Recent analysis indicates that Bitcoin’s long-term holders are realizing substantial profits during this market cycle, surpassing gains noted in past periods.

Insights Into Bitcoin Long-Term Holder Profit Trends

A recent publication from Glassnode has shed light on the financial maneuvers of Bitcoin long-term holders (LTHs) amidst the ongoing market fluctuations.

LTHs are defined as investors who have maintained their Bitcoin holdings for over 155 days. This prolonged duration suggests a strong commitment to their assets, signifying that they are less likely to engage in trading during market volatility. Thus, this group represents the steadfast backbone of the cryptocurrency community.

Although this group may seem inactive, they periodically reassess their investment strategies. Their patient approach often leads to considerable gains, prompting some to consider profit-taking when market conditions align favorably.

Historical data has shown that significant profit realizations by LTHs typically coincide with the latter stages of bullish market trends. Monitoring these activities can provide valuable insights into market dynamics and potential turning points.

The following chart from Glassnode illustrates the trend of cumulative profits realized by Bitcoin LTHs from the onset of each cycle’s all-time high (ATH) to its eventual peak.

Glassnode has identified the initial ATH breakout as a pivotal moment for LTHs, who typically increase their profit-taking activities thereafter. The market tends to flourish as long as there is sufficient demand to counterbalance their selling intentions. Once buying interest diminishes, the market can reach its zenith.

Data shows that so far in this cycle, Bitcoin LTHs have realized a cumulative profit of 3.27 million BTC, surpassing all previous cycles with the exception of the 2017 boom.

This trend may signal that Bitcoin is nearing a critical phase of its current cycle. Another valuable metric to analyze in this context is the Percent Supply in Profit.

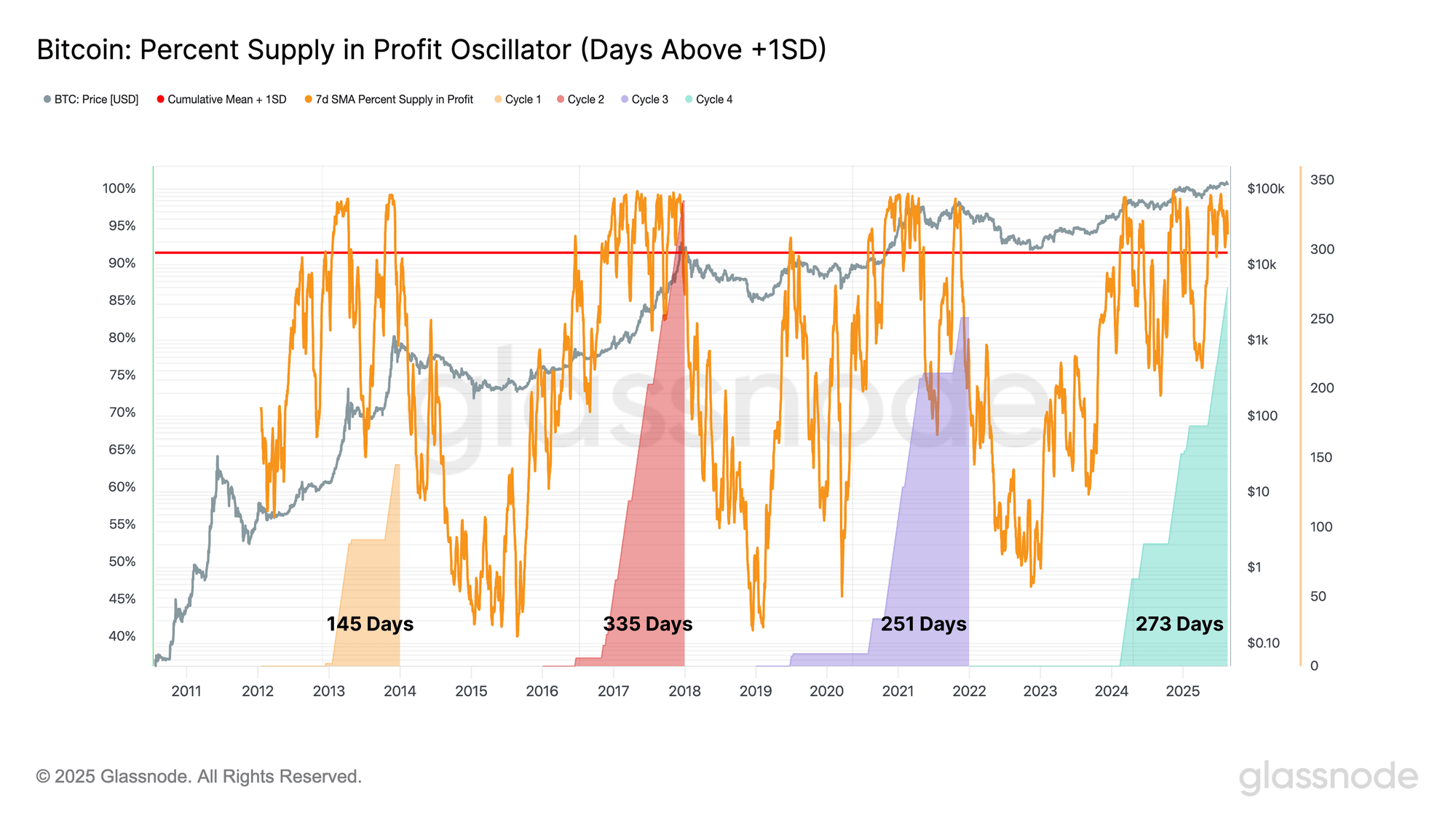

The chart illustrates that Bitcoin’s Percent Supply in Profit has surpassed one standard deviation above its mean for 273 days during this cycle, marking it as the second-highest on record, trailing only the previous cycle from 2016 to 2018.

While these indicators strongly support the notion that Bitcoin is operating within an extreme market phase, there remains uncertainty regarding whether this cycle will ultimately mirror its predecessors. Observers will need to remain vigilant in tracking developments as the situation unfolds.

Current BTC Market Status

As of now, Bitcoin is trading at approximately $113,400, having experienced a nearly 4% decline over the past week.