In a bold move to strengthen its position in the cryptocurrency market, the Japan-based investment firm Metaplanet has set its sights on raising a staggering 555 billion yen (approximately $3.7 billion) as part of its ambitious “Bitcoin Strategy.” The firm’s objective is to amass a significant stockpile of 210,000 Bitcoin (BTC) by the end of 2027, as revealed in their recent announcement.

Metaplanet Aims for Massive Fundraising to Bolster BTC Holdings

The details shared by Metaplanet indicate that the firm plans to raise these funds via a stock offering. The capital acquired will mainly support its strategy to acquire 210,000 BTC before the close of 2027, marking a significant venture into the world of digital assets.

To finance this initiative, Metaplanet intends to issue perpetual preference shares, promising an attractive annual dividend of up to 6%, contingent upon various market factors including interest rates and investor interest.

While this move has sparked concerns about potential dilution among existing shareholders, Metaplanet reassures that the expected increase in Bitcoin holdings will create substantial corporate value, counteracting any dilution effects.

For those new to the scene, BTC Yield stands as an important metric, reflecting how the company’s Bitcoin assets appreciate relative to its equity base. This is calculated by dividing the growth rate of BTC held by the total diluted shares outstanding, helping investors gauge the overall performance.

Interestingly, this announcement follows closely after Metaplanet successfully added 800 BTC to its assets. As per data from CoinGecko, the firm currently ranks sixth among corporate Bitcoin holders, with a total of 17,132 BTC now in its possession.

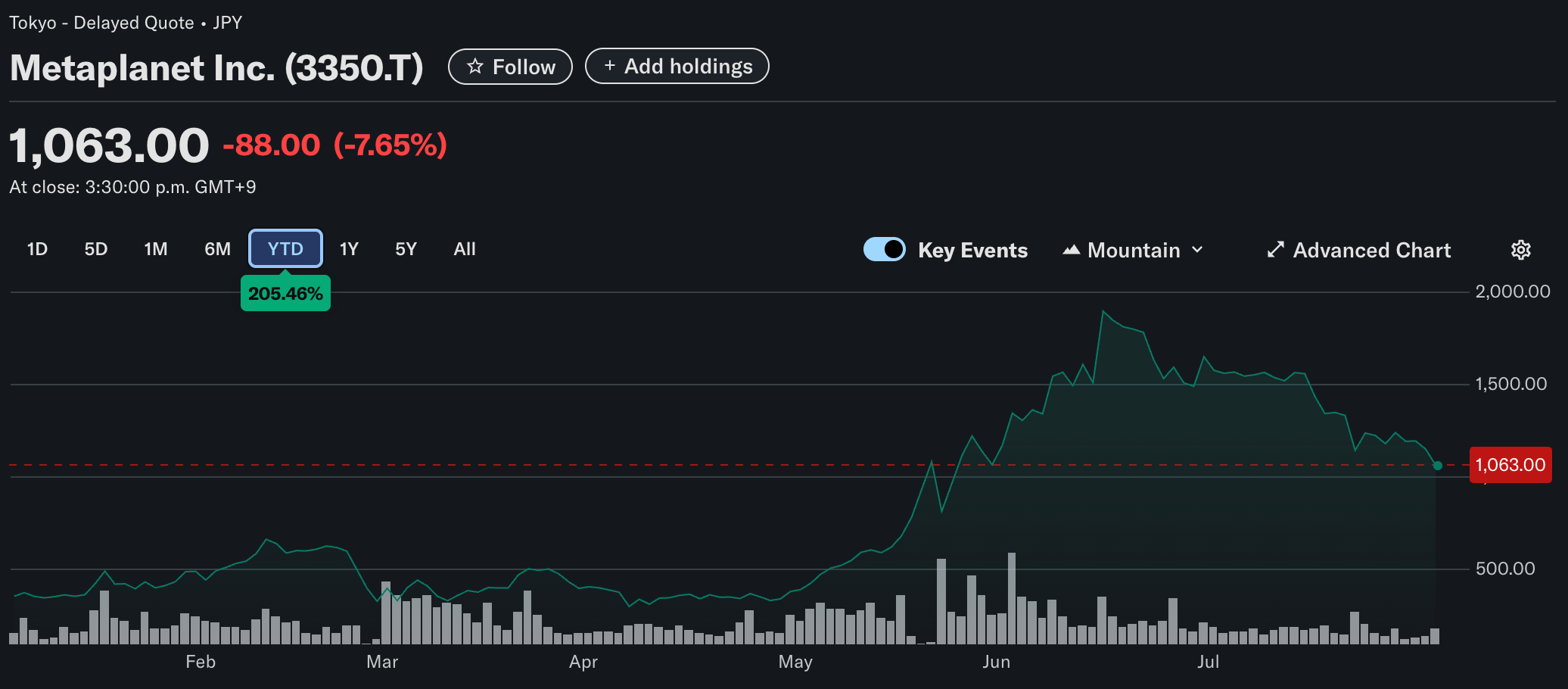

Despite Metaplanet’s stock closing down 7.65% today at 1,063 yen ($7.18), it has nonetheless surged more than 200% year-to-date, indicating strong investor confidence amid market fluctuations.

Growing Trend: Companies Focus on Bitcoin Investment

With the recent announcement of Donald Trump as the winner of the November 2024 US presidential election, the anticipation of crypto-friendly regulatory changes has instigated a wave of optimism among major corporations looking to enhance their digital asset exposure.

Notably, Marti Technologies, listed on the NYSE, has declared its intention to allocate 20% of its cash reserves into Bitcoin. Furthermore, MARA Holdings has successfully completed a $950 million raise aimed at expanding its Bitcoin portfolio.

Additionally, firms in the UK, such as Satsuma Technology and The Smarter Web Company, are also taking pivotal steps to accumulate more BTC. The renewed interest from institutional investors is further bolstered by encouraging macroeconomic signals.

Recent reports from the Chicago Mercantile Exchange’s (CME) FedWatch tool suggest a 78.8% likelihood of the US Federal Reserve cutting interest rates in their upcoming meeting. Such a move could positively influence risk-on assets, including Bitcoin. At the time of this report, Bitcoin is trading at $115,189, down 2.8% in the past 24 hours.