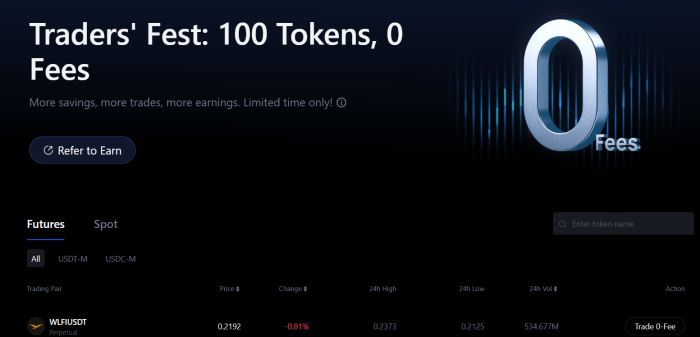

MEXC has emerged as a leading contender in the cryptocurrency exchange landscape, achieving remarkable growth in Q2 of 2025 through its innovative strategies, including a compelling zero-fee program on select futures contracts.

This strategic move not only sought to lower entry barriers for traders but also capitalized on the increasing trend of embracing stablecoins as part of the broader crypto adoption narrative.

A Low-Cost Strategy Resonates with Traders

According to the CoinGecko Q2 2025 Crypto Industry Overview, there was a striking 24% increase in total cryptocurrency market capitalization from the previous quarter. Additionally, the stablecoin segment reached unprecedented heights, amassing a market cap of $243.1 billion, with the $USDC supply growing by $1.4 billion, indicating a strong demand for regulated, dollar-equivalent assets.

By removing trading fees on popular $USDC-margined futures pairs, MEXC enabled traders to explore high-demand markets without cost barriers, effectively positioning itself as a pivotal player in the evolving crypto market.

The elimination of trading costs significantly boosted user engagement and liquidity, allowing MEXC to optimize its offerings in response to market dynamics.

Top Performing Trading Pairs

During this initiative, the exchange observed impressive performances across a variety of trading pairs:

- $TON/$USDC captured a commanding 42% market share.

- $ETH/$USDT maintained a notable 33% market share, solidly anchoring its status as a leading trading option.

- The pairs $ONDO/$USDC and $POPCAT/$USDC each reported substantial market share gains, surpassing 5%.

The diverse mix of established cryptocurrencies, infrastructure investments, and emerging meme coins on MEXC allowed it to cater to a wide spectrum of trader preferences.

Institutional investors gravitated towards $ETH and $TON, while the volatility of $POPCAT attracted retail traders seeking quick gains.

A Shift from Speculation to Sustainable Investments

The success of this quarter also reflects a significant shift in investor psychology. In Q1, speculative coins like Dogwifhat and Brett garnered much attention. However, as regulatory frameworks became more favorable, investors began prioritizing sustainable innovations such as DeFi projects and infrastructure development in Q2.

MEXC’s zero-fee structure aligned seamlessly with this market transition, opening doors for traders to explore long-term growth sectors.

Establishing a Pathway for Continuous Development

The zero-fee policy facilitated not only decreased trading costs but also an ecosystem of heightened liquidity and increased market share.

This initiative set the stage for MEXC’s further prospects, particularly in the increasingly competitive futures landscape.

With over 40 million users across 170 nations, MEXC has garnered acclaim for being an accessible trading platform. The exchange frequently features emerging tokens, offers exciting promotions, and provides one of the most competitive fee structures in the industry.

Its commitment to user-friendly experiences—encapsulated by the motto ‘Your Easiest Way to Crypto’—has attracted a diverse range of participants, from novice traders to seasoned professionals.

The Growing Role of Stablecoins and DeFi

The current spotlight on $USDC futures comes as stablecoins solidify their positions within the crypto ecosystem. Serving as a fundamental liquidity source, stablecoins are vital for transactions, cross-border payments, and decentralized finance solutions.

The market cap milestone of $243.1 billion signifies not only sector growth but also diversification, with compliant tokens like $USDC gaining traction among investors seeking stability.

MEXC’s choice to promote $ONDO/$USDC in its zero-fee campaign illustrates the competitive landscape of exchanges, now focused on aligning with forward-thinking industry sectors.

Institutional attention towards DeFi remains strong, with innovative entities like Ondo Finance ($ONDO) showcasing novel ways to integrate traditional finance with blockchain solutions.

Looking Ahead: MEXC’s Future Aspirations

This strong quarterly result fortifies MEXC’s reputation as a fierce competitor in the futures exchange arena.

The zero-fee initiative stands to become a lasting advantage, allowing MEXC to attract traders eager to engage with the latest market trends, thus establishing a strategic framework for sustained growth into 2026 and beyond.

Always remember to conduct your own research before making investment decisions. This article is not intended as financial guidance.

Authored by Bogdan Patru, Bitrabo –