Bitcoin’s journey has recently taken a pause after reaching an impressive $123,000, leading to a sense of uncertainty in the market. As this digital asset reassesses its position, it’s traded below vital resistance levels. The current atmosphere has encouraged some analysts to theorize that the peak at $123K may indicate the upper limit for this market cycle, igniting concerns about a possible downward trend.

Nevertheless, insights from CryptoQuant shed light on a more optimistic view. Their data suggests that long-term holders (LTH) remain confident, seemingly undeterred by recent price fluctuations. These investors are continuing to gain significant unrealized profits, indicating a strong belief in Bitcoin’s growth potential, which supports a predominantly bullish outlook despite recent market conditions.

On the flip side, short-term holders (STH) are facing challenges, as their profit margins have diminished in the midst of recent price swings. This divergence between LTH resilience and STH vulnerability has triggered short-term volatility; however, the overarching supply dynamics appear robust.

Long-Term Holders Maintain Optimism Amidst Short-Term Pressures

A prominent analyst from CryptoQuant, AbramChart, points out that long-term holders play a crucial role in upholding Bitcoin’s encouraging narrative. The Net Unrealized Profit/Loss (NUPL) remains significantly above 0.5, suggesting that these holders are enjoying substantial profits and show no inclination to sell. Their strong resolve and commitment are underpinning Bitcoin’s price, even as market enthusiasm appears to fade post the recent spike to $123K.

In stark contrast, short-term holders are navigating a more turbulent environment. Their NUPL metrics indicate fluctuating profit potential, with some opting to realize gains during market rallies or facing pressures from holdings that are underperforming. This sentiment contributes to the recent price volatility experienced in the Bitcoin market.

As it stands, Bitcoin is hovering around the $104K level, largely supported by the unwavering belief of long-term holders. The lack of significant selling activity among this group signals continued faith in Bitcoin’s upward potential, despite the market’s temporary setbacks.

AbramChart underscores that as long as long-term holders refrain from extensive selling, the larger upward trend remains secure. The current price fluctuations could simply represent a consolidation phase within a bullish framework, providing short-term holders with potential buying opportunities in anticipation of the next surge.

Current Price Action: Navigating Key Resistance Levels

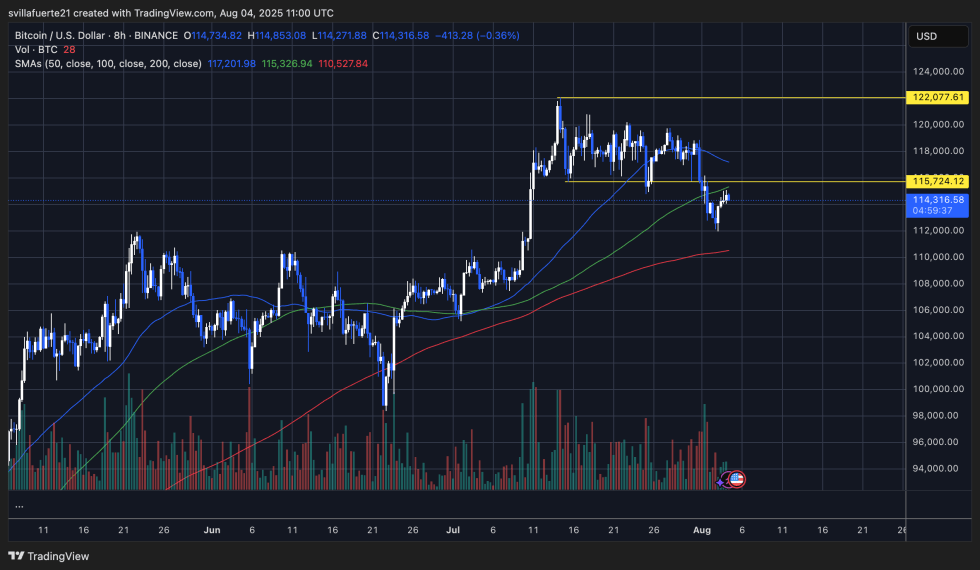

Currently, Bitcoin (BTC) is trading at approximately $114,316 after a notable decline from local highs of $122,077. The market is now revisiting the $115,724 resistance area, a zone that previously served as a solid support level during a prolonged consolidation. Additionally, the 100-period moving average (illustrated in green) situated around $115,326 is introducing additional resistance, posing a significant challenge for bulls looking to gain momentum.

Recent volumes have surged during the bounce, suggesting that bullish participants are actively defending the $112K support threshold. However, the price remains under pressure as it trades below the 50-period moving average (depicted in blue) at $117,201, signaling a bearish sentiment unless this level is reclaimed soon.

The overall market structure indicates a potential relief rally within a corrective phase. A definitive close above $115,724 is essential for shifting sentiment back to bullish, targeting a re-examination of the highs around $122,077. Conversely, failing to breach resistance may lead to continued sideways trading, with immediate focus shifting to support around $112,000.