Recent data from CoinGate has highlighted a significant shift in cryptocurrency payment preferences, with Litecoin (LTC) emerging as a prominent choice for users.

Litecoin Surges in Popularity for Crypto Transactions

In an insightful announcement, CoinGate unveiled their findings reflecting consumer behavior over the last month. The Lithuanian payment processor specializes in enabling merchants to accept a variety of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

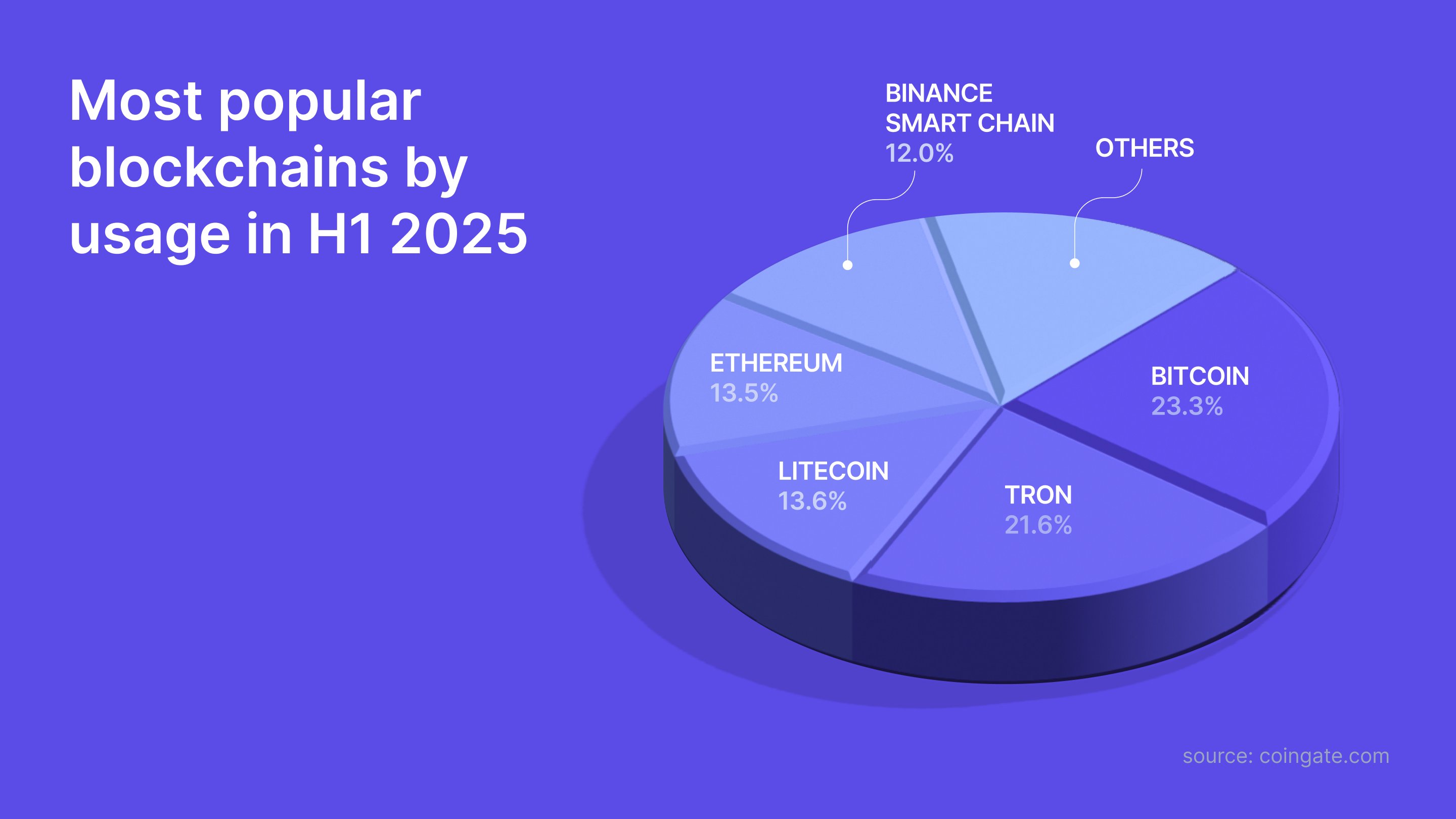

The accompanying pie chart displays the distribution of cryptocurrency transactions that CoinGate processed in July, illustrating a notable trend.

Leading the charge, Bitcoin continues to dominate with a transaction share of 22.9%. However, Litecoin’s ascent to second place, capturing 14.5% of payments, is especially significant.

