The crypto community is seeing some movement as FTX, formerly a major player in the cryptocurrency exchange market, prepares for its third round of creditor repayments. Starting September 30, the organization plans to distribute approximately $1.9 billion to qualifying claimants, as confirmed by both the FTX Recovery Trust and FTX Trading. This payment is based on a record date set for August 15 and is not anticipated to face any additional disputes.

This upcoming repayment follows significant distributions earlier this year: $1.2 billion was allocated in February and another $5 billion was announced in May, demonstrating ongoing efforts to address the financial recovery for affected creditors. Yet, skepticism remains among some stakeholders regarding the full situation.

Recent analytics from Arkham Intelligence have triggered curiosity about FTX’s management of its cryptocurrency assets. Observations indicate substantial transactions involving ETH and SOL by wallets associated with both FTX and Alameda Research. This raises questions: are these resources intended for customer reimbursements, or is there something more at play?

Arkham Highlights Unusual Transactions by FTX and Alameda

In a surprising turn of events, just prior to the impending $1.9 billion creditor repayment, Arkham identified notable transactions from wallets affiliated with FTX and Alameda. Reports indicate that FTX Cold Storage staked approximately $45 million worth of SOL, while Alameda-related accounts deposited $80 million worth of ETH with a major staking service named Figment. This has raised eyebrows in the crypto community—especially with Arkham questioning why these funds are not being directed toward creditor repayments.

The timeline for these transactions is particularly troubling. Blockchain data shows that both entities are still actively managing significant crypto holdings, despite being under bankruptcy protection and facing ongoing legal issues. While confirming the third round of distributions set for September 30, the optics regarding asset staking versus selling for cash may further weaken creditor confidence.

Additionally, there remains an alarming $4.3 billion in disputed claims. The criteria for which claims will qualify for the anticipated payments are still not clearly defined. Creditor Sunil Kavuri has pointed out that many creditors, particularly those located in China and other specified jurisdictions, might be excluded from these distributions, potentially leading to further frustrations and legal disputes as the repayment process unfolds. Transparency is still lacking, causing concerns to mount.

Market Adjustments Following Recent Gains

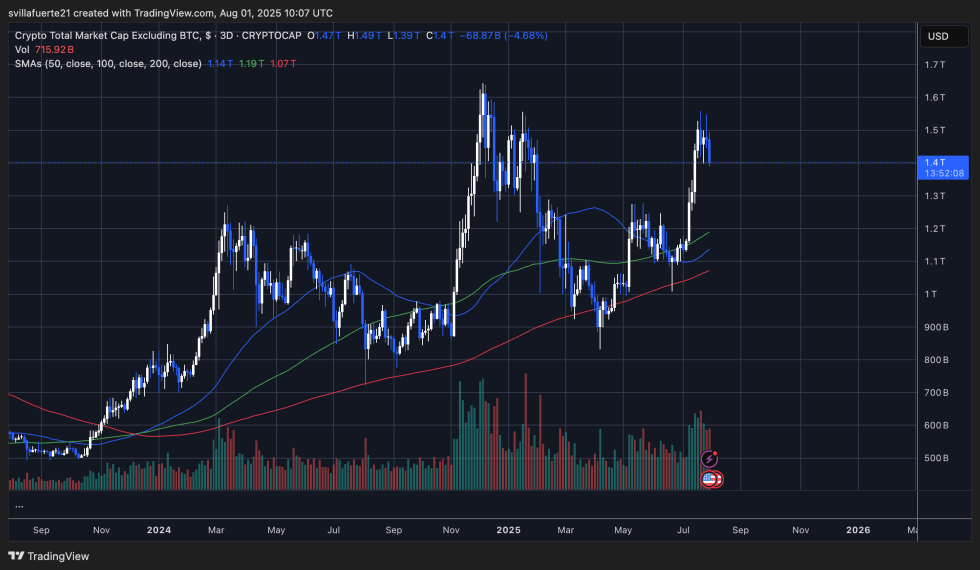

Meanwhile, the broader cryptocurrency market—excluding Bitcoin—has experienced a noticeable decline, dipping nearly 4.7% from its peak of $1.49 trillion, now resting around $1.40 trillion. This decrease follows a notable surge that propelled the altcoin market above $1.1 trillion to reach impressive yearly highs. However, this recent pullback emphasizes the effects of profit-taking and short-lived market enthusiasm.

From a technical standpoint, current charts indicate that price levels encountered resistance around the $1.5 trillion mark. Despite the recent downturn, the market structure remains somewhat optimistic, as prices stay above the 50-day, 100-day, and 200-day simple moving averages (SMAs)—which are currently aligned in a bullish manner. The 50-day SMA serves as potential support, positioned at $1.14 trillion, which could be crucial if the market faces further downward pressure.

The trade volume during this recent upward trend highlighted substantial market interest. However, the red bars emerging in this retracement indicate an increase in profit-taking activities. If the market can maintain levels above $1.35 trillion, there’s a possibility of further upward movement. Conversely, a failure to sustain this level may price the market toward a deeper correction targeting the $1.25 trillion support area.

Featured image from Dall-E; chart sourced from TradingView.