In a groundbreaking move, the crypto industry witnessed a significant milestone today as Solmate, a pioneering digital asset treasury and infrastructure firm connected to the Solana ecosystem, successfully completed a staggering $300 million private placement. This endeavor aims to accelerate the adoption of Solana-based solutions across various markets.

Capital Infusion for Enhanced Solana Ecosystem

With its recent rebranding, Solmate, previously known as Brera Holdings, is poised to play a vital role in the evolving landscape of cryptocurrency. This notable capital infusion will empower the company to purchase and stake SOL tokens, advancing the use of Solana’s innovative blockchain.

The successful PIPE offering was made possible due to the backing of the Pulsar Group, an influential technology consultancy rooted in the UAE, alongside strong support from the Solana Foundation and renowned investment entities such as RockawayX and ARK Invest.

By focusing on accumulating and staking SOL, Solmate aims to create sustainable value for its shareholders. The firm also plans to explore innovative revenue models stemming from the burgeoning infrastructure of Solana staking. An ambitious goal includes establishing the UAE as the premier hub for Solana’s global ecosystem.

In an exciting leadership development, Marco Santori has been appointed as Solmate’s inaugural Chief Executive Officer. He brings a wealth of experience from his prior role as Chief Legal Officer at Kraken. Solmate’s proposed investment will entail setting up high-performance metal servers in Abu Dhabi, designed to significantly enhance typical digital asset treasury validator methods. Santori emphasized:

Our vision surpasses that of a conventional treasury. We aim to implement a uniquely differentiated approach within a competitive landscape of similar entities, constructing robust crypto infrastructures in the UAE. Our investors maintain a strong commitment to the SOL ecosystem and expect us to acquire SOL throughout all market conditions. As institutional acceptance grows, Solmate is strategically positioned to capitalize on the rising demand across various sectors including DeFi, NFTs, and AI.

With the launch of its SOL validator, regional investors will have the advantage of optimizing SOL’s inherent yield capabilities, furthering Solana’s foothold in the Middle East. Remarkably, predictions indicate that the Solana network could surpass both Bitcoin and Ethereum in growth due to its increasing number of active developers.

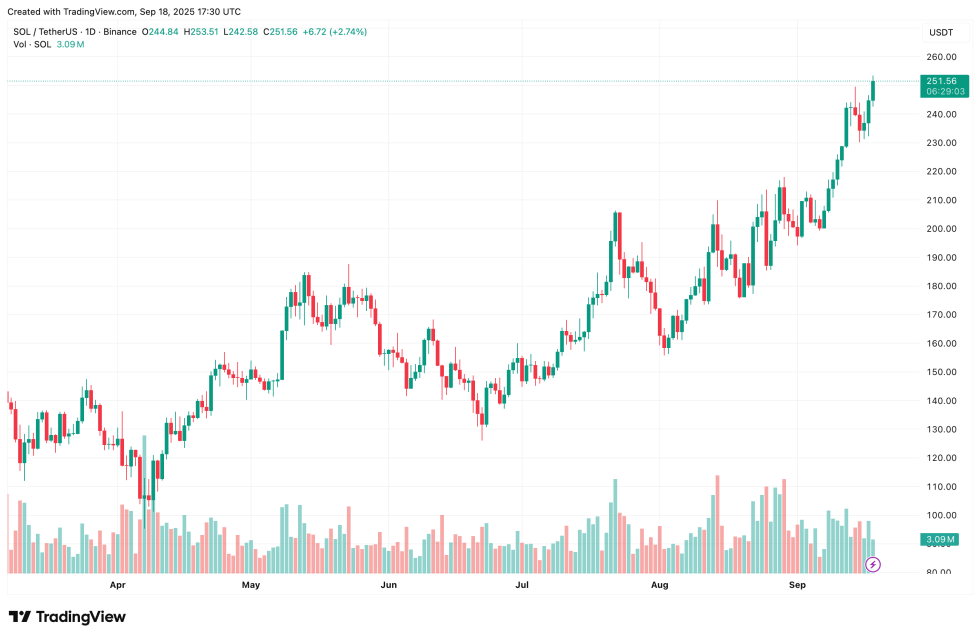

Following this announcement, shares of Brera Holdings experienced a notable surge, trading at an impressive $32.32, as reported by Yahoo! Finance. Concurrently, SOL saw a price increase, surpassing $250, and trading at a point approximately 14.8% under its all-time peak.

The Competitive Landscape: Can SOL Surpass ETH?

In the realm of digital assets, while Bitcoin holds the position as the largest cryptocurrency by market cap, Solana’s primary rival is Ethereum, as both operate as intelligent contract platforms distinct from Bitcoin’s structure. Currently, Ethereum boasts a market cap of approximately $558 billion, far eclipsing Solana’s $137 billion, but rapid advancements within the Solana ecosystem signal a potential closing of this gap.

For instance, Forward Industries, a publicly-listed company, made waves by acquiring $1.58 billion in SOL tokens as part of a broader treasury initiative. Recent analyses indicate that around 1.55% of Solana’s total circulating supply is now under the control of institutional investors, highlighting a growing trend.

Furthermore, prominent figures in finance, such as Mike Novogratz, have recognized SOL’s potential, asserting that it stands as a preferred blockchain for financial applications. Presently, SOL is trading at $251.66, witnessing a substantial 7.8% increase within the past 24 hours.