Following Litecoin, USDC claims the third position at 14%, while USDT lags slightly behind with a 12.2% share. Notably, Tron also enters the fray, securing 12.9% of the overall payments.

Despite its current market cap ranking of nineteenth, Litecoin’s efficacy as a payment method cannot be overstated. It is favored for its quick and inexpensive transactions, making it a sought-after option for merchants.

This preference aligns with the trend of users prioritizing efficient payment solutions on platforms like CoinGate, reinforcing Litecoin’s value as a payment medium.

In a previous report, CoinGate illustrated the trends of H1 2025, showing Litecoin’s continued popularity with users.

Data revealed that Litecoin accounted for 13.6% of payments in H1 2025, only narrowly ahead of Ethereum at 13.5%. Both Bitcoin and Tron maintained more substantial leads with 23.3% and 21.6%, respectively.

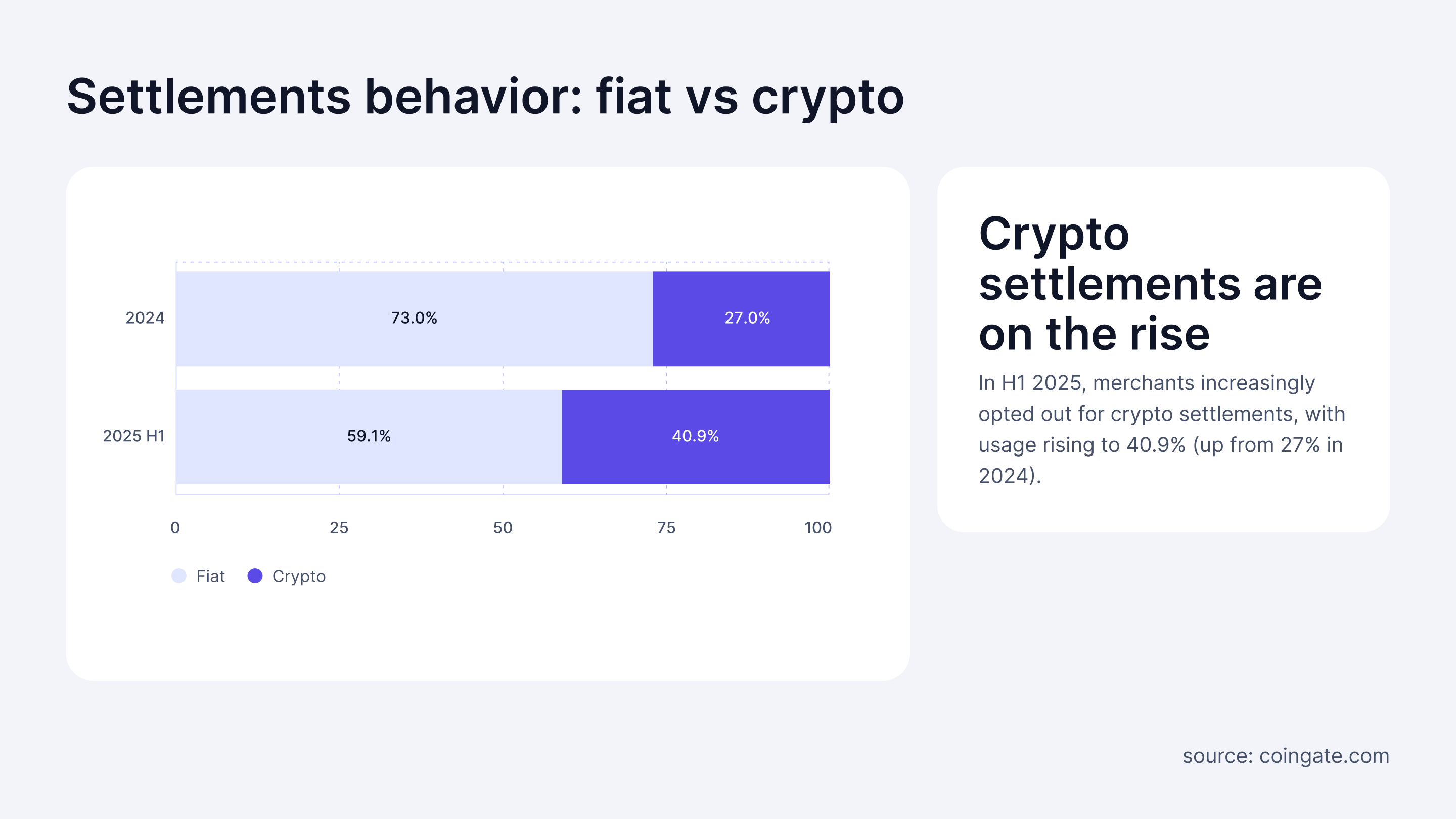

A particularly interesting observation from the report is the growing comfort among merchants regarding cryptocurrency usage.

While only 27% of merchants opted to retain payments in digital currencies during 2024, this figure surged to an impressive 40.9% in H1 2025, indicating a growing trend toward crypto settlements.

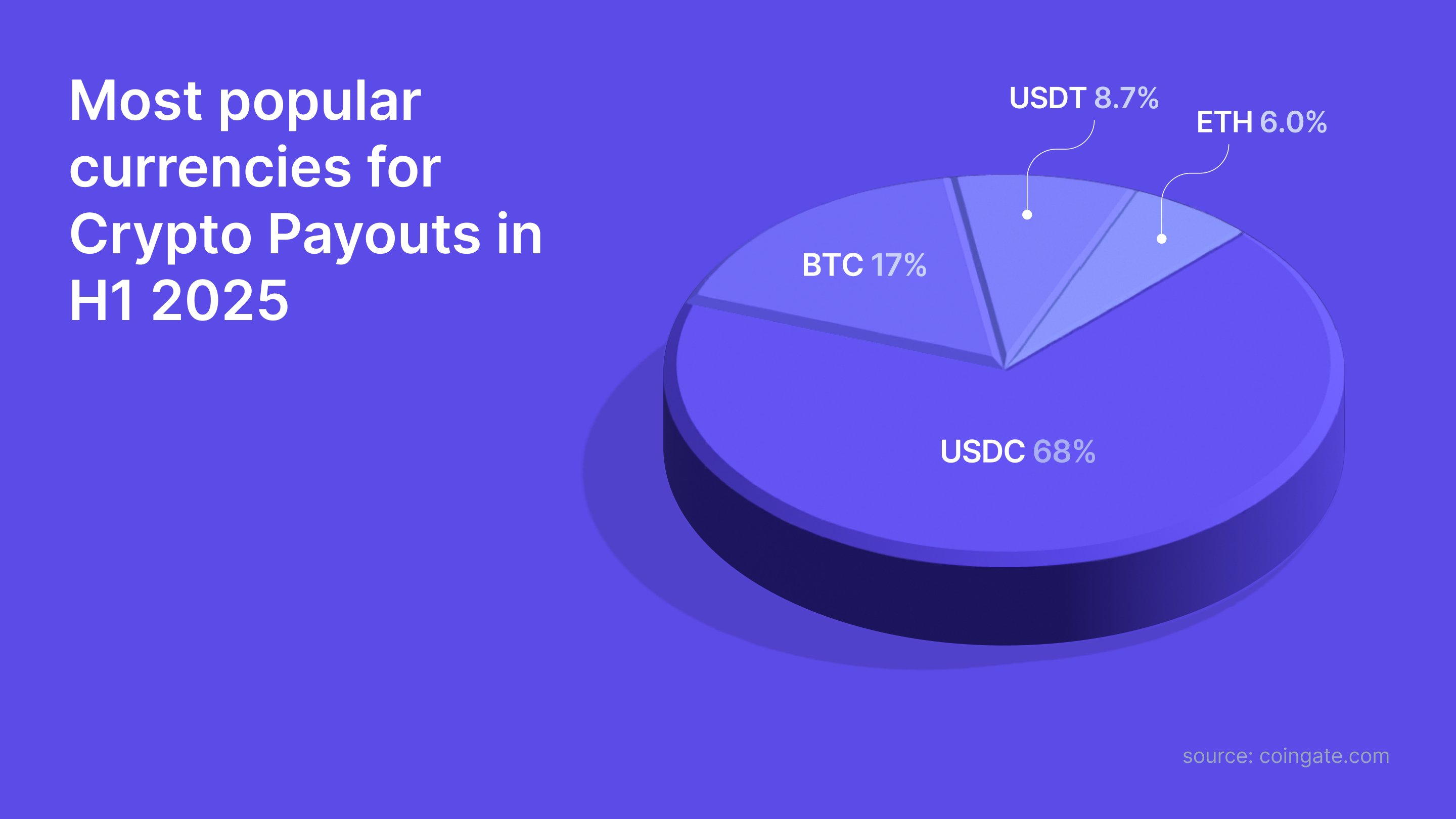

When it comes to merchant payouts, USDC stands out as the preferred option, likely due to its stability and regulatory advantages. Bitcoin follows closely, but Litecoin has yet to establish a significant presence in merchants’ payout preferences.

Current Status of LTC Pricing

After experiencing a notable increase of over 9% in just 24 hours, Litecoin’s price has stabilized around the $119 mark, reflecting investor confidence.