Ethereum is experiencing a revival, showcasing a significant uptick of over 13% since last week’s nadir around $3,350. Following periods of intense price swings and market jitters, buyers have re-entered the ring, propelling the price upward and regaining momentum. This resurgence in volatility has reignited market interest in ETH, as many analysts are monitoring the asset’s potential to breach critical resistance levels.

On a broader scale, the outlook for Ethereum remains fundamentally robust. Institutional engagement with Ethereum is on the rise, with large-scale acquisitions noted recently. As on-chain activity surges, this indicates not just increasing demand but also a growing user base across decentralized finance (DeFi), non-fungible tokens (NFTs), and Layer-2 solutions. Moreover, Ethereum’s pivotal role in the tokenization of real-world assets and its advanced smart contract capabilities underline its long-term promise.

As ETH navigates the challenging landscape of resistance levels, the upcoming trading sessions will prove crucial. Successfully maintaining a position above the $3,700 mark could pave the way for continued bullish momentum, while any resistance might trigger another retracement. Regardless, Ethereum’s recent performance alongside its solid fundamentals hints at a revitalization of investor optimism, possibly setting the groundwork for a sustained upward trajectory in the near term.

Ethereum Whale Activity Indicates Confidence in the Asset

Noteworthy analyst Ted Pillows reported a surge in accumulation from a mysterious whale or institutional investor, who has snapped up $122,955,634 worth of ETH over the last couple of days. This substantial purchase, coinciding with Ethereum’s recovery from recent lows, is perceived by many in the market as a powerful indication that savvy investors are capitalizing on lower prices to build their long-term positions.

The timing and volume of this acquisition hint at a strategic approach, reflecting confidence in Ethereum’s foundational strengths and its increasing relevance within the evolving digital landscape. As traditional finance money begins to flow more robustly into cryptocurrency, Ethereum is positioning itself as a cornerstone asset for institutional portfolios due to its programmability and expanding applications in tokenization and DeFi space.

While Bitcoin appears to be trending toward overvaluation and several altcoins are still stuck below critical support levels, Ethereum’s relative resilience stands out. Amidst a more cautious market environment, this trend of accumulation illustrates that knowledgeable investors are looking beyond immediate market fluctuations to establish positions for potential multi-year bullish cycles.

Price Action Insights: ETH Tests Significant Resistance Levels

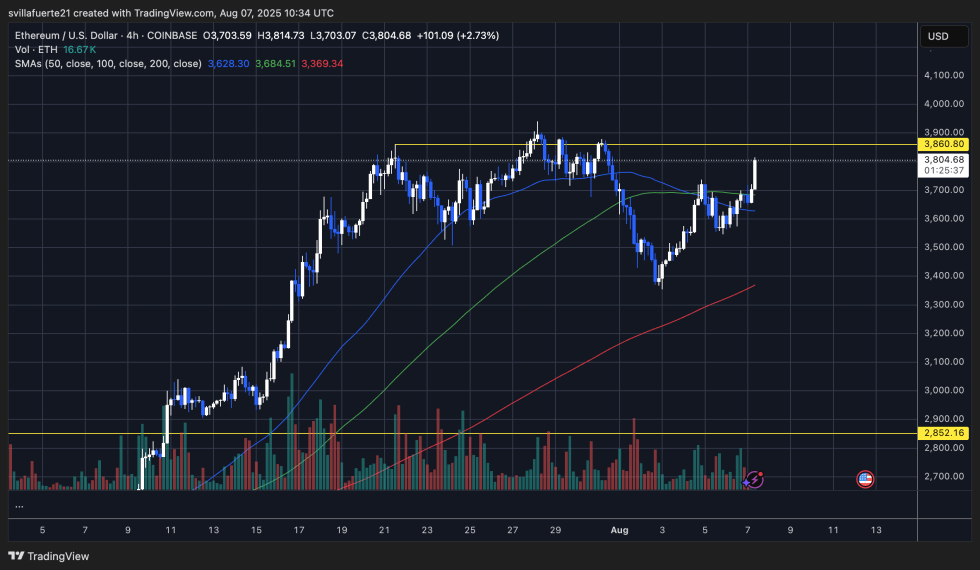

Ethereum (ETH) has seen a remarkable 13% rise since last Sunday and is currently challenging the influential resistance level at $3,860, as revealed in the 4-hour chart. After carving a local bottom around $3,350, ETH has been on a steady ascent fueled by heightened trading volumes, indicating renewed buyer enthusiasm and bullish sentiment.

The recent breach above the $3,700 threshold was accompanied by strong positive price movements, supported by increasing volume and reclaiming critical moving averages (MAs). The alignment of these averages—50, 100, and 200 SMAs—below the price lends credence to the optimistic outlook, as ETH sets up support zones between $3,630 and $3,685.

However, the $3,860 resistance level poses a significant hurdle. This level has historically been a point of rejection in late July and has yet to solidify as support. Should Ethereum manage a confirmed breakout above this area, accompanied by consistent volume and consolidation, it could challenge the $4,000 to $4,200 range in the near future.

Featured image from Dall-E, chart from TradingView.