As Ethereum continues to navigate the challenging cryptocurrency landscape, it has recently managed to sustain itself above the crucial $4,500 mark, showcasing its strength and resilience. The second-largest digital currency is currently hovering below a significant resistance point at $4,750, which many analysts believe is a pivotal threshold. The current market dynamics present both opportunities and challenges that investors should closely monitor.

Recent analysis from leading crypto data platforms indicates a notable increase in unrealized profits amongst Ethereum wallets with holdings between 10,000 and 100,000 ETH. These levels are reminiscent of November 2021, when the asset first reached its record price, underscoring the potential for substantial market movements in the near future.

While there is considerable bullish sentiment in the air, the proximity of the resistance level has raised flags for some analysts. The outcome of Ethereum’s current positioning could either lead to a breakout that paves the way towards new all-time highs or a retracement that suffocates bullish momentum.

Ethereum’s Whale Activity Signals Important Trends

Ethereum’s current price action signals a critical juncture, especially as many mid-sized whales are witnessing notable profits like never before. As these profits reach similar heights as those recorded during the last peak, concerns regarding profit-taking have emerged. Historical patterns suggest that such elevations often precede market corrections, as long-term holders decide to cash out.

Typically, this kind of market sentiment among larger holders can amplify volatility. Should these investors choose to secure profits, a wave of selling pressure may ensue, potentially leading to a dip in prices. While this behavior often indicates caution, it does not guarantee immediate downturns. The psychological impact on the market can lead to various reactions among participants, particularly large investors whose decisions ripple through trading platforms.

Despite this cautionary stance, it’s important to note that Ethereum’s fundamentals remain robust. Increased institutional investments, alongside strong network activity, have the potential to cushion against aggressive profit-taking and could sustain the upward trend. The balance between bullish enthusiasm and profit-locking tendencies will be crucial in determining Ethereum’s near-term performance.

The next few weeks will prove essential. If Ethereum successfully surmounts the resistance at $4,750, it could ignite a new upward trajectory towards unprecedented levels. Conversely, if profit-taking increases, we might witness a phase of consolidation or even a more pronounced market correction. The decisions made by larger holders in the coming days will play a crucial role in shaping Ethereum’s future course.

Technical Analysis: Understanding Key Price Levels

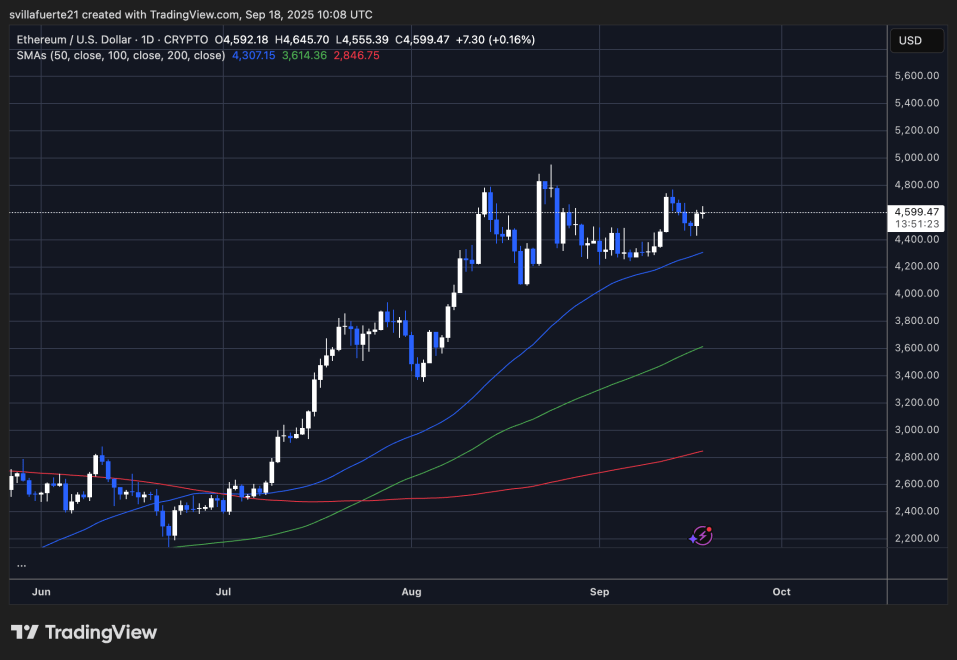

Currently, Ethereum trades at approximately $4,599, demonstrating stability above the $4,500 support level. A careful examination of the charts reveals a consolidation phase, particularly after challenges faced in exceeding $4,750. Nevertheless, the overarching trend remains optimistic, with Ethereum continuously establishing higher lows since early September.

Key indicators, including the 50-day simple moving average (SMA), which sits around $4,307, provide a vital support level that has cushioned several recent declines. Additionally, the 100-day SMA at $3,614 and the 200-day SMA at $2,846 reflect a long-term bullish structure, reinforcing the idea that the market is currently enjoying a favorable trend.

A potential breakout above the $4,750 resistance zone, particularly supported by increasing trading volumes, could set the stage for a run towards $5,000 and beyond. Conversely, a failure to maintain the $4,500 level might prompt a downward correction towards $4,300 or even the significant $4,000 psychological threshold.

As the market evolves, keeping a keen eye on Ethereum’s price movements and whale trading behaviors will be essential for all investors. With fluctuating sentiments and dynamic trends, the future remains unpredictable yet filled with possibilities.