In a significant move for the cryptocurrency space, former White House crypto director Bo Hines has joined Tether as a Strategy Advisor focused on Digital Assets and U.S. Expansion. Hines is also hinting that a groundbreaking Strategic Bitcoin Reserve Act may be nearing passage before the end of the year, marking a pivotal time for crypto legislation in the United States.

Strategic Bitcoin Reserve Act: A Potential Game Changer

In a recent discussion with CoinDesk’s Sam Ewen, alongside Tether CEO Paolo Ardoino, Hines expressed optimism about the future of U.S. cryptocurrency legislation. He stated, “The government is eager to explore innovative and budget-conscious methods for accumulation.” Hines credited former President Trump as a vital advocate for the cryptocurrency sector, suggesting, “This is a top priority for him, and the Strategic Bitcoin Reserve is a crucial component.” He confidently asserted, “We are on course for two historic pieces of legislation to solidify America’s standing as the global leader in crypto.”

BREAKING: BO HINES CONFIDENT ABOUT THE #BITCOIN RESERVE ACT SIGNING THIS YEAR!

2025 = A LANDMARK YEAR FOR BTC pic.twitter.com/CQHtHhwZa2

— Crypto Analyst (@crypto_expert) August 26, 2025

These remarks come on the heels of Hines’ transition to Tether. While he led the crypto policy initiative at the White House, Hines played a critical role in driving the legislative efforts culminating in the GENIUS Act, signed into law on July 18, 2025. This act established a fundamental regulatory framework for stablecoins linked to the U.S. dollar, setting the stage for future crypto market structure legislation and the establishment of a Strategic Bitcoin Reserve (SBR).

A federal executive order issued on March 6, 2025, had already set the groundwork for this reserve, alongside a separate digital asset stockpile. The Bitcoin Reserve Act, which is set to solidify these measures, would offer a more structured approach to regulatory compliance and governance concerning Bitcoin assets.

This executive directive established an SBR composed of coins already in governmental possession through forfeiture, effectively preventing their sale and suggesting a long-term view of Bitcoin as a reserve asset. The Senate’s version, led by Senator Cynthia Lummis, and the House counterpart from Representative Nick Begich aim to formalize this reserve through legislation, having both been introduced in March and currently pending in committee.

In his interview, Hines indicated a degree of continuity in the administration’s approach despite his recent departure. He relayed, “I trust Patrick [Witt] to effectively continue advocating for the industry,” while laying out the future legislative agenda—after GENIUS, the next focus will be on market structure and the SBR. He conveyed a strong belief that substantial progress in crypto legislation is imminent.

The current policy environment is crucial in shaping the future of cryptocurrency. The March 2025 executive order mandates that seized and forfeited Bitcoin be retained within a stable reserve, creating a dedicated asset for strategic purposes. Moreover, the administration emphasizes that these holdings are not intended for sale, thus promoting Bitcoin as a long-term asset rather than merely a speculative investment. The imminent BITCOIN Act aims to clarify the guidelines for reserve management, governance, and procurement, potentially opening doors for additional budget-neutral Bitcoin acquisitions.

Moreover, discussions in the Treasury Department, particularly by Treasury Secretary Scott Bessent, reveal varying stances on Bitcoin procurement. Despite earlier public assertions that the government would not engage in new Bitcoin purchases, recent commentary indicates an exploration of budget-neutral avenues for reserve enhancement. Hines reiterated this sentiment, noting the focus on integrating seized Bitcoin while avoiding tax implications.

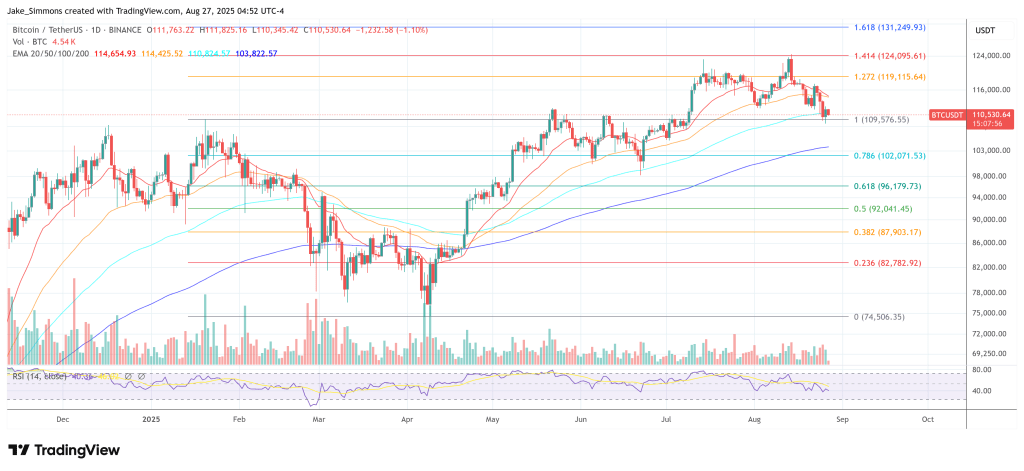

As of now, Bitcoin is trading at an impressive $110,530, underlining the growing interest and investment in the cryptocurrency space.