As the cryptocurrency landscape evolves, Ethereum is experiencing a remarkable resurgence, almost reaching its historical peak of $4,792. With a robust bullish trend underway, investors are seeing renewed interest, particularly as Bitcoin sees a period of consolidation. This creates an opportune environment for altcoins, including Ethereum, to gain traction and momentum amongst market participants.

The driving force behind Ethereum’s rally can largely be attributed to heightened institutional interest. Recent on-chain metrics reveal a consistent accumulation pattern among large investors, who are increasingly placing their bets on the future of ETH. With institutional wallets expanding their holdings, a significant shift is taking place, reducing the availability of Ethereum on exchanges and OTC platforms.

Tightening supply dynamics combined with rising investor confidence have set Ethereum up for a potential breakout. Investors are particularly focused on the $4,800–$4,900 resistance level, with predictions that a breach of this area could unleash new price movements, further propelling the overall altcoin market into a bullish phase.

Whale Activity Suggests Strong Market Sentiment for Ethereum

Recent reports from blockchain analytics firm Arkham Intelligence indicate that Ethereum has seen one of the year’s largest whale movements. A single wallet recently moved 60,000 ETH from Coinbase Prime, a transaction valued at an impressive $284.76 million. Such activities not only demonstrate market confidence but also signal a long-term commitment to the ecosystem.

Additional insights reveal that this whale has already diversified their assets by distributing 3,200 ETH into multiple wallets. One of these wallets has engaged in staking, cementing the notion that this isn’t a fleeting trade but rather a strategic move for yield generation. Market analysts are closely watching this wallet, known as 0x697D8eFb007Ec5CCAC0C67290D545b916348480B, for further developments.

The substantial amount of ETH being staked represents a bullish sentiment, as it reduces the overall liquidity in the market. This strategic locking away of assets aligns well with the ongoing institutional demand and signals a potentially robust support structure for Ethereum’s price.

With growing speculation about an upcoming altseason, experts believe Ethereum could spearhead this potential shift. As Bitcoin stabilizes at elevated levels, the rotation of capital into promising altcoins, with Ethereum leading the charge, could revitalize interest across the market.

Technical Analysis: Weekly Chart Insights

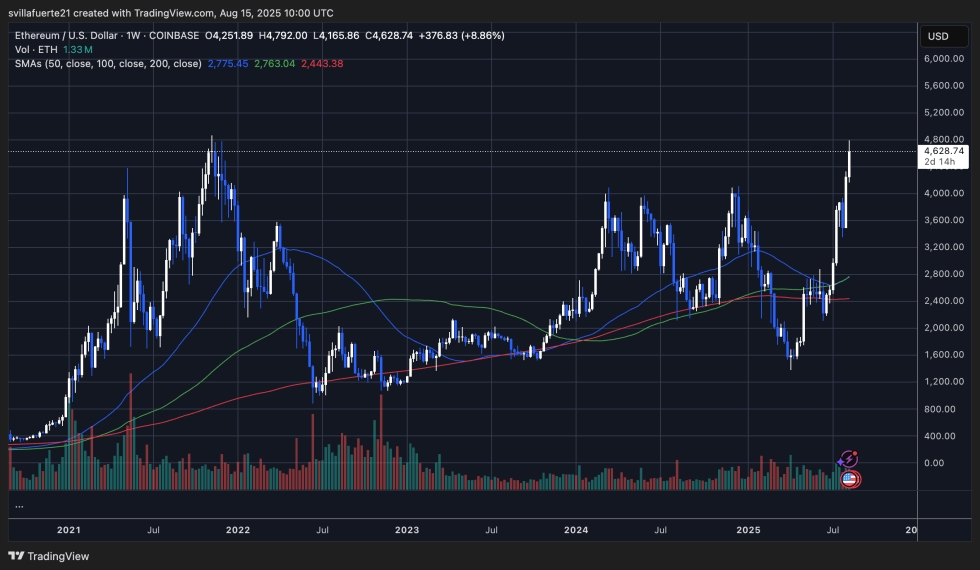

As Ethereum continues to ascend, the weekly chart reflects a significant upswing, culminating at a price point near $4,792—a remarkable ascension towards its all-time high. Over the past month, key resistance levels at $3,200 and $4,000 were easily surpassed, indicating strong market support.

The crossing of the 50-week moving average above the 100-week MA reinforces the bullish trajectory for Ethereum, supported by a robust move above the 200-week MA of approximately $2,443. Notably, recent trading volumes have surged, suggesting that the current price movements are underpinned by substantial market participation.

Nevertheless, the steep ascent raises the possibility of a short-term pullback or consolidation phase. Maintaining stability above the $4,200–$4,300 support zone will be crucial for sustaining the constructive bullish outlook, with traders remaining alert for a potential leap into new price territories.

Featured image from Dall-E; chart from TradingView.