In a groundbreaking move, BitMine Immersion Technologies has officially declared that its Ethereum (ETH) reserves have surpassed 833,000 tokens. This impressive feat positions BitMine as the world’s leading corporate holder of Ethereum, highlighting a larger trend within the cryptocurrency sector where corporations are increasingly vying for digital assets.

BitMine Leads the Ethereum Accumulation Race

As reported in a recent official release, BitMine Immersion Technologies – renowned for its Bitcoin (BTC) mining operations – has achieved a remarkable milestone by accumulating an impressive 833,137 ETH, thereby overtaking competitors such as SharpLink Gaming.

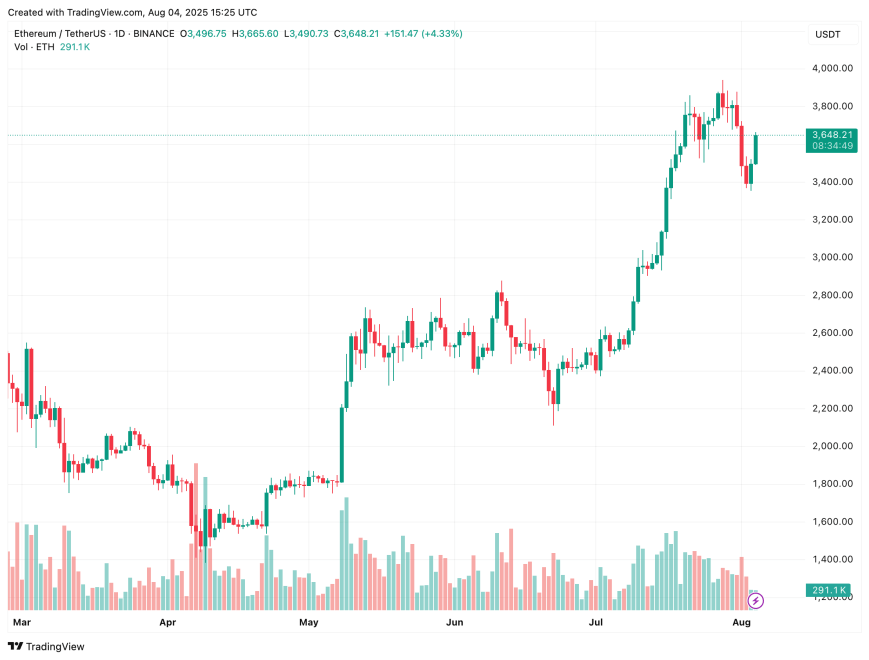

The current valuation of BitMine’s assets exceeds $2.9 billion, calculated at an ETH market price of $3,491 per token. Upon this thrilling announcement, Tom Lee, Chairman of BitMine’s Board, remarked:

BitMine has acted with unparalleled urgency in securing what we term the ‘alchemy of 5%’ of Ethereum. In just 35 days, we have transitioned from zero to over 833,000 ETH, positioning ourselves as frontrunners among our crypto treasury counterparts.

Initiated on June 30, BitMine’s treasury strategy has quickly showcased its effectiveness, allowing the firm to claim the title of the largest ETH treasury holder worldwide, surpassing established players.

Data sourced from StrategicETHReserve.xyz indicates that BitMine’s ETH reserves have skyrocketed by 283.1% within the last month. This accumulation now represents more than 0.5% of Ethereum’s total supply.

In terms of rankings, SharpLink Gaming trails with 438,200 ETH, while The Ether Machine holds 334,800 ETH. Other notable ETH holders include The Ethereum Foundation, Coinbase, Bit Digital, and BTCS.

With these substantial reserves, BitMine ranks third among all corporate crypto holders, behind only Michael Saylor’s Strategy (formerly MicroStrategy) and MARA Holdings—both predominantly holding Bitcoin.

Following the announcement, BitMine’s stock witnessed a notable increase of 2.65%, reaching $32.52. The stock performance has been remarkable, showing a year-to-date growth of 348%.

Institutional Interest in Ethereum Surges

The Ethereum Foundation, once the preeminent holder of ETH, is now witnessing a decline in its dominance as various corporations engage in aggressive ETH accumulation strategies, driven by increasing institutional interest.

In a recent development, BTC Inc., a company focusing on Ethereum initiatives, disclosed plans to secure $2 billion aimed at bolstering its crypto treasury, including ETH. Additionally, The Ether Machine has recently enhanced its balance sheet by adding 15,000 ETH.

This trend is supported by exchange data that reveals a significant reduction in ETH reserves on centralized exchanges, dropping to their lowest level in nearly a decade. Currently, ETH is trading at $3,648, reflecting a marginal increase of 0.9% over the last 24 hours.