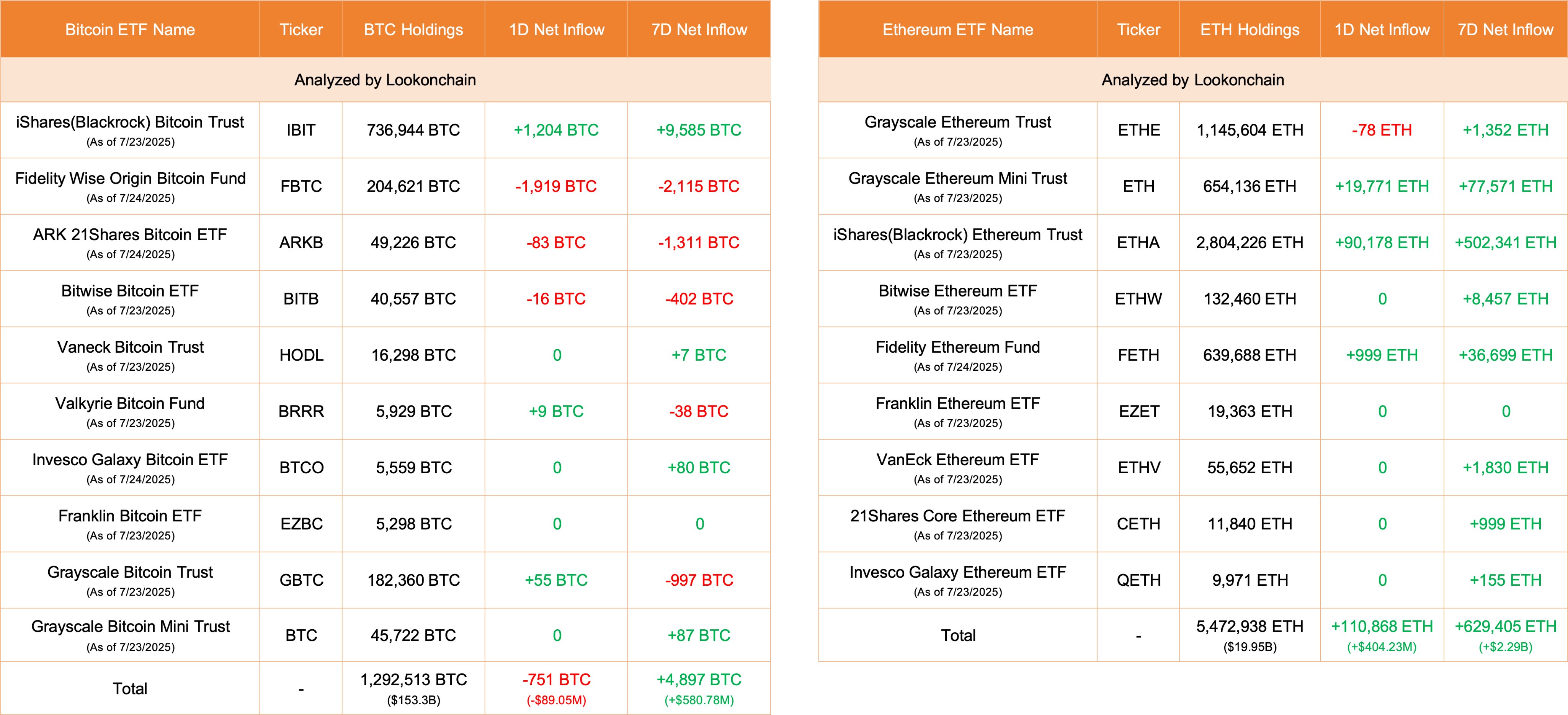

In a follow-up message from Lookonchain, updated statistics on Bitcoin and Ethereum exchange-traded funds (ETFs) were shared.

Ethereum Etfs" width="4096" height="1869" title="2011 Bitcoin Holder Awakens, Reaps 322,000X Profits-Bitrabo">

Ethereum Etfs" width="4096" height="1869" title="2011 Bitcoin Holder Awakens, Reaps 322,000X Profits-Bitrabo">

The ETF net flow for Bitcoin and Ethereum shows positive trends over the previous week; however, a net outflow for Bitcoin reveals that 751 BTC ($89 million) left these funds in the past day. Fidelity’s FBTC fund experienced the most significant outflow with 1,919 BTC ($227 million) exiting its portfolio.

Conversely, Ethereum ETFs witnessed significant inflows, with 110,868 tokens ($404 million) entering during the same timeframe.

Current Bitcoin Market Status

As of this moment, Bitcoin’s price hovers around $118,900, remaining stable compared to the previous week.