The recent activities surrounding Bitcoin acquisition have captured significant attention, with notable players undeterred by ongoing price fluctuations.

Strategic Investment in Bitcoin Continues

In a striking development, Strategy’s chairman, Michael Saylor, took to X to announce a substantial acquisition of 3,018 BTC. This purchase, totaling approximately $356.9 million at an average of $115,829 per coin, signals strong confidence in Bitcoin despite the current market dip.

Documents filed with the US Securities and Exchange Commission (SEC) reveal that this acquisition occurred within the window of August 18th to 24th, a period during which Bitcoin experienced notable downward pressure. Nonetheless, Strategy did not shy away from increasing its holdings.

This latest addition is markedly larger than previous purchases, which included a buy of 430 BTC ($51.4 million) just a week earlier and another of 155 BTC the week prior.

Following this acquisition, Strategy’s total Bitcoin reserves have surged to an astonishing 632,457 BTC. At today’s exchange rate, this amounts to nearly $71.1 billion, surpassing the initial investment of $46.5 billion by approximately 53%.

It’s not just Bitcoin that is performing well for the firm. As outlined in another X post by Saylor, Strategy has also demonstrated remarkable stock performance, reflecting broader confidence in their investments.

“Five years ago, $MSTR adopted the Bitcoin Standard. Since then, we’ve outperformed every asset class,” Saylor stated. This decision has spurred a broader movement among corporations to embrace Bitcoin as a treasury asset.

For instance, Japan’s Metaplanet, led by president Simon Gerovich, mirrors this strategy by steadily accumulating Bitcoin. Recently, Gerovich announced an acquisition of 103 BTC worth $11.7 million, bringing their total reserves to 18,991 BTC, acquired for an aggregate of $1.95 billion.

The trend of treasury strategies is extending to altcoins as well. SharpLink, a notable player, currently holds 740,760 ETH, while firms such as Galaxy Digital, Jump Crypto, and Multicoin Capital are rumored to initiate a robust $1 billion acquisition spree in Solana.

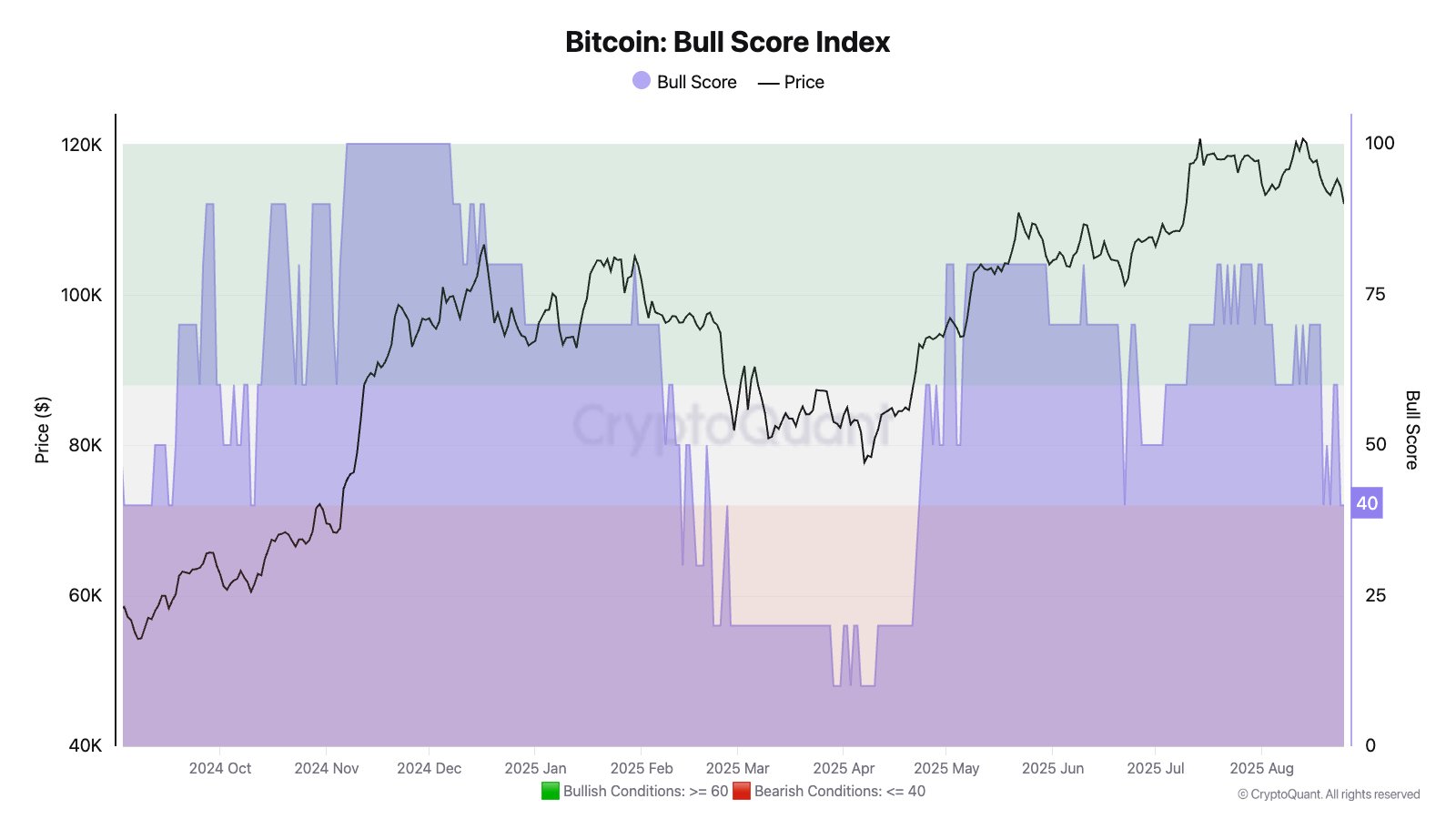

In contrasting news, the CryptoQuant Bull Score Index indicates the market’s current trajectory is leaning bearish. Julio Moreno, CryptoQuant’s head of research, highlighted this development in a recent X post, where the index, which analyzes various on-chain metrics, dropped to 40, signaling a shift to a “Getting Bearish” phase.

The chart indicates a downturn for Bitcoin as the index flags a bearish phase. Moreno’s insights provide a clearer picture of market sentiment, particularly relevant for investors keen on understanding current trends.

Current Bitcoin Market Situation

In light of these developments, Bitcoin’s price remains under pressure, recently noted at the $110,900 mark, reflecting the market’s cautious stance.