Solana has reported an impressive surge this September, with $SOL increasing by 23.5%. This remarkable performance outpaces both $BTC’s 6.9% and $ETH’s 6.4%, marking a significant moment for the blockchain network.

This spike in price corresponds with the recent acquisition of 6.5 million $SOL by Galaxy Digital, valued at approximately $1.55 billion. This event has ignited curiosity about whether institutional investors are gearing up for a major market movement. Such actions often precede explosive gains in the fourth quarter, making it a critical period for traders to monitor.

The general mood on Crypto Twitter remains optimistic, although frequent liquidations highlight the underlying volatility still at play. Solana’s rising liquidity is also benefiting projects like the Snorter Token ($SNORT), a trading tool that capitalizes on the positive momentum within the network.

Institutional Interest Fuels Solana’s Ascent

Galaxy Digital’s significant purchases are one of the key drivers behind the surge in Solana’s price this month. The company’s investment strategy has analysts speculating that they might be acting for Forward Industries, which recently secured funding to create a dedicated Solana treasury.

The magnitude of these transactions suggests a strong belief in Solana’s potential. The network has faced challenges in the past, including outages; however, the influx of billions indicates that large investors are convinced it’s a smart gamble as we transition into the next cycle.

This mirrors the situation with Bitcoin earlier this year, where ETFs brought in substantial investments. If Solana follows a similar pattern, we might see fast-tracked price development as retail investors begin to return to the market.

Expert and Community Forecasts

Market analysts are formulating bullish predictions for $SOL, spotting bullish patterns that suggest a strong uptrend.

One trader noted a classic cup-and-handle formation, hinting at the possibility of the price reaching between $330 and $350 if the upward momentum persists.

Another analyst warns that significant resistance around $261-$296 must be broken for the rally to confirm. Until this happens, a potential pullback into the $210-$220 range remains realistic.

Amin_BTC further emphasizes the importance of $235 as a pivotal support level; a failure to maintain this could lead to a deeper decline.

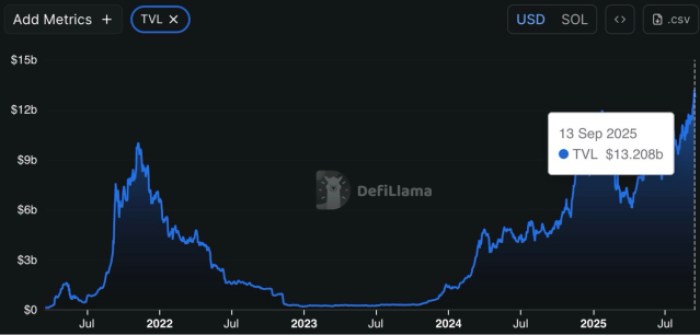

Despite these concerns, the overall sentiment is bullish, bolstered by Solana’s Total Value Locked (TVL) hitting an impressive all-time high of over $13 billion this month.

Historically, strong performances in September have laid the groundwork for impressive fourth-quarter outcomes. The early activity from institutions further enforces this trend.

Nevertheless, the market is delicate, evidenced by $445 million in liquidations in recent trading hours, including a notable $32 million in $SOL.

Positive Developments in Solana’s Ecosystem

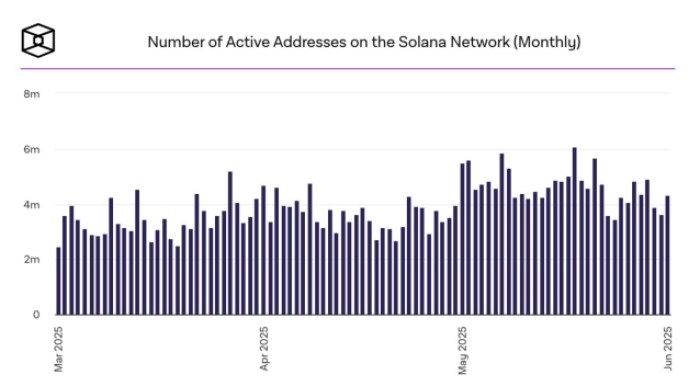

Aside from price fluctuations, the fundamentals within Solana are strengthening significantly. The on-chain activity metrics reveal a rebound, showcasing an increase in active users and revenue, which helps explain the recent upswing in $SOL price.

This phase is often described as ‘Altcoin Phase 3,’ where established coins gain widespread attention. For investors, Solana is emerging as a formidable competitor against Bitcoin and Ethereum.

As liquidity in the market grows, there is a rising trend toward Solana-focused tools, like Snorter Token — designed to empower retail traders to achieve the same advantages sought by larger institutions.

Snorter Token ($SNORT) – Innovative Tool with a Mix of Branding

The momentum within the Solana ecosystem has led to an increased interest in trading tools, and Snorter Token ($SNORT) aims to fill that gap as a preferred option.

Functions of the Snorter bot include managing trading activities through Telegram, allowing users to execute swaps quickly, engage in instant token launches, replicate successful investors, detect rug pulls, and monitor portfolios all from a single interface.

Tokens holders enjoy reduced execution fees, enhancing cost-effectiveness compared to rivals, while the bot itself is designed to offer quicker responses due to its optimized infrastructure. Unlike most meme coins, Snorter backs its brand with tangible, functional advantages.

For those interested, a comprehensive guide on purchasing Snorter Token is available for easy access.

With a successful presale already underway, having raised over $3.94 million at a token price of $0.1045, and staking yields reaching 119%, Snorter is making waves in the trading community. The rising interest in Telegram bots further underlines the potential of this market, projected to reach a market value of $154 billion by 2033.

Snorter positions itself as a forward-thinking trading tool, integrating features like MEV protection and broad cross-chain support, along with relying on the enthusiasm of its community.

With the additional advantages of early support and a favorable presale phase, $SNORT provides an intriguing entry point into both meme culture and the utility-driven solutions that traders need to stay competitive against institutional players.

For more information on Snorter, including its tokenomics, roadmap, and future goals, check out our detailed guide.

This article does not constitute financial advice. Given the risks associated with presales and cryptocurrency investments, please conduct your own research (DYOR) before making any financial commitments.

Written by John Doe, Bitrabo –