The ongoing data from blockchain platforms indicates that cryptocurrency exchanges continue to dominate the landscape of Bitcoin trading, with Binance observing trading volumes significantly higher than those associated with spot ETFs.

Current State of Bitcoin Trading Volume Across Platforms

A recent update from CryptoQuant sheds light on the comparative performance of US spot exchange-traded funds (ETFs) versus traditional exchanges in Bitcoin trading.

Spot ETFs serve as investment tools that enable individuals to gain exposure to Bitcoin without actually holding the cryptocurrency directly. These funds are traded on conventional financial platforms, thus allowing those less familiar with crypto to partake in Bitcoin investments with ease.

Having gained approval from the US SEC early last year, spot ETFs have rapidly become a popular choice among investors. Prior to their introduction, individuals had to engage with cryptocurrency exchanges for Bitcoin purchases. Unlike ETFs, exchanges facilitate the transfer of actual Bitcoin to a user’s wallet, which can then be moved to self-custody, offering a different level of control and access.

For many conventional investors, the prospect of navigating the often-complex world of cryptocurrency wallets can be intimidating. Spot ETFs provide a more straightforward, off-chain pathway into Bitcoin, positioning them as a direct alternative to exchanges.

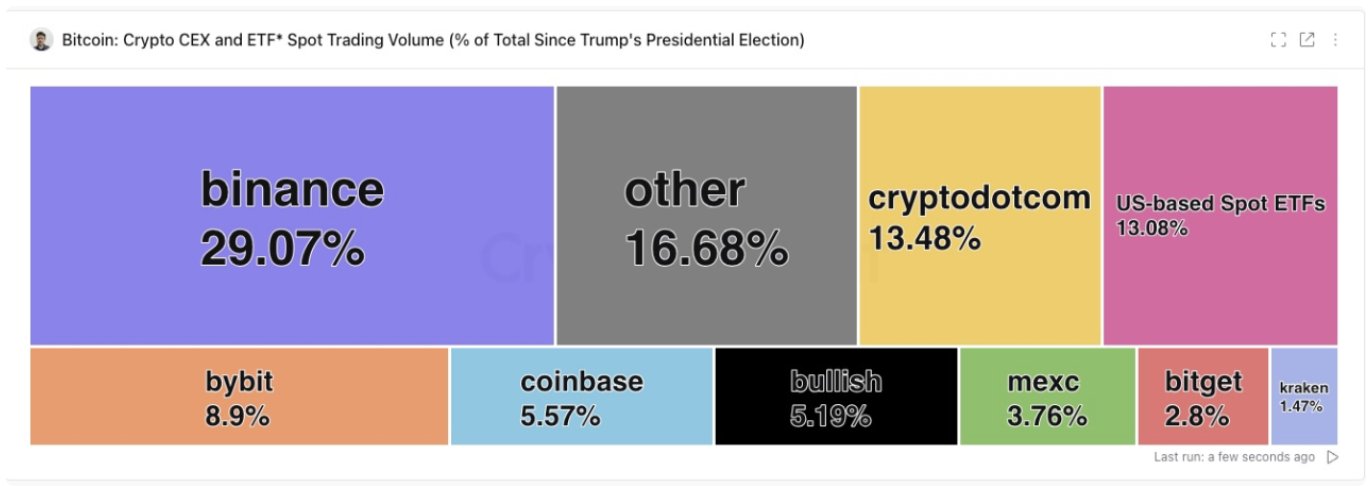

Despite their swift rise in popularity, a pertinent question remains: How do spot ETFs compete with traditional exchanges in terms of trading volume? Below is a visualization from CryptoQuant that highlights the trading dynamics between US spot ETFs and major crypto exchanges.

The chart illustrates that Bitcoin spot ETFs have recently experienced daily trading volumes fluctuating between $5 billion to $10 billion. While these numbers are impressive on their own, they are substantially lower than the trading volumes recorded on crypto exchanges.

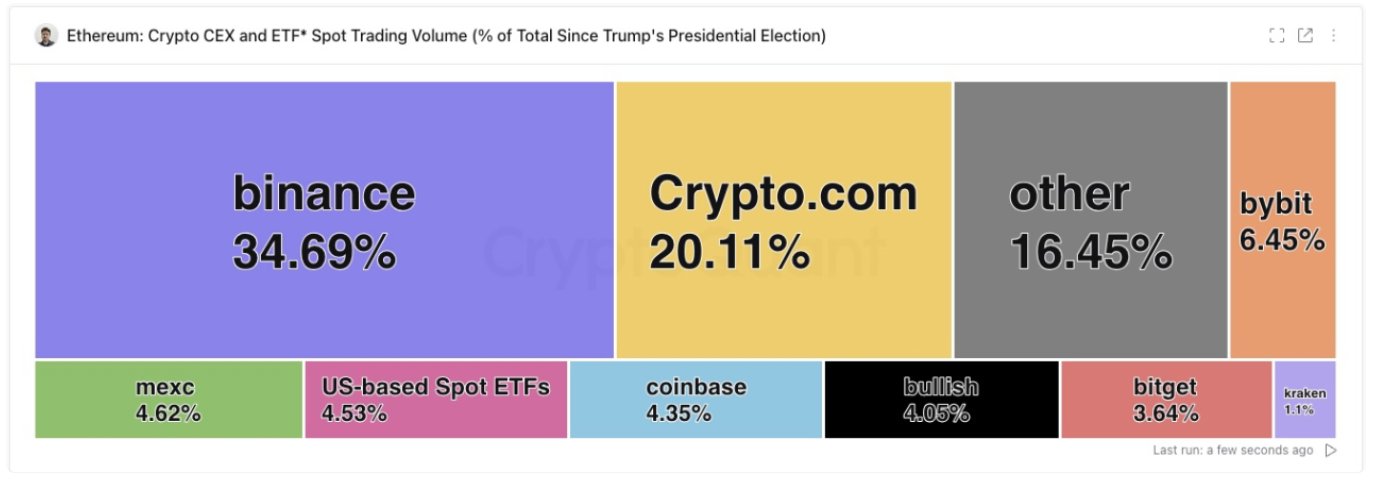

Taking the lead, Binance—the preeminent platform in the crypto space—can attract upwards of $18 billion in trading volume during peak sessions. Since the beginning of Donald Trump’s presidency, Binance has maintained an overwhelming market share of approximately 34.69%.

In contrast, US spot ETFs account for merely 4.53% of Bitcoin trading volume. Other platforms such as Crypto.com (20.11%), Bybit (6.45%), and MEXC (4.62%) all have significantly higher trading volume percentages. This data leads analysts to assert that exchanges remain the dominant trading venues.

A similar scenario is observed in the realm of Ethereum spot ETFs, which were introduced in the US in mid-2024.

As seen in the accompanying chart, Binance has captured an impressive 29.07% share of total Ethereum trading volume, overshadowing the US spot ETFs, which only represent 13.08%. While the gap is narrower compared to Bitcoin, it underscores the competitive edge that traditional exchanges maintain.

Current Bitcoin Price Insights

In recent market developments, Bitcoin has experienced a drop of approximately 3% over the past 24 hours, pushing its current price down to $108,500.