In a recent strategic partnership, the innovative blockchain company Ripple announced its collaboration with the prominent Spanish financial institution, Banco Bilbao Vizcaya Argentaria (BBVA). This agreement aims to equip BBVA with advanced custody services for major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

Ripple’s Strategic Partnership with BBVA

Ripple, renowned for its pioneering role in the blockchain space with the XRP token, has joined forces with BBVA to enhance its digital asset service offerings. This collaboration comes on the heels of BBVA’s July announcement regarding the rollout of Bitcoin and Ethereum trading services tailored for Spanish retail customers.

Under this new partnership, Ripple will introduce its cutting-edge custody solution, Ripple Custody, which is designed for institutional use. This technology empowers BBVA to provide robust custodial services, ensuring secure management of both tokenized assets and traditional digital currencies.

Cassie Craddock, Ripple’s Managing Director for Europe, noted the positive impact of the European Union’s (EU) Regulation on Markets in Crypto-Assets (MiCA), which facilitates banks in the region to offer digital asset services more efficiently.

The MiCA legislation serves as a comprehensive framework to regulate digital currencies, stablecoins, and associated service providers across EU member states, aiming to enhance consumer protection and market integrity.

With Ripple Custody in place, BBVA is well-positioned to meet the burgeoning demand for digital assets among its clientele. The partnership also ensures that the bank adheres to rigorous security, regulatory, and operational standards. Francisco Maroto, Head of Digital Assets at BBVA, remarked:

By employing Ripple’s custody solution, we are able to harness reliable technology that aligns with the pinnacle of security and operational excellence. This collaboration enables BBVA to offer comprehensive custody services to our customers, thereby supporting their exploration of digital assets with the reliability of a well-established banking institution.

This agreement marks another milestone in the ongoing relationship between BBVA and Ripple, as Ripple currently provides custody solutions to BBVA’s operations in Turkey and Switzerland, showcasing its expansive reach in the global digital asset custodial market.

The Growing Importance of Crypto Custody Solutions

The cryptocurrency landscape has witnessed significant advancements in custody solutions recently. For instance, Ripple’s recent collaboration with UAE-based Ctrl Alt signals a commitment to expanding its services in the Middle East.

A supportive regulatory climate for digital currencies in the US is prompting financial institutions to enhance their crypto custody offerings. Notably, US Bancorp has resumed its Bitcoin custody services after a lengthy break, reaffirming the growing acceptance of cryptocurrencies among traditional banks.

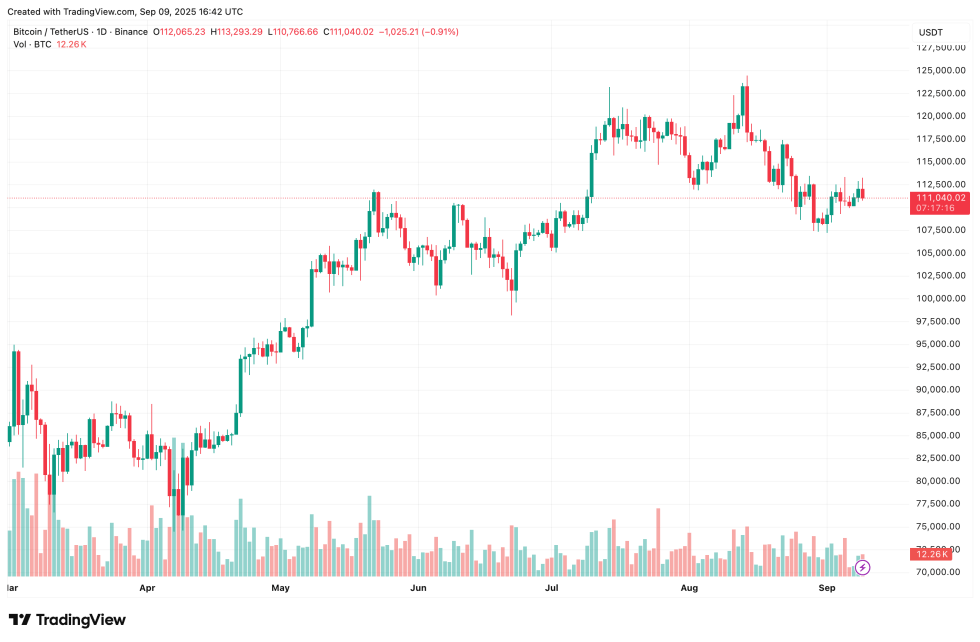

Additionally, the major banking regulators in the US, including the OCC, Federal Reserve, and FDIC, have collectively released new guidance on best practices for the custody of digital assets. As of now, Bitcoin is priced at approximately $111,040, reflecting a slight decline of 1.2% over the last day.