In recent developments, a prominent Bitcoin financial entity has revealed their ongoing commitment to accumulating digital assets. The firm disclosed its latest acquisition of an additional 525 Bitcoin (BTC) from September 8 to September 14, showcasing a strategic approach to asset management.

Expanding Cryptocurrency Holdings

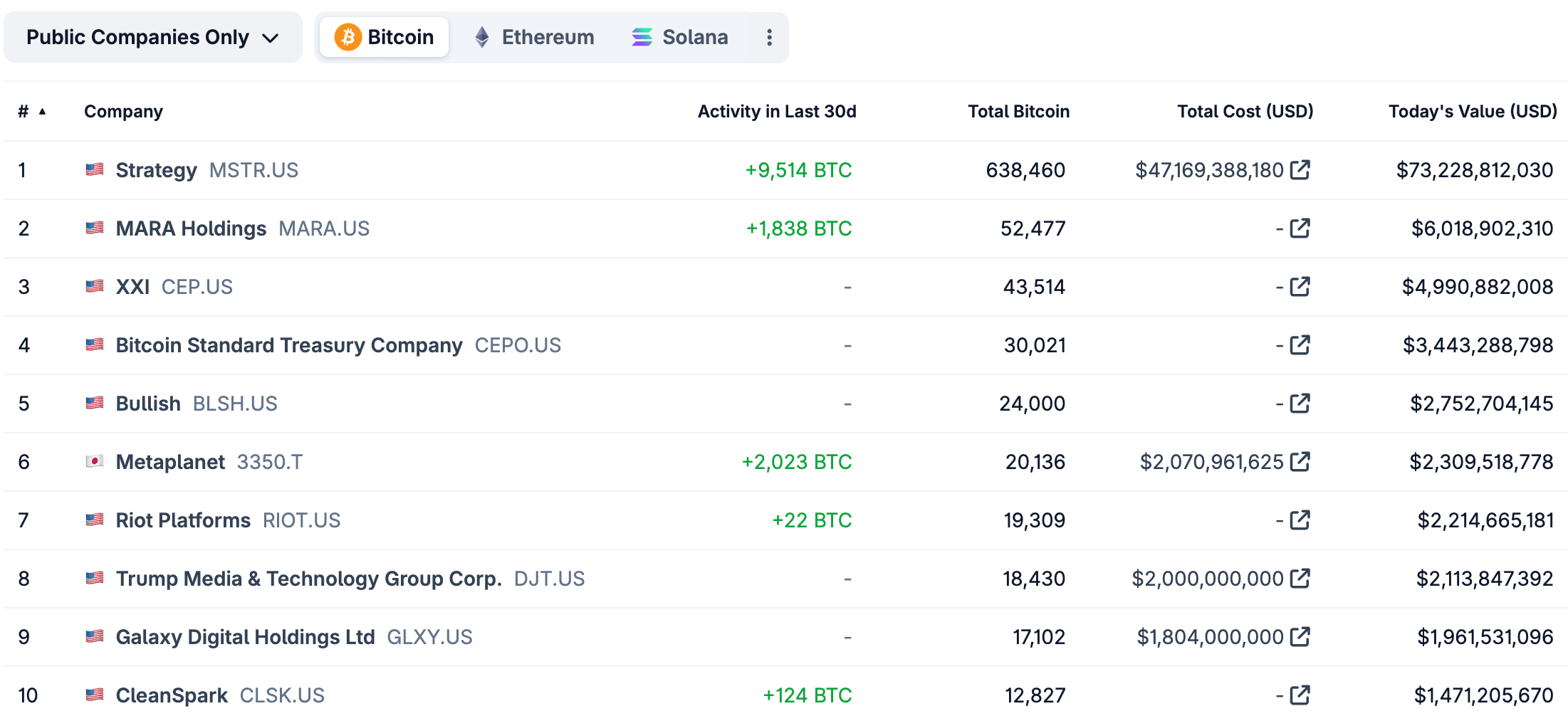

This leading Bitcoin treasury firm has successfully enhanced its BTC reserves, now totaling a remarkable 638,985 BTC, equating to over $73 billion. Notably, the average purchase price stands at approximately $114,562, reflecting its aggressive investment strategy.

Upon analyzing the total BTC holdings, it’s evident that the firm possesses just over 3% of Bitcoin’s finite supply of 21 million BTC. With approximately $26 billion in paper profits, the firm’s position in the market is robust.

Interestingly, the recent purchase was funded through the sale of its preferred stocks, indicating a creative financing strategy that could inspire other firms.

In the stock market, however, shares of this firm experienced a slight decline of 2.15%, changing hands at $324.31. Despite this, there’s an encouraging year-to-date increase of nearly 12%.

According to data from Coingecko, this firm remains the largest publicly-traded entity holding Bitcoin, vastly ahead of its closest competitor, which possesses 52,477 BTC. Collectively, firms focused on Bitcoin treasury management hold a staggering value exceeding $113 billion.

BitMine Broadens Its Ethereum Portfolio

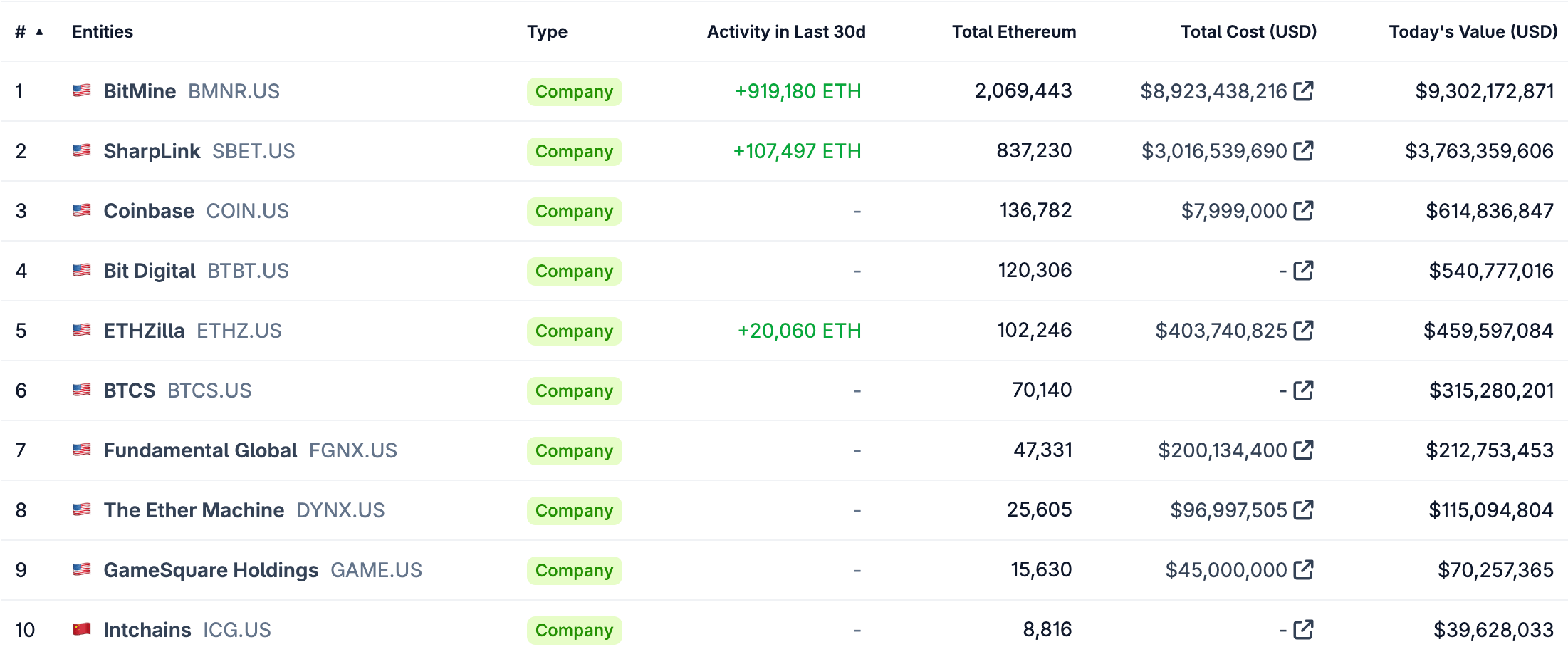

In another notable update, BitMine Immersion Technologies has disclosed that its total crypto and cash assets now exceed $10 billion. This includes their recent acquisition of 82,233 Ethereum (ETH), valued at about $370 million.

With this latest investment, BitMine now possesses over 2.1 million ETH, currently valued at nearly $9.75 billion, alongside 192 BTC worth $22.1 million. This firm also maintains close to $569 million in liquid capital, presenting a significant financial buffer.

When ranked in terms of ETH holdings, BitMine is at the top, followed closely by companies like SharpLink and Coinbase, reflecting a competitive landscape in crypto asset management.

The trend of institutional adoption of cryptocurrencies is gaining global traction, with numerous countries exploring similar strategies as those of leading firms. Nations are also contemplating the formation of national Bitcoin reserves, following El Salvador’s pioneering move.

Countries such as Kyrgyzstan have recently proposed establishing a national Bitcoin reserve, with other nations like the Philippines and Brazil echoing similar sentiments. This shift indicates a growing recognition of the potential benefits of cryptocurrencies.

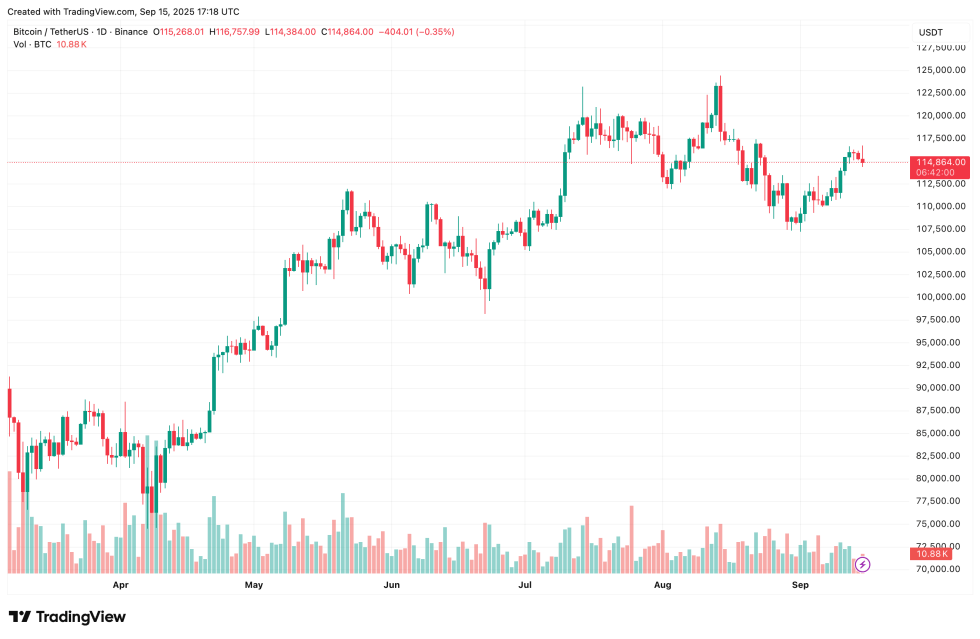

Experts predict a likely development for the US, as significant industry figures suggest a possibility of establishing a Bitcoin reserve by 2025. As of now, Bitcoin is priced at $114,864, with a slight decrease of 0.6% in the last 24 hours, reflecting the dynamic nature of the market.