In a recent discussion on CNBC’s Squawk Box, notable financial figure Mike Novogratz, CEO of Galaxy Digital, shared insights about the current state of Bitcoin (BTC). He emphasized that Bitcoin appears to be undergoing a consolidation period, coinciding with a growing interest among treasury firms in diversifying their holdings into altcoins.

Novogratz Observes Trends in Cryptocurrency Market

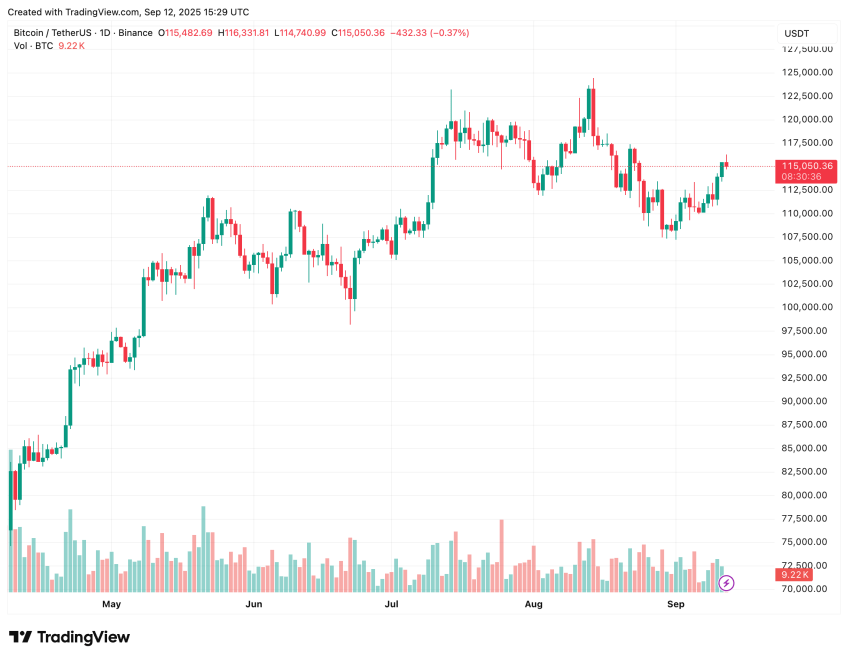

As Bitcoin trades approximately 7.4% below its historical peak of $124,128, achieved on August 14, it showcases a stable price action. Despite a notable increase of 5.2% in the last two weeks, the cryptocurrency seems to remain in a narrow trading range, suggesting a phase of consolidation.

During his television appearance, Novogratz articulated that Bitcoin has not shown much upward momentum recently, as treasury firms have been preoccupied with acquiring substantial amounts of altcoins. Yet, he remains optimistic, hinting at a potential price surge for BTC as the year progresses. He remarked:

Bitcoin is indeed in a consolidation phase. This is mainly due to treasury companies exploring other cryptocurrencies.

It’s worth noting that numerous companies have significantly added altcoins, particularly Ethereum (ETH), to their financial portfolios. For example, BitMine Immersion Technologies has made headlines by holding over 2.1 million ETH, valued at nearly $9 billion.

Other entities have followed suit. Recently, ETHZilla, a treasury firm dedicated to Ethereum, announced holdings exceeding 100,000 ETH. Nasdaq-listed SharpLink has expanded its ETH collection to over 800,000, showcasing a compelling trend.

Why the Shift Toward Altcoins?

The ongoing pivot towards altcoins can be attributed to several compelling factors. Ethereum, for instance, provides a vast array of applications beyond mere currency transfer. It plays a crucial role in enabling stablecoin transactions, supporting decentralized finance (DeFi), and powering non-fungible tokens (NFTs).

Jan van Eck, the CEO of VanEck, went as far as labeling Ethereum as the “Wall Street token,” highlighting its extensive functionalities. He pointed out that Ethereum retains key strategic advantages against its competitors.

Moreover, notable investments, such as the $44 million placed in ETH by Yunfeng Financial, underline the growing allure of altcoin assets. Additionally, the firm Ether Machine recently secured $654 million in ETH through private funding, showcasing the accelerating trend toward altcoin-focused treasury management.

Not just Ethereum, but other altcoins, like Solana (SOL), are also experiencing a surge in interest. Earlier this week, Forward Industries made headlines by securing $1.65 billion in cash and stablecoin commitments aimed at developing a treasury strategy centered around SOL.

While the current fascination lies with altcoins, it’s crucial to stay focused on Bitcoin’s ongoing developments. A significant breakout from its consolidation pattern could potentially spark a shift back to BTC from altcoins. As it stands, BTC is trading at $115,050 with a slight increase of 0.4% over the last 24 hours.