Recent analysis indicates that the landscape for cryptocurrency exchange-traded funds (ETFs) is evolving, with Bitcoin starting to show some positive momentum while Ethereum continues to dominate inflows.

Last Week Marked a Turnaround for Bitcoin Spot ETFs

According to a recent update from Glassnode, Bitcoin spot ETFs registered net inflows, demonstrating renewed interest in this asset class. Sports ETFs are designed to facilitate investment in Bitcoin and Ethereum through conventional trading platforms, catering especially to those less familiar with digital wallets.

The primary advantage of these spot ETFs is that they offer an accessible means for traditional investors to gain exposure to cryptocurrencies without delving into complex digital asset management. It allows for a smoother entry into the crypto market.

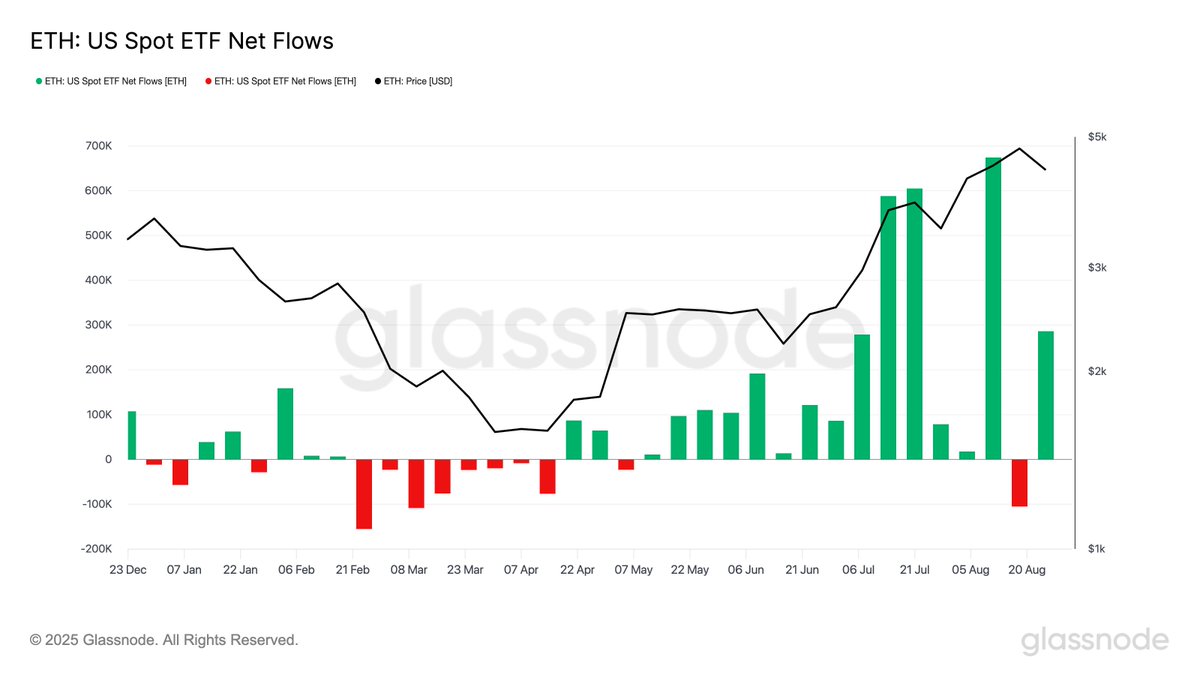

While Bitcoin spot ETFs once saw robust demand, the levels have fluctuated. Below is a visualization shared by Glassnode, illustrating the recent performance trends in weekly net inflows of these ETFs.

The graph highlights that the US Bitcoin spot ETFs experienced substantial net inflows from April to July, followed by a downward trend leading to outflows in recent weeks.

Prior to this past week, Bitcoin’s inflows had been negative for three out of four weeks. However, the most recent data reflects a change with net inflows resuming, albeit at a modest volume of 3,018 BTC (approximately $329 million based on current values).

This return to positive inflows, although coinciding with a decrease in Bitcoin’s price, suggests a sustained institutional interest in BTC. Nonetheless, Ethereum remains the favored asset among investors, showcasing more robust engagement.

The chart indicates that, while US Ethereum spot ETFs experienced a dip in inflows last week, they too have bounced back recently. However, unlike Bitcoin, Ethereum’s outflows were not a consistent theme; in fact, it enjoyed a remarkable 14-week net inflow streak before this temporary setback.

During this impressive streak, significant spikes in inflows were frequently observed, illustrating that institutional investors were making substantial placements in Ethereum. The latest inflow of 286,000 ETH (valued at around $1.2 billion) into the spot ETFs underscores this trend.

Bitcoin’s Current Price Dynamics

While Bitcoin is showing signs of recovery in ETF inflows, its price dynamics appear to be influenced by external market forces, particularly following a recent peak of $109,200.