Recent trends indicate a remarkable increase in investor interest in Solana, with the perpetual futures Open Interest surpassing $7 billion. This surge is a clear indication of growing speculative activity in SOL, signaling a vibrant market environment.

Recent Growth in Solana Open Interest

According to insights from leading analytics firms, the growth of Solana’s Open Interest is closely tied to its recent price performance. This metric, which tracks the number of outstanding perpetual futures contracts, is reflective of both long and short positions across various exchanges. Investors seem more enthusiastic as SOL continues to show resilience in a fluctuating market.

Here is a graphical representation of Solana’s Open Interest trajectory over the past year:

The graph illustrates that as SOL’s price recently broke through the $200 mark, it coincided with a steep rise in Open Interest, confirming that market engagement is intensifying. Historically, such spikes in speculative trading are common during bullish phases, as investors are drawn to opportunities that promise significant gains.

However, it’s essential to monitor these changes closely. A rapid increase in Open Interest may indicate heightened leverage, potentially increasing the risk of liquidation events in dynamic market conditions.

With SOL’s perpetual futures Open Interest climbing, observers suggest that this might lead to greater price fluctuations as liquidation pressures could emerge. The ultimate direction of these price movements will hinge on which faction, long or short, prevails in the market.

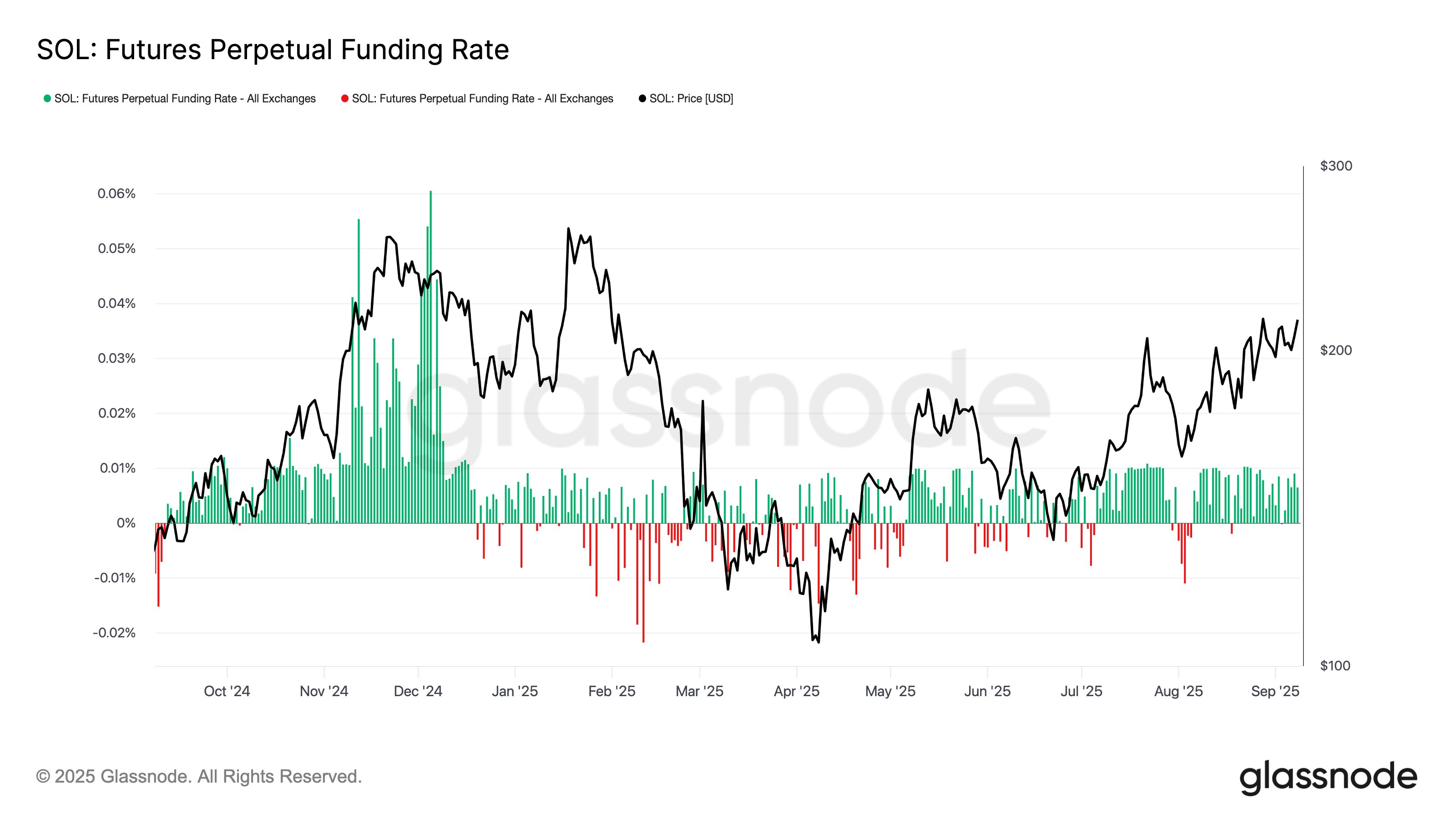

A valuable tool for assessing this situation is the Funding Rate. This metric reveals the fees exchanged between participants in the perpetual futures market. A positive Funding Rate indicates that long holders are compensating short holders, while a negative rate points to bearish market sentiments.

Recent data shows that Solana’s Funding Rate has remained positive, suggesting increased confidence among investors betting on price rises.

Interestingly, the lack of a substantial increase in the Funding Rate alongside the Open Interest rise implies that new positions in the market may not be overly speculative. This could indicate room for continued growth if momentum is maintained, as noted by industry analysts.

Current Status of SOL Prices

Solana has distinguished itself in the cryptocurrency landscape with a recent price increase of nearly 7%, pushing its value up to $224. This strong performance highlights Solana’s potential as a leading player in the market.