The increasing momentum of Ethereum’s influence in the financial landscape is spotlighted by the recent announcement from Fundamental Global Inc. (FGF), which has set out on a revolutionary $5 billion strategy focusing on cryptocurrency. This approach signals a significant shift in the perception of Ethereum, demonstrating growing trust among institutional investors regarding its enduring significance.

The unfolding events on August 7 revealed direct market reactions. FGF’s stock, initially dipping by 1.44% to $36.17, rebounded afterward with a notable increase of 3.76% in after-hours trading, reaching $37.53. This movement reflects a positive investor sentiment towards the company’s bold treasury allocation, aligning it with other innovative players incorporating Ethereum into their financial plans.

FGF mirrors the recent trends displayed by various corporations like Sharplink Gaming, which embrace Ethereum Treasury strategies. This emerging trend illustrates a pivotal shift wherein companies are leveraging Ethereum as a foundational asset within their long-term capital frameworks. Such institutional interest not only amplifies Ethereum’s credibility but also enhances its narrative as a reliable store of value amid growing financial digitalization.

FGF’s $5 Billion Commitment: A Turning Point in Institutional Investment

FGF’s strategic entry into the cryptocurrency domain is remarkable. By filing an S-3 with the US Securities and Exchange Commission (SEC), the company aims to offer up to $5 billion in securities, with a substantial portion allocated to Ethereum acquisition. This indicates a revolutionary jump for a publicly traded entity, traditionally operating outside the crypto sector.

In its filing, FGF highlighted its new strategy: “We have commenced an Ethereum (ETH) treasury strategy. With Ethereum being the backbone of decentralized finance and transactions, our goal is to centralize ETH as a key asset in our portfolio.”

FGF’s ambition encompasses a commitment to accumulate ETH as a primary treasury asset, thereby aiming to bolster its overall asset portfolio through strategic management. This initiative will integrate advanced methods such as staking, liquid staking, and participation in DeFi protocols to optimize returns and asset growth.

As FGF delineates ETH as its core treasury reserve asset, it joins the ranks of other corporations paving the way for increased integration of Ethereum into their financial strategies. This move not only diversifies asset allocations but also positions these organizations within the rapidly evolving digital finance sector.

This commitment from FGF indicates a broader recognition among institutions of Ethereum’s vital role in modern finance. With more companies aligning with these treasury strategies, the demand for ETH is likely to receive continual upward pressure, solidifying its status as a valuable, yielding asset within corporate finances.

Market Analysis: Key Indicators to Track

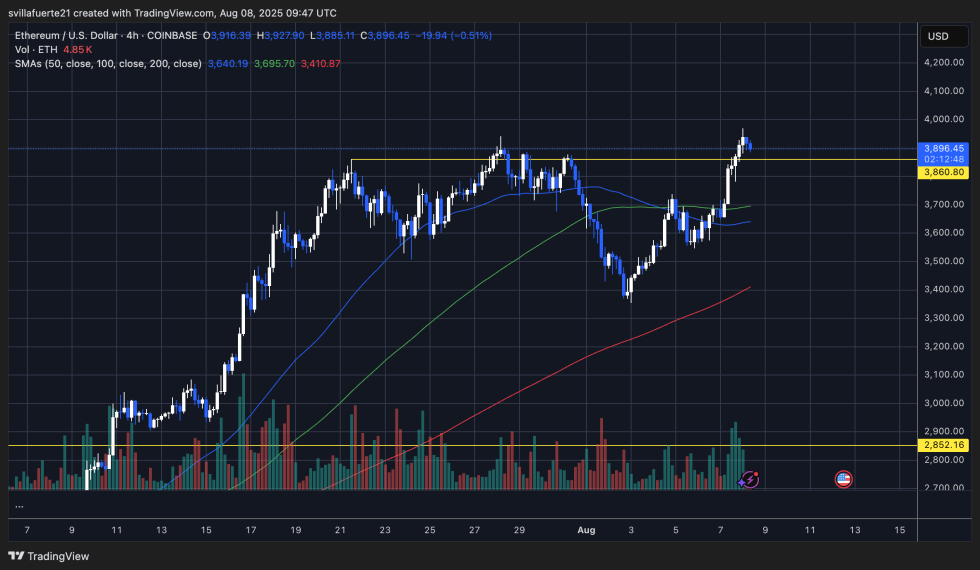

Ethereum (ETH) is currently witnessing a resurgence in bullish activity, as indicated by breaking through the crucial $3,860 resistance point on the 4-hour chart. Positive buying volume has propelled prices towards the $3,900 mark. This upswing comes on the heels of a swift recovery from a low of $3,350 earlier in the week, with ETH trending above its moving averages—50-day (blue), 100-day (green), and 200-day (red)—a scenario representing a bullish trend.

Nevertheless, the $3,900–$3,920 range has emerged as an area of resistance, where profit-taking is occurring among sellers. A steadfast close above this threshold could facilitate a rally toward the psychologically significant $4,000 mark, seen last in mid-July. Conversely, immediate support has shifted to $3,860, which now holds as a potential demand zone. Should it falter, ETH risks a retreat to the $3,700 region, aligning with the 100-day moving average, offering further technical support.

Volume dynamics suggest that buyer dominance is steady, but a form of consolidation may be required before another upward movement occurs. As long as ETH sustains above the $3,860 level, overall trends considerably favor bullish continuation, especially bolstered by institutional interests like FGF’s significant treasury strategy. A downside breach of $3,860 may, however, jeopardize this optimistic outlook in the short term.

Featured image from Dall-E, chart from TradingView.