The cryptocurrency market has recently faced a dramatic wave of liquidations, totaling an astonishing $1.7 billion as values decline sharply. This turmoil is linked primarily to Bitcoin’s downward spiral.

Bitcoin’s Recent Struggles: A Price Dive Below $113,000

Initially, Bitcoin appeared to be gaining traction, reaching around $118,000. However, the momentum faltered sharply by the week’s end, leading to a significant decline as it began the following week under $113,000.

To illustrate this trend, consider the following price chart.

While Bitcoin struggled, it wasn’t alone; Ethereum (ETH) and many altcoins mirrored the bearish trend, with some experiencing even steeper drops. Dogecoin (DOGE) plummeted by 10.5%, while Chainlink (LINK) faced a decline of 9%.

This widespread volatility in the crypto market often leads to significant activity in derivatives exchanges, creating a ripple effect of chaos.

Massive Liquidations Within the Crypto Market: Nearing $1.7 Billion

Recent data provided by CoinGlass indicates an unprecedented wave of liquidations within the crypto derivative sphere. Here, “liquidation” means the forced closing of a contract after significant losses exceed platform limits.

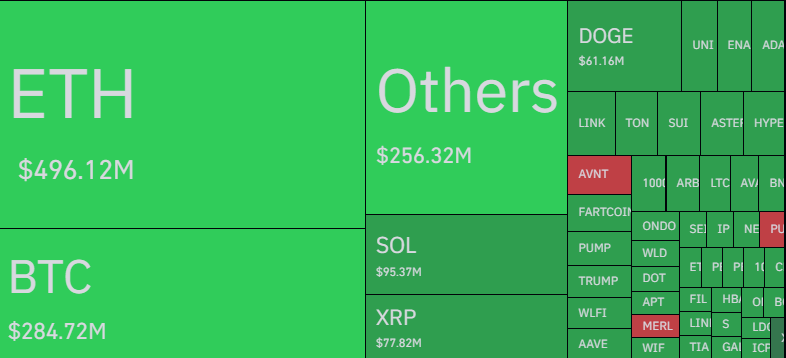

With the market predominantly trending downward, most affected positions were long contracts. As illustrated in the table below, it’s evident that recent liquidations heavily favored long trades.

In total, a staggering $1.67 billion was liquidated over the span of a single day, with a whopping $1.59 billion deriving from long positions. Only a small margin, about 5%, accounted for short positions, translating to $83 million.

When dissecting individual assets, Ethereum appears to have borne the brunt of the liquidations, contributing a significant $496 million to the total.

Bitcoin typically leads in liquidation figures; however, it experienced just $285 million, trailing ETH by over $200 million. The pronounced dominance of Ethereum may have resulted from its sharper 7% price dip, coupled with its increased speculative trading interest.

Following Ethereum, Solana (SOL) rounded out the top three with about $95 million in liquidations, while XRP (XRP) accounted for $78 million, despite its greater market capitalization relative to SOL. Dogecoin was on the list as well, with liquidations amounting to $61 million.

Liquidation episodes, particularly on this scale, are not uncommon in the cryptocurrency landscape. The inherent volatility and accessibility of leverage often contribute to such events. Nevertheless, this latest liquidation surge stands out due to its vast scale and impact.