Cryptocurrency markets are experiencing heightened fluctuations, with Bitcoin maintaining a critical struggle just below the pivotal $115,000 mark. While it resists a decisive breach under $110,000, this impasse represents a narrow trading range that typifies the current market sentiment. As bullish enthusiasm appears to wane, traders grapple with an uneasy sense of trepidation regarding price movements, raising concerns about potential downward corrections should buying impetus fail to reignite.

Despite prevailing uncertainties, the underlying fundamentals paint a more optimistic long-term picture for Bitcoin. The continual rise in institutional interest remains a cornerstone of its market potential, as several firms persist in accumulating Bitcoin, viewing it as a strategic treasury asset amidst ongoing economic instability and inflationary pressures that keep the cryptocurrency’s relevance alive.

In a recent notable development, blockchain analytics firm Lookonchain revealed that Metaplanet, a pioneering Bitcoin Treasury company in Japan, enhanced its portfolio by acquiring an additional 1.36 BTC with a total investment of approximately $15.26 million at an average cost of $112,180. This latest acquisition underscores their unwavering commitment to Bitcoin as part of their long-term asset strategy.

Surge in Institutional Investment for Bitcoin

As reported by Lookonchain, Metaplanet currently possesses 20,136 BTC, valued at an astounding $2.24 billion, having made purchases at an average price of $102,495. This substantial holding not only emphasizes the firm’s strategic outlook on Bitcoin but also reflects a significant trend in which institutional investors recognize cryptocurrency as a viable and valuable asset class. Unlike other organizations that test the waters with minor allocations, Metaplanet stands out as a leader in corporate Bitcoin adoption within Japan, mirroring a broader shift in global investment strategies.

It’s essential to highlight that the push toward cryptocurrency isn’t confined to American enterprises. Japanese firms like Metaplanet are stepping into the spotlight, showcasing how Bitcoin is gaining traction as a treasury reserve asset on a global scale. This expansion in adoption beyond the U.S. not only validates Bitcoin’s growing acceptance but also solidifies its reputation as a secure store of value worldwide.

Looking ahead, the upcoming weeks hold critical significance for Bitcoin. Historically regarded as a bearish period, September could potentially surprise analysts if cryptocurrencies like Bitcoin and Ethereum manage to recover lost ground. With Bitcoin firmly standing above key support levels and institutional purchasing on the rise, market sentiment may transition from a cautious outlook to one filled with renewed optimism.

Assessing Stabilization Above $110,000

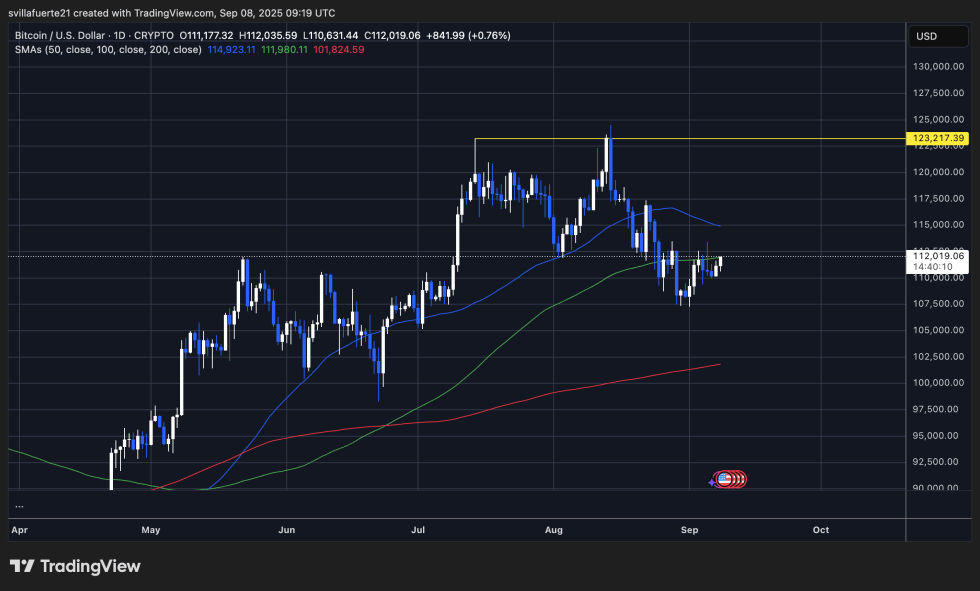

Currently, Bitcoin is trading around $112,019, indicating some level of stabilization following recent volatility amid price fluctuations that saw it plunge from an all-time high nearing $124,500. The current trends suggest that BTC is actively working to secure a foothold above the critical $110,000 threshold, an area that has become increasingly significant for demand. Presently, Bitcoin is trading above the 100-day Simple Moving Average (SMA) at $111,980, suggesting that buyers are aimed at defending essential medium-term support levels.

Nevertheless, the momentum continues to appear tenuous. The 50-day SMA is currently on a downward trend, reflecting that short-term sentiment is still under pressure. The 200-day SMA, resting considerably lower at around $101,824, would serve as a last line of defense against significant corrections. The battle for Bitcoin’s value currently rests upon the stability of the $110,000 to $112,000 range versus the aspiration to reclaim the $115,000 resistance level, which aligns with decreasing moving averages.

If Bitcoin’s bulls secure a decisive closing above $115, the possibility of retesting resistance at $123,000 could materialize. Conversely, a dip below $110,000 may amplify selling pressures, driving Bitcoin closer to $105,000 or below. In summary, the current analysis reflects a period of consolidation, where buyers are striving to regain control amidst prevailing caution in the market.

Image provided from Dall-E; chart courtesy of TradingView.