Ethereum is navigating through a critical phase as market dynamics shift and selling pressure escalates. Following the breach of the $4,500 threshold, ETH now finds itself in a constricted trading range. Bulls are grappling to maintain these crucial levels, while analysts caution that failing to reclaim the $4,500 mark promptly could lead to a more pronounced correction, with potential targets hovering around $3,900. This environment of uncertainty weighs heavily on market sentiment; however, evidence suggests that major players remain undeterred, actively acquiring ETH.

Recent findings from Lookonchain indicate that large investors, or whales, have secured a notable total of 218,750 ETH—equivalent to roughly $942.8 million—within a mere two days. This uptick in accumulation signals a robust belief in Ethereum’s potential, not just as a premier smart contract platform but also as a key player in an expected altcoin rally. As capital begins to shift from Bitcoin, institutional investors appear to be positioning themselves early for Ethereum’s anticipated upward movement.

While Ethereum faces challenges, its underlying fundamentals remain solid, bolstered by increased institutional interest, consistent whale activities, and a flourishing DeFi ecosystem. The tug-of-war between bullish defenders and bearish challengers will significantly influence ETH’s forthcoming trajectory.

Robust Institutional Accumulation Fuels Optimism

Despite recent volatility, the funnel of institutional capital into Ethereum remains impressive. According to Lookonchain, institutions like Bitmine have notably acquired 69,603 ETH—valued at approximately $300 million—from notable firms like BitGo and Galaxy Digital.

Moreover, five newly established wallets gathered a total of 102,455 ETH, amounting to around $441.6 million from FalconX. Such substantial purchases indicate an unwavering confidence in Ethereum’s long-term prospects and reinforce the notion that institutions are strategically positioning for future advancements.

This surge in institutional accumulation carries significant implications. Primarily, it cements Ethereum’s role as a focal point in institutional investment strategies, especially amidst a wider rotation from Bitcoin into altcoins. Importantly, it reveals that even with increasing market volatility, the demand for ETH shows remarkable resilience. The scale at which these acquisitions occur suggests that institutional investors view short-term price corrections as optimal entry points.

Nonetheless, the path forward does carry inherent risks. Technically speaking, Ethereum must secure a foothold above $4,200 to prevent a sizeable decline. A failure to maintain this threshold could see the price retreating to the $3,900 support zone, which may trigger further market sell-offs. Yet, the confidence displayed by institutional investors acts as a stabilizing force against fluctuations, indicating that Ethereum’s fundamental demand remains strong and could pave the way for its next bullish phase.

Key Consolidation Phase for Ethereum

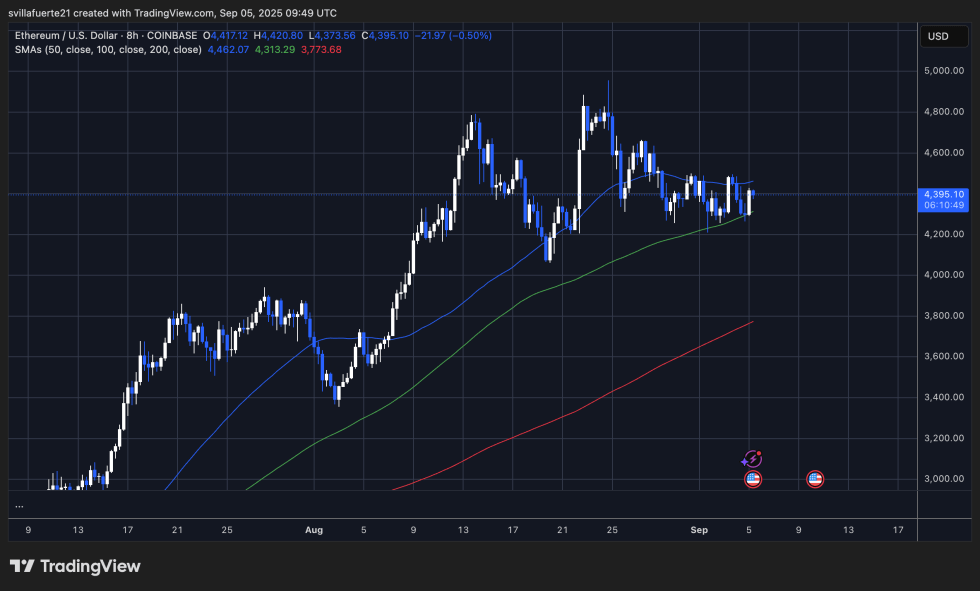

Currently, Ethereum (ETH) is consolidating just under the critical $4,500 level, trading around $4,395 after several days of minimal price movement. The price chart illustrates ETH’s tight trading range between $4,250 and $4,500, highlighting a growing sense of market hesitation as buyers attempt to support the current demand while sellers exert pressure.

The 50-day moving average (indicated by the blue line) lies just above the current price, acting as a dynamic resistance level, whereas the 100-day moving average (the green line) around $4,313 serves as a nearby support point. A close below $4,250 could potentially lead to a deeper retreat toward $3,900, a crucial support zone. Conversely, for bullish momentum to be reinforced, ETH must break and maintain levels above $4,500 to set the stage for a potential retest of highs nearing $4,800.

Despite the indecisiveness in price movements, the overall structure remains encouraging. ETH trades significantly above the 200-day moving average (red line), which trends upward near $3,773, implying that the long-term bullish outlook is still intact. However, the immediate focus will largely depend on whether the bulls can uphold the $4,200–$4,250 corridor, with ETH in a pattern of consolidation as breakout or breakdown indicators are yet to surface.

Featured image from Dall-E, chart from TradingView