As the digital currency landscape evolves, various states in the U.S. are beginning to embrace cryptocurrency. Recently, the Ohio Board of Deposit marked a significant milestone by choosing a vendor to facilitate cryptocurrency transactions for state services.

Ohio Embraces Cryptocurrency Payments

The Ohio Board of Deposit has officially decided to allow the use of cryptocurrency for various state fees. This decision reinforces Ohio’s commitment to adopting modern financial technologies.

This progressive initiative comes after a policy change in May 2025 that recognized cryptocurrencies as legitimate tools for financial transactions within the state.

Ohio Secretary of State Frank LaRose expressed optimism about this development, stating that integrating cryptocurrency payments will bolster Ohio’s reputation as a business-friendly environment. LaRose highlighted:

The growing demand for digital payment options has been evident in our offices. We aim to continue leading the charge in business innovation, making it easier for job creators and their financial transactions.

This groundbreaking step positions Ohio as the fourth state, joining the ranks of Colorado, Utah, and Louisiana, to accept digital assets as payment for government services. Such advancements demonstrate a broader acceptance of cryptocurrencies across the country.

In April 2025, Colorado became a pioneer, allowing its residents to pay taxes using cryptocurrencies through platforms like PayPal’s Cryptocurrency Hub. This marked a significant turning point in how states manage tax collection.

Utah has also been proactive, with recent legislation designed to protect the rights of cryptocurrency miners, ensuring that individuals can freely engage in activities like mining and staking without regulatory obstacles.

The Future of State-Controlled Bitcoin Reserves

With Ohio taking steps to incorporate cryptocurrency into its financial systems, other states are also exploring the possibility of establishing their own cryptocurrency reserves, particularly in Bitcoin. This could lead to a significant shift in how states manage their assets.

Currently, Texas, Arizona, and New Hampshire are leading the way, having implemented legislation for state-managed Bitcoin reserves. This could lay the groundwork for future financial strategies that leverage the benefits of Bitcoin’s pioneering technology.

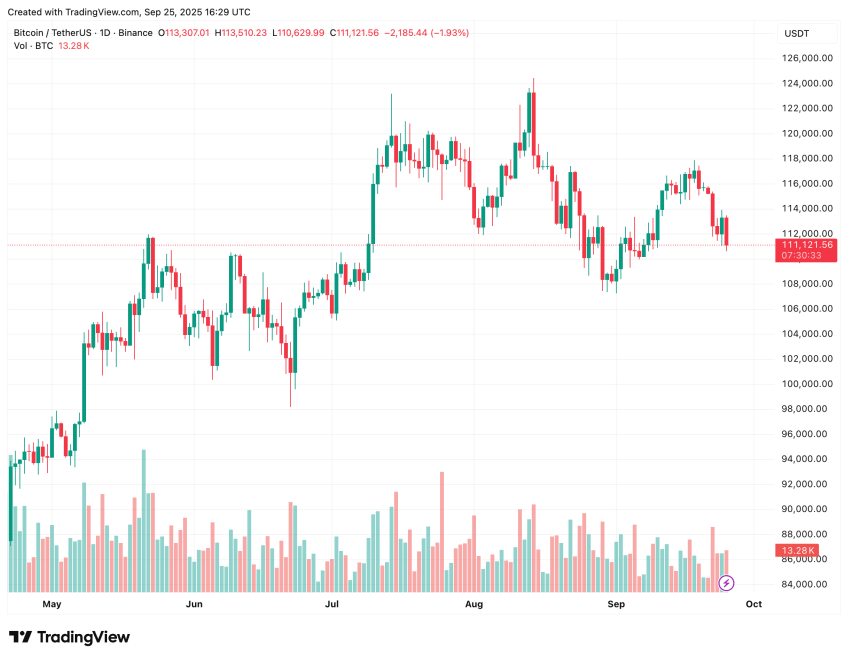

Conversely, a number of states including Montana, North Dakota, South Dakota, and Pennsylvania have opted against creating Bitcoin reserves, reflecting a cautious approach towards digital currencies. At present, 16 states are still contemplating this initiative, showing a diverse range of opinions on the future of state-level cryptocurrency management. As it stands, Bitcoin is trading at $111,121, with fluctuations reflecting ongoing market dynamics.