Tron (TRX) is currently capturing the spotlight in the cryptocurrency space due to its robust underlying fundamentals and a notable price trend that hints at a continued rise. In an era characterized by market fluctuations, Tron has exhibited a remarkable ability to adapt and thrive, significantly bolstered by its expansive ecosystem and a stake in the stablecoin domain.

A pivotal factor influencing this upward momentum is Sunswap, the premier decentralized exchange (DeX) operating on the Tron network. Recent statistics reveal Sunswap’s impressive growth trajectory, as it continues to break transaction records and attract a wider user base. Incorporation with popular wallets such as BitgetWallet, TrustWallet, and TronLink has streamlined access to Tron’s DeFi solutions for a vast audience.

Apart from DeFi advancements, Tron stands out as the leading platform for USDT transactions, boasting an outstanding circulation of over $80 billion Tether on its blockchain. This prominent role highlights Tron’s capacity as a key liquidity provider in the cryptocurrency markets, enabling swift and cost-effective transactions.

The Rising Beacon of Sunswap

Renowned analyst Darkfost reports that Sunswap has recently achieved over 16 million transactions, firmly establishing itself as the cornerstone of Tron’s DeFi landscape. This achievement underscores a steady stream of activity, even amidst market volatility in 2025. Evidence of stability is mirrored in the 2.5 million active addresses on the Tron network, a number that continues an upward trajectory.

Furthermore, Sunswap’s significant growth extends beyond mere transaction volume; it’s also diversifying its portfolio by listing an array of new tokens, including TRUMP, a speculated token associated with former President Donald Trump, gaining substantial buzz among investors. This diversification strategy showcases Sunswap’s agility to adapt and respond to evolving market sentiments.

Reflecting upon 2024, transactions involving the top 20 tokens surpassed 12 million, predominantly led by WTRX and USDT. However, emerging tokens like SUNDOG and JST also carved out their niches, while the category of lesser-known tokens labeled “OTHERS” saw a rise in activity.

As we navigate through 2025, with transaction volumes already surpassing 6 million, a noticeable shift occurs. While WTRX’s dominance wanes, newer players such as LMTV, SUNDOG, and JST are gaining prominence. This shift not only spreads trading activity across a wider range of assets but also signals a healthier and more balanced DeFi ecosystem on the Tron network.

TRX Price Dynamics: Navigating Support Levels

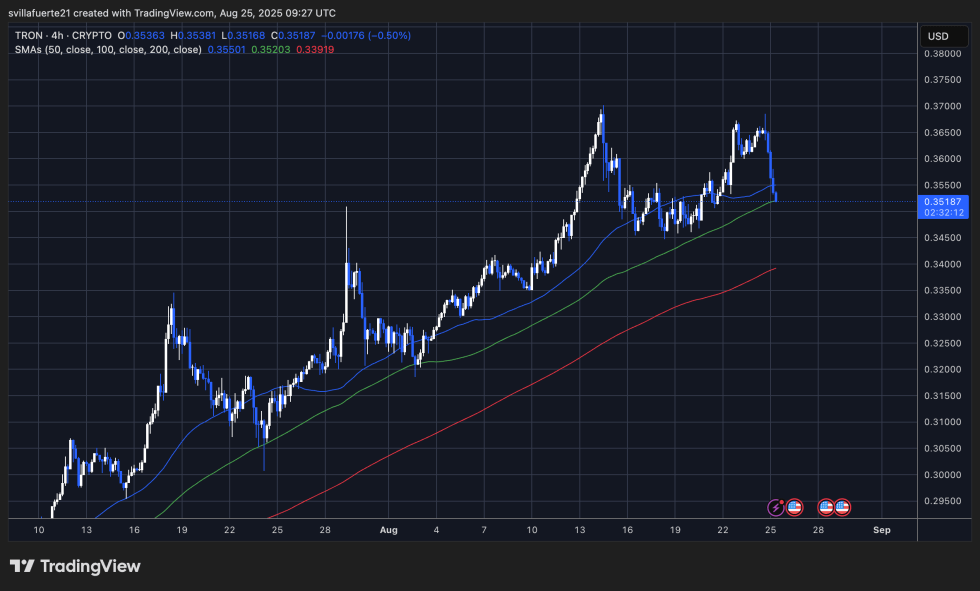

Analyzing the 4-hour price chart of Tron (TRX) reveals a period of consolidation post an extensive uptrend, with current trading hovering around $0.3518. The bullish outlook persists in the short term, yet momentum is gradually waning as TRX approaches its 50-period moving average around $0.3550, a crucial resistance zone, while the dynamic support level rests at the 100-period SMA, currently near $0.3520.

Over the past month, TRX has established a pattern of higher highs and higher lows, reinforcing a bullish market setup. Nevertheless, a significant rejection near the $0.37 level signifies growing selling pressure as local highs are challenged. A breach of the 100-SMA could potentially lead the price toward the 200-SMA, estimated at $0.3390, which unveils a more substantial support area.

If bullish momentum prevails above $0.3520, reclaiming the 50-SMA may lead to a retest of $0.365–$0.370, setting the stage for a possible breakout towards new peak levels. On the other hand, a drop below $0.3390 could initiate a prolonged consolidation, perhaps steering TRX to the $0.32 vicinity.

The overall trend remains robust, yet momentum indicators advise a careful approach as the market stabilizes following a notable upward surge. The upcoming trading sessions will be critical in determining whether TRX can revitalize its bullish trajectory or if it will slide into a corrective phase.

Image sourced from Dall-E, chart data from TradingView.