Bitcoin is navigating a turbulent path as it struggles to regain previous highs, causing unease among investors about the strength of its trajectory. Recently, the price has dipped below significant demand areas, giving rise to questions regarding bullish momentum, which appears to be waning. Currently, market participants are intently observing Bitcoin’s potential recovery, or if a more significant correction looms ahead.

The sentiment across the cryptocurrency market has noticeably shifted. Many experts predict that Bitcoin might soon approach the psychological barrier of $100K. Such a movement would represent one of the most substantial corrections in this cycle, likely inciting fear among short-term traders while simultaneously presenting opportunities for longer-term holders.

Leading analyst Axel Adler provides crucial insights into the current landscape, citing data that reflects ongoing derivative pressure exerted on Bitcoin. Adler emphasizes that the primary trend for Bitcoin indicates pullbacks driven by long de-leveraging practices. With high activity in derivative markets impacting price movements, current pressure metrics suggest that traders should remain cautious of possible downturns.

Bitcoin’s Open Interest: A Red Flag?

According to Axel Adler, Bitcoin’s existing weakness is intricately linked to the dynamics of the derivative market. The current Bitcoin Open Interest Pressure Score is around 30%, which indicates heightened risk scenarios historically. This situation leaves the market susceptible to sudden downward movements. Traders using leverage, in particular, find themselves in challenging positions as any substantial dip in spot prices may lead to cascading liquidations, thereby amplifying volatility.

Adler also notes that certain indicators on the price chart reinforce these concerns. For instance, the presence of specific cluster markers suggests continued sideways or downward market momentum as traders de-leverage their long positions. Those who overstretched during Bitcoin’s ascent above $120K are now facing potential losses, further dampening momentum and creating barriers for recovery efforts.

Another factor complicating the situation is a recent trend of capital rotation within the cryptocurrency markets. Institutions and large holdings are reportedly offloading parts of their Bitcoin positions to acquire Ethereum, driven by the growing adoption and activity within the ETH ecosystem. This flow of liquidity has likely contributed to Bitcoin’s difficulties in maintaining levels above $110K, thereby weakening bullish sentiment.

Should Bitcoin fail to reclaim its previous highs and if derivative pressures remain significant, the likelihood of testing the $100K mark increases. Alternatively, if the market stabilizes and manages to absorb the selling pressure, Bitcoin may reset leverage and gear up for its next pivotal movement. Regardless, investors should brace for increased market fluctuations in the near term.

Current Price Dynamics: A Critical Test

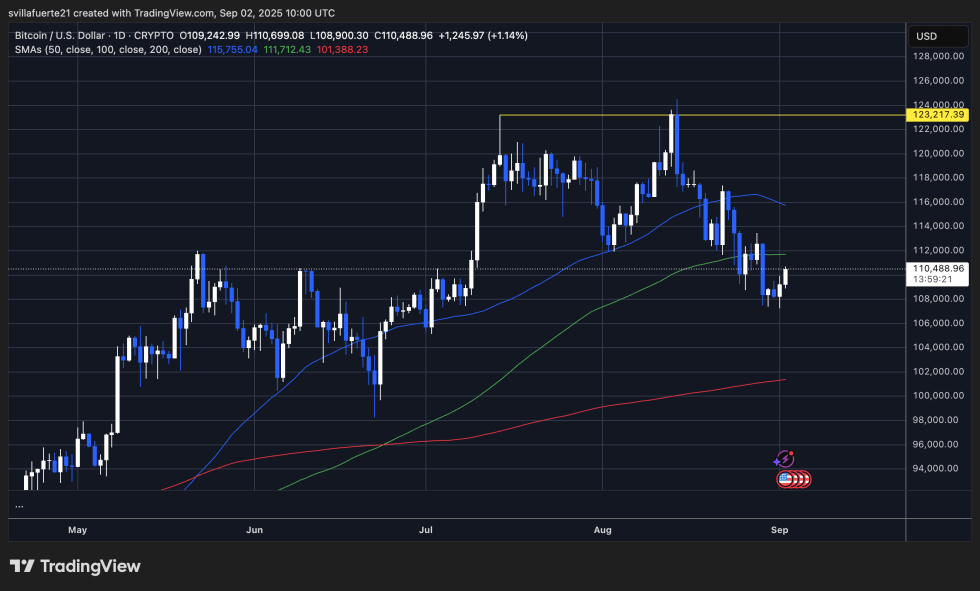

Bitcoin (BTC) is currently exhibiting signs of stabilization after a period of considerable volatility. As of now, BTC trades around $110,488, making attempts to rise above the important threshold of $110K. This point has become a significant battleground for market bulls and bears, with forthcoming movements likely shaping the short-term direction.

The 50-day moving average looms above the current price at approximately $115,755, marking an essential area of resistance. To confirm bullish strength, Bitcoin needs to surpass this level and target resistance at $123,217, which presents a significant barrier for any attempt at new highs. Conversely, the 200-day moving average near $101,388 serves as a critical safety measure. If prices fall significantly below this marker, a reevaluation of support levels may urge a deeper correction, with $100K acting as a psychological line in the sand.

The prevailing market structure suggests consolidation as the cryptocurrency digests the rapid rise earlier in the cycle. If bulls can maintain momentum above $110K, the prospect for movement towards $115K and eventually $123K remains feasible. However, any setbacks could lead to retests of lower support levels around $105K to $101K.

Stay informed as this dynamic situation unfolds, with market participants keenly watching each development. Featured image from Dall-E, chart sourced from TradingView.