In a significant development within the cryptocurrency sector, Japanese firm Metaplanet has announced a sizable addition to its Bitcoin holdings, acquiring Bitcoin valued at approximately $93 million.

Metaplanet Boosts Bitcoin Reserves

President Simon Gerovich disclosed in a recent update on X that the organization successfully acquired another 775 BTC. This purchase occurred at an average acquisition price of $120,006 per Bitcoin, culminating in a total expenditure of $93 million.

This latest acquisition increases Metaplanet’s total Bitcoin holdings to 18,888 BTC, bringing the cumulative cost basis to $1.94 billion. Given current market conditions, the total market value of these assets stands at an impressive $2.17 billion, indicating an unrealized gain of almost 12%.

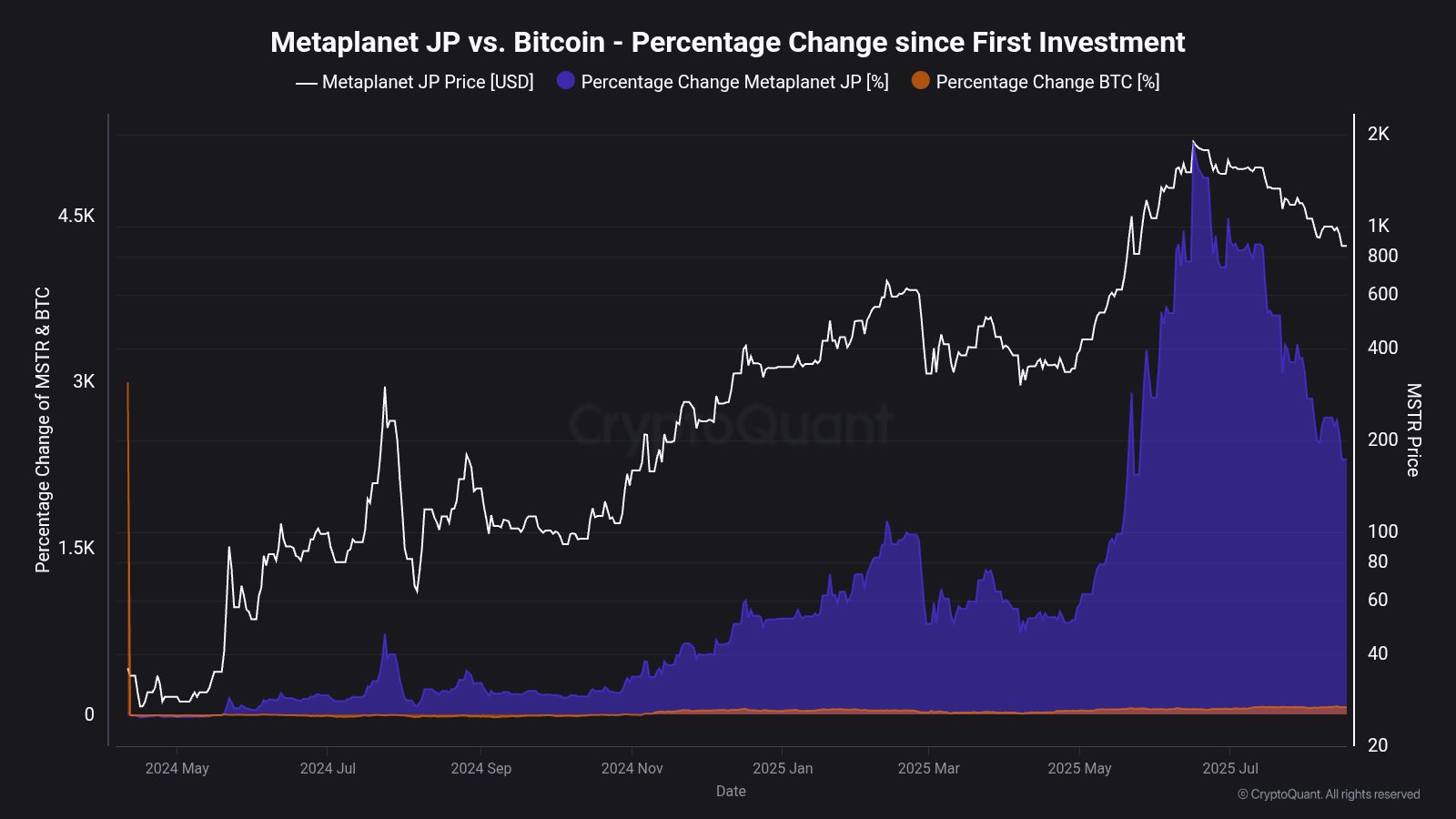

Market analyst Maartunn from CryptoQuant has provided insightful visual data demonstrating the trajectory of Metaplanet’s Bitcoin purchases since the initiation of its treasury strategy in the previous year.

This acquisition follows a record-setting performance reported for Q2 2025, showcasing substantial improvements in both net income and operational profit. Nonetheless, it is worth noting that despite these advancements, the stock value of Gerovich’s firm is still down by 50% from its all-time peak hit in June.

In a similar vein, the leading Bitcoin treasury firm, Strategy, has recently reported a purchase of its own. Chairman Michael Saylor announced the acquisition of 430 BTC for a total of $51.4 million, raising its total reserves to a staggering 629,376 BTC, with a historical cost of $46.15 billion.

Saylor is known for hinting at impending purchases through strategic posts, and this occasion followed suit as he shared the company’s BTC portfolio tracker with the coded caption: “Insufficient Orange.” This cryptic method continues to intrigue Bitcoin enthusiasts.

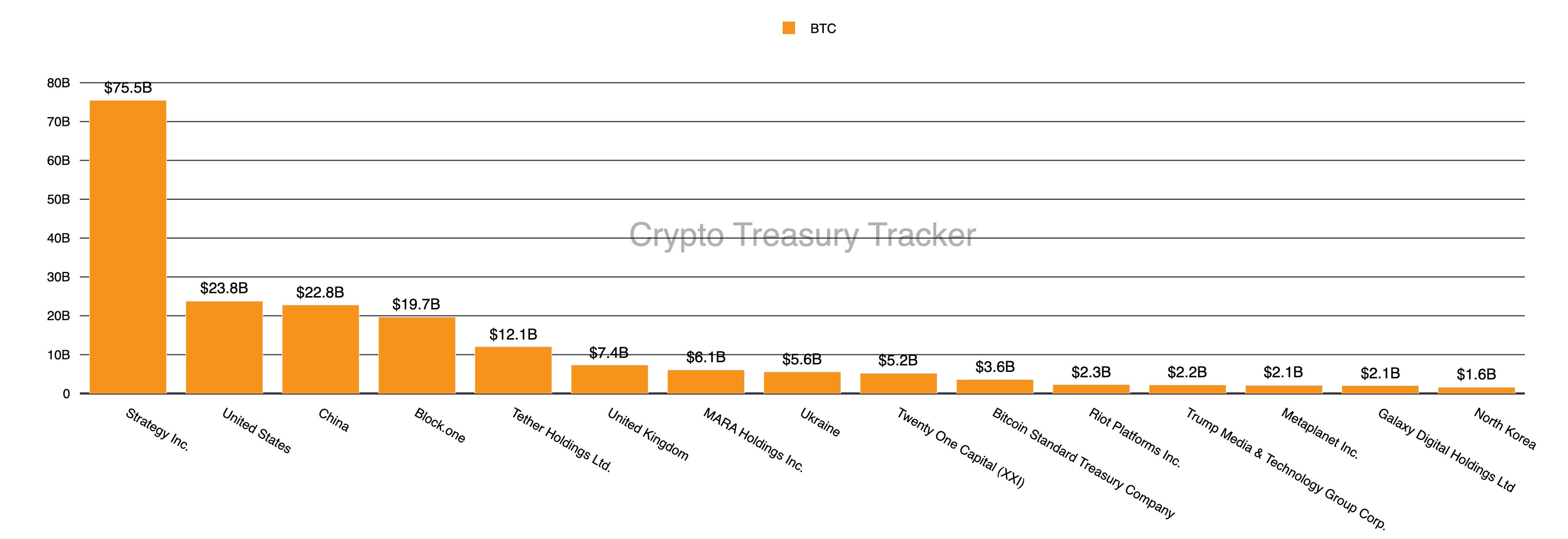

According to recent data from institutional DeFi solutions provider Sentora, Strategy outmatches all other institutions, including governmental entities, in Bitcoin holdings. The following chart illustrates the vast disparity in Bitcoin reserves between Strategy and Metaplanet:

The data shows that Strategy’s Bitcoin holdings far surpass those of any other institutional holder, including the US government. Notably, China ranks just below the US by approximately $1 billion.

Metaplanet currently stands in the thirteenth spot regarding Bitcoin reserves among corporations. However, with its relentless buying strategy, it could potentially enhance its rankings in the near future.

Current BTC Pricing Trends

While treasury enterprises are actively accumulating Bitcoin, the cryptocurrency market reflects a downward trend, with current prices dipping to around $115,100